Do you want to pay startup prices for public companies?

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Venture capital funding its own venture capital fund to invest venture capital funds predicated on other venture funding … hating on the App Store, China edition …

📉 Trending Down: Free association at West Point … Disney+’s subscriber base … packages from China (just kidding) … job openings … analyst joy at the DoJ suing to bloc the HPE-Juniper deal …

Trump Watch:

The entire CIA got offered ‘buyouts’ of a sort; the message this shouts is that experienced members of the intelligence community are not needed.

Trump’s new

planriff on what to do with Gaza is 100% buck wild.The gist is as follows: Trump said yesterday that he doesn’t think “people should be going back to Gaza.” Then, later in the day, Trump said that “the US will take over the Gaza Strip and we will do a job with it too.” What does that mean? “We’ll own it and be responsible for dismantling all of the dangerous unexploded bombs and other weapons on the site, level the site and get rid of the destroyed buildings,” Trump said according to a CNN transcription of his comments.

American troops are a possibility, per the President.

So what’s the Gaza plan? Trump: “This was not a decision made lightly. Everybody I’ve spoken to loves the idea of the United States owning that piece of land, developing and creating thousands of jobs with something that will be magnificent.”

Everyone is very mad, apart from the Israeli far-right.

USAID staff are expected to be put on leave en masse.

The Department of Education is expected to get gutted at a minimum and perhaps illegally ordered to shutter at maximum. Here’s what the DoE does and how it spends money.

Earnings Recap

Alphabet

Alphabet’s stock is off 7% in pre-market trading after reporting earnings. The company’s Q4 revenue ($96.5 billion, +12%), and net income ($26.5 billion, up from $20.7 billion in the year-ago quarter) were not enough to delight investors. Why? The revenue figure was a miss, and the net income beat (measured in EPS) was not enough to help investors get over a miss in cloud revenue.

Per CNBC, the street had expected Google Cloud to turn in $12.19 billion worth of top line, not the reported $11.96 billion. (Year ago: $9.2 billion).

From the earnings call (transcript), lots of AI momentum to shout about and even falling costs:

“Cloud customers consume more than eight times the compute capacity for training and inferencing compared to 18 months ago” … “Our AI developer platform, Vertex AI, saw a 5x increase in customers year over year” … “Total operating expenses decreased 1% to $24.9 billion” … “Google Cloud operating income increased to $2.1 billion and operating margin increased from 9.4% to 17.5%.”

And then there is the capex question. Per Alphabet: “We expect to invest approximately $75 billion in capex in 2025, with approximately $16 billion to $18 billion of that in the first quarter,” which will lead to — in part — greater depreciation costs, the company said.

The CO take: The market is overvaluing the long-term stability of Google’s search revenues, and underestimating its potential, future AI revenues.

Uber

Uber’s stock is off 5.2% in pre-market trading after reporting earnings. The company saw gross bookings rise 18% in Q4 ($44.2 billion), revenue scale 20% to $12.0 billion, and operating income of $770 million, +$118 million from the year-ago period. The company’s net income was impacted by tax changes, so it’s ∆ is somewhat meaningless.

Uber continues to kick off mountains of cash (free cash flow of $1.7 billion in Q4 2024), and reduce leverage ($2.0 billion worth of “outstanding debt” redemptions in the quarter).

So, why the share price decline? Uber beat trailing revenue expectations, but it’s guidance for Q1 2025 gross bookings was light, spooking investors.

And Alphabet reported during its earning call that Waymo — which despite some workings with Uber does feel contra — is “now averaging over 150,000 trips each week and growing” while its parent company expects it to expand “network and operations partnerships to open up new markets” both domestically and abroad.

Are we seeing investors begin to worry that self-driving fleets are eating some of Uber’s lunch?

Snap saw its shares drop despite beating trailing expectations partially on profit concerns in 2025. Reddit reports later today.

What’s Palantir worth?

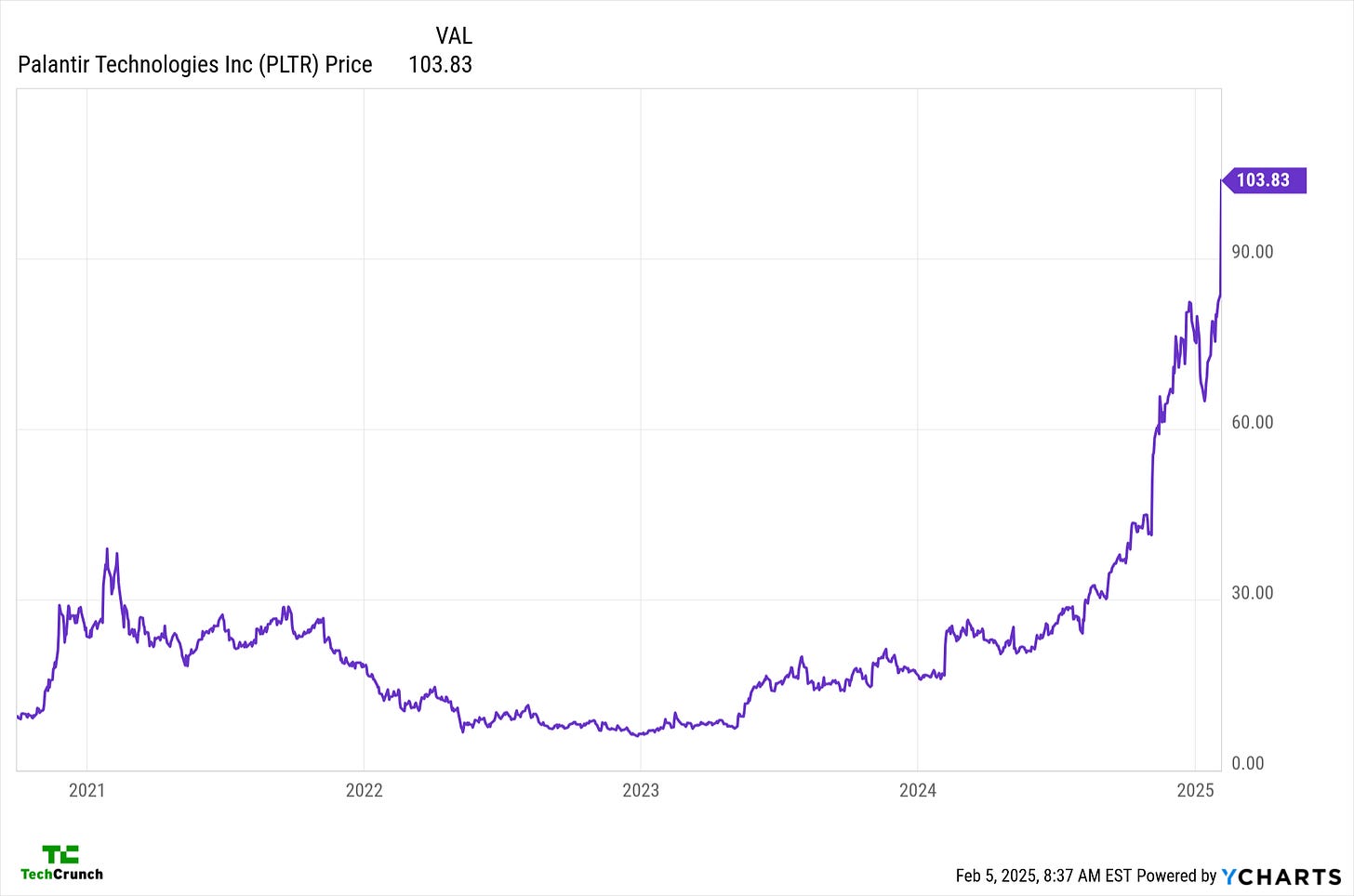

In the wake of blockbuster Q4 earnings, shares of Palantir soared just under 24% yesterday. The company’s valuation ascent has been little short of vertical:

This has lead to folks wondering if Palantir’s worth has not gotten a bit ahead of its skis. Forbes notes that Palantir is now “by far the most expensive stock on the S&P via the commonly cited valuation metric of price-to-sales,” which is impressive.

Here are the numbers you need to know (Palantir earnings from its Q4 report):

Revenue growth +36% YoY and +14% QoQ ($828 million in Q4).

Customer count +43% YoY and +13% QoQ.

Adjusted free cash flow of $517 million for a 63% margin.

Palantir expects to grow from $2.87 billion in 2024 revenue to “$3.741 - $3.757 billion” in 2025, for growth of around 30% in the coming year.

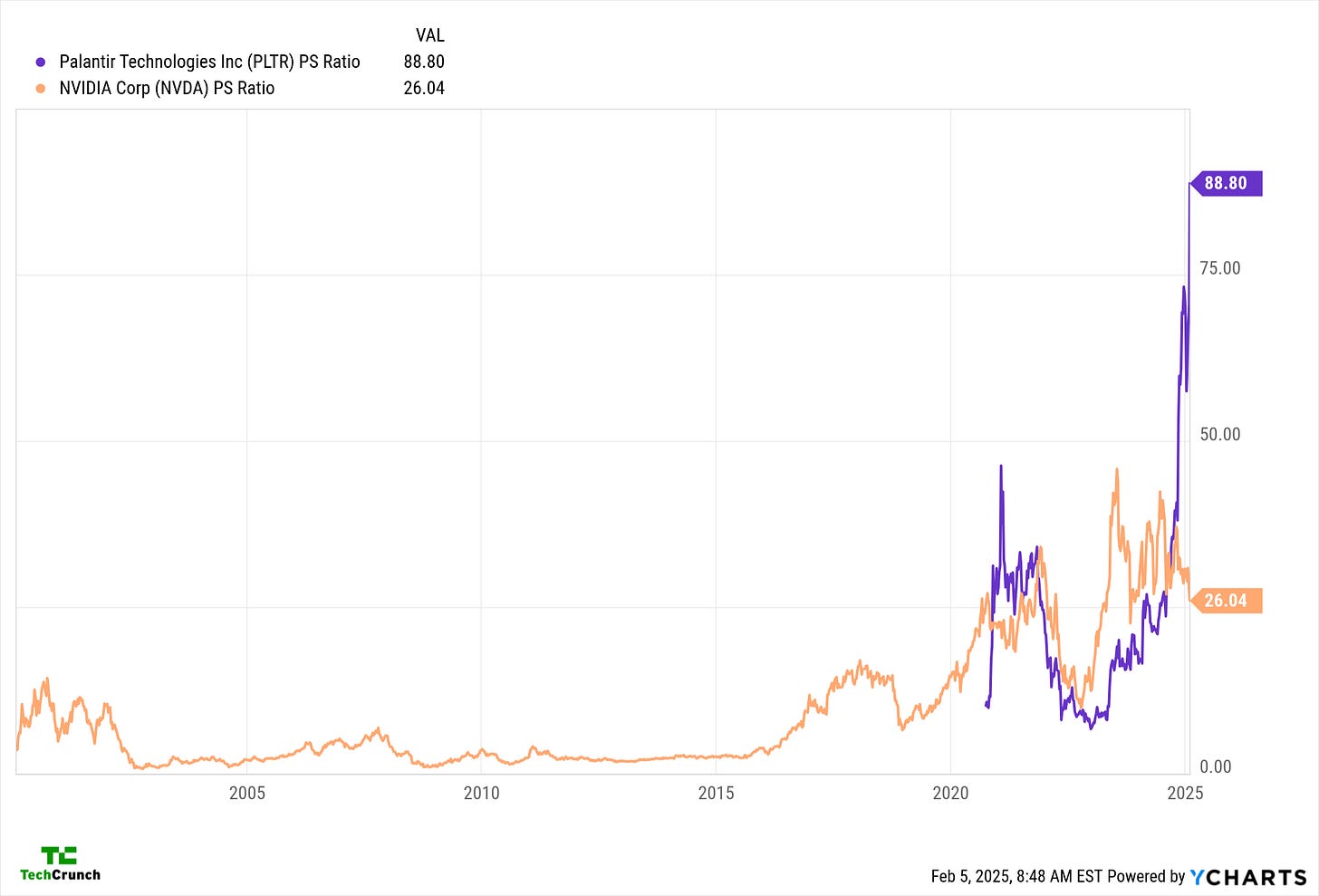

Those are very impressive figures. But as Forbes points out, the current average price/sales ratio for the S&P is 3, not north of 70 as Palantir currently exhibits (Yahoo Finance data). Palantir is so expensive today that its price/sales metric is around double “the 35 price-to-sales ratio of fellow AI wunderkind Nvidia,” the publication writes.

Or in chart form (YCharts calculates price/sales multiples a little bit differently than Yahoo Finance, as you will see, so pay more attention to direction than absolute magnitude):

On one hand, Palantir is doing super well and thus deserves a rich valuation.

On the other, Palantir is so expensive now that it’s hard to justify its valuation at all. But here’s the weird thing: That neither surprises nor shocks.

There’s a fascinating reality-denial mechanism in the stock market today for shares that the market expects to benefit from the Trump presidency. To wit:

Trump Media and Technology Group reported $1.0 million worth of revenue (and $4.7 million worth of interest incomes). It’s market cap? $6.64 billion.

How does Palantir benefit from a similar vibe-based boost? It was co-founded by Peter Thiel, whose acolyte is now the Vice President. There are other connections between currently dominant politics and the company; if you are a cynical sort, you might think that Palantir is going to do well selling to the government in the coming years.

If so, then you might wager that Palantir is going to blow its own guidance out of the water, and thus earn into its inflated valuation. That feels like a stretch to me, but as you might as well call me Mr. Boring Index Fund Man, I am hardly the target audience for this trade.

If we put on our accounting visor, we see a stock valued as if it was a high-growth startup instead of a public company forecasting revenue growth deceleration in its current year. There’s a disconnect between the company’s valuation and expected performance that can’t be hand-waved away, frankly.

So should you short the stock. Probably not, though CO should never be read as investment advice. Why? Because the market can stay bonkers longer than you can stomach paper losses on a short position. And today the stock market is not acting rationally in certain areas and there’s little indication — yet — that sanity is about to rear its head. The opposite, frankly.