Why tokenize stocks?

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: PC gaming … speedrunning government … Humanity’s Last Exam … broken clocks … cancel culture … ring-kissing … ads in newsletters? … longevity … astroturfing the Chinese stock market … war casualties …

The in-orbit economy, thanks to Spaceium (space refueling), Lumen Orbit (space-based datacenters), OrbitFab (space refueling), Turion Space (cheaper, managed satellites), Starfish Space (satellite servicing), Impulse Space (moving between orbits) — and that’s a partial list of the companies we’re tracking

📉 Trending Down: The labor market … personal safety … the Microsoft-OpenAI partnership … the Canadian economy … the Indian economy … the Russian economy … West Bank freedom …

DEIA: While the government guts DEI programs, they are not merely attacking attempts to ensure equitable employment at the Federal level — they are also undercutting accessibility programs as well.

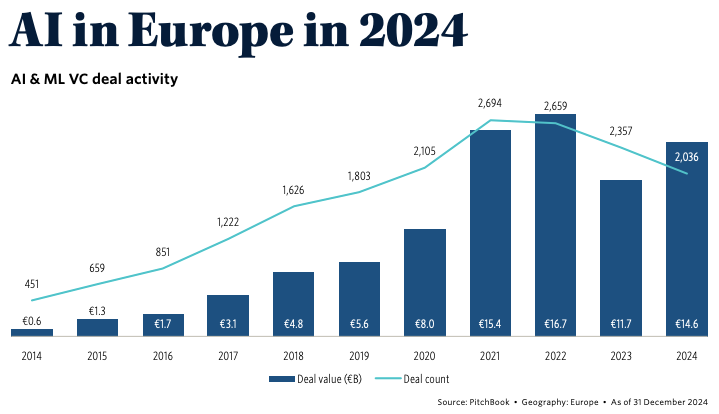

Chart of the Day

I was reading the latest PitchBook report on European venture capital this morning, in which I ran into the following bit of data:

A few takeaways:

While European venture capital in aggregate saw a small decline from 2023 to 2024 in investment value terms, more dollars flowed into AI startups last year than the preceding. That’s good news for European bulls hoping to earn a piece of our collective AI future.

European AI investment is closer to peak levels than I expected. Despite the current AI hype cycle, I still expected a greater decline compared to 2021-era results.

The UK leads in terms of venture-backed AI companies in Europe, with Germany and France all but tying for silver.

And, finally, that the above sums are peanuts. Databricks just put together a transaction worth 2024’s European aggregate AI venture investment in a single go. Not that we’re making a perfect apples::apples analogy, but the scale comparison matters.

Put another way, how does Europe add a zero to the end of its AI venture tally in 2025?

Today in Techno-Political Drama

Project Stargate was supposed to be a simple win for the participants: Trump got to claim credit for work that he didn’t do, SoftBank’s Masa Son got to pledge big checks to a burgeoning industry, and OpenAI got a victory lap for work it was already doing. Simple, right? Elon Musk didn’t agree and has spent ample time since throwing stones at OpenAI, Sam Altman, and the dollar figures in question.

We covered some of the back-and-forth, but it’s worth adding that since then Musk has called Sam a “swindler” and has been promoting Sam’s historical political tweets, which were critical of Trump.

Anyway, all that’s spilled milk under the bridge. Here’s the new set of news items that matter:

Capacity arguments between Microsoft and OpenAI partially led to Project Stargate — which could save Microsoft money

As I tried to argue yesterday on the podcast, the proof here will be in dirt on shovels, cable in the ground, power hookups, and spinning fans. We’ll know soon enough if Project Stargate is will become Project Starlate.

Tokenization

Having covered crypto since 2013 — back when it was bitcoin, litecoin, and friends — I’ve seen arguments come and go. I’ve also taken part here and there to learn. I minted an NFT once (and this), have used a variety of platforms over the years to buy a dusting of crypto tokens to learn the process, and even wound up playing the Pudgy Penguin climbing game.

But until stablecoins demonstrated that they could be created safely (able to hold their peg while staying liquid), and made accessible to markets where dollars (or other similarly respected currencies) are scarce or expensive, I have remained modestly in the why are people trying to use this singular technology for so many things that already work camp.

So when people brought up tokenization over the years, I’ve been skeptical. We already have a system to capture, mark, and trade value. The stock market works, in other words, so why would we want to bring blockchain into the mix?

Blackrock led a “Strategic Funding Round” into Securitize last year, which calls itself the “leader in tokenizing real-world assets,” recall

The same reason why stablecoins are big, it turns out.

After seeing news that tokenized stocks are coming to Solana, I posted that more liquidity is welcome, but that I couldn’t see the why behind the move; I can already buy index funds, single shares, partial shares, options, and anything else I might possibly want or need for zero or low-cost on existing, stable systems. Hell, I can DCA into bitcoin using low-cost ETFs today. So why tokenize stocks?

Ryan Bethencourt, CEO of Wild Earth Pets and startup investor, made the following argument:

Given the recent outperformance of the American stock market compared to peer results, you likely do want to be able to buy in, regardless of where you live, what your local currency is, or whatever local restrictions thereof allow. Enter tokenization of stocks on the blockchain.

Niche? Probably. Useful? Possibly. Still a bit of a faff? I can’t say that it is. Financial inclusion has always been the most interesting element of fintech to me, so here crypto I think is doing a Good Thing.

Extractive and exploitative memecoins remain on my shit list, however.