How soon until we can afford robot butlers?

📈 Trending Up: Mudslinging in AIville … some good-ish inflation news? (or not) … Fal … UK GDP (barely) … higher, for longer … tariffs … nine-figure dealmaking … Chestnut Carbon …

📉 Trending Down: Free speech … domestic cybersecurity … marriages in China … car sales? … data center power demand? …

Nibbles

OpenAI will release GPT-4.5 in weeks, and GPT-5 in months. Per Sam, the company’s 4.5 model will be its last “non-reasoning” model; that’s to say that the o-series models and the trad ChatGPT models you’ve used previously will become one with GPT-5. This is great for simplicity, but less great if you were really counting down to getting more access to o3.

OpenAI got too clever with its model variants; it knows this; consumers just want the good model, cheaply, and quickly. DeepSeek didn’t climb the global app store ranks for no reason. Competition rules.

TERF NROThe FreePress (FP) is an interesting beast. After its golly-gee-whiz-bang response to Trump’s electoral win last year — this, in particular — I have kept abreast of its reporting. Notably, I’ve detected a delicate tone amongst the strident chords of quasi-state media that is a touch resistance-y. To wit: “EXCLUSIVE: Trump Is Starving the National Endowment for Democracy,” “Beware the Internet Mob—on USAID and Everything Else,” and “What DEI Isn’t.” It’s still The FP, but I wonder if the anti-gay nature of the American right is causing a little rift between the tech-right and more trad-Republicans.Ukraine. My heart hurts. Trump and Putin appear on course to decide the fate of Ukraine sans Ukraine or other European powers. It’s between farce and tragedy that after Ukraine beat military expectations time and time again with its own blood — long live the Kursk salient — the nation is at risk of being chopped up with the help of my elected leader simply because his foreign policy is comprised of equal parts placating dictators and undercutting allies.

Ukrainian readers: I’m sorry. We should do better. We could do better. We may not do better.

ABC News: “Germany's defense minister criticized President Donald Trump for what he called "regrettable" concessions to Moscow.”

Politico.eu: “It was the moment Europeans and Ukrainians have been dreading for months, if not years.”

WaPo: “President Donald Trump’s phone call to Russian President Vladimir Putin on Wednesday has deeply rattled Kyiv and its European partners, triggering long-held fears that Ukraine could be excluded from the peace talks determining its own future and security — as well as that of the rest of the continent.”

Updates from venture land

EnCharge AI just raised what it describes as an “oversubscribed” $100 million Series B. That’s a big enough round to make even your jaded scribbler sit up straight and take note.

EnCharge AI competes with GPUs, TPUs, and FGPAs with something called in-memory computing. The company’s explanation is worth reading if you are curious for more on the technical details.

The gist is that EnCharge AI’s tech could allow for a lot more AI processing at the edge — that is, on-device and outside of data centers — which could be big. It’s not known today how much future AI inference work will be done centrally versus on distributed endpoints.

That said, I love seeing lots of companies raise lots of money pursuing divergent, even contradictory approaches to the future. Competition is good.

EnCharge AI is hardly the only startup raising chests of cash to build new AI-empowering hardware. Cerebras is seeing a demand spike, Etched is building transformer-specific tech, Meta might snap up a South Korean chip company building silicon to run open-source LLMs, the list goes on.

Apptronik raised $350 million. In a Series A, Danny P reports. The investor hope, Axios writes, is that the “quantum of capital” Apptronik just raised will help it “scale the company's robots from tech conference novelty acts to essential ‘workers’ in a variety of industries.”

Recall that there are a number of competing humanoid robotics startups competing for the same crown. Figure, for example, made a lot of noise about executing small tasks with its own robot in a BMW plant, for example. Figure also says that it believes “there is a path to 100,000 robots over the next four years.” That’s a lot.

I am of two minds here. First, dependable, inexpensive humanoid robots around the house would kick maximum ass. To get there, we will have to start with less-reliable, expensive humanoid robots in warehouse and factories. Second, are we as close as the startups think to that future? I hope so, but the part of my brain that would make me a terrible investor frets.

Musk-a16z Administration Watch

I joked that The FP is ‘quasi-state media’ above, not because it is in technical terms. No. But as The FP has reportedly raised capital from Marc Andreessen (busy helping staff the new administration) and David Sacks (former Trump fundraiser, booster, and current employee), and was picked by Substack (backed by a16z) as its trial case for more aggressive platform support, you get me.

Puckishness aside, here are updates from the Musk-a16z administration spotters:

Bloomberg: “President Donald Trump plans to pick Brian Quintenz, the head of policy at Andreessen Horowitz’s a16z crypto arm, to lead the Commodity Futures Trading Commission, according to a document sent by the White House to Capitol Hill that was reviewed by Bloomberg News.”

Wired: “The Trump administration is replacing some of the nation’s top tech officials with Silicon Valley talent tied to Elon Musk and companies associated with Peter Thiel. This could make it easier for Musk’s so-called Department of Government Efficiency (DOGE) engineers to gain access to sensitive government systems, sources and experts say.”

It would not be accurate to argue that the United States has a shadow government. It’s more that the regular government has become a shadow to its shadow. You can’t get past this moment without wondering who is really in charge.

And then there was earnings

In brief, as we’re already at word-count for the day:

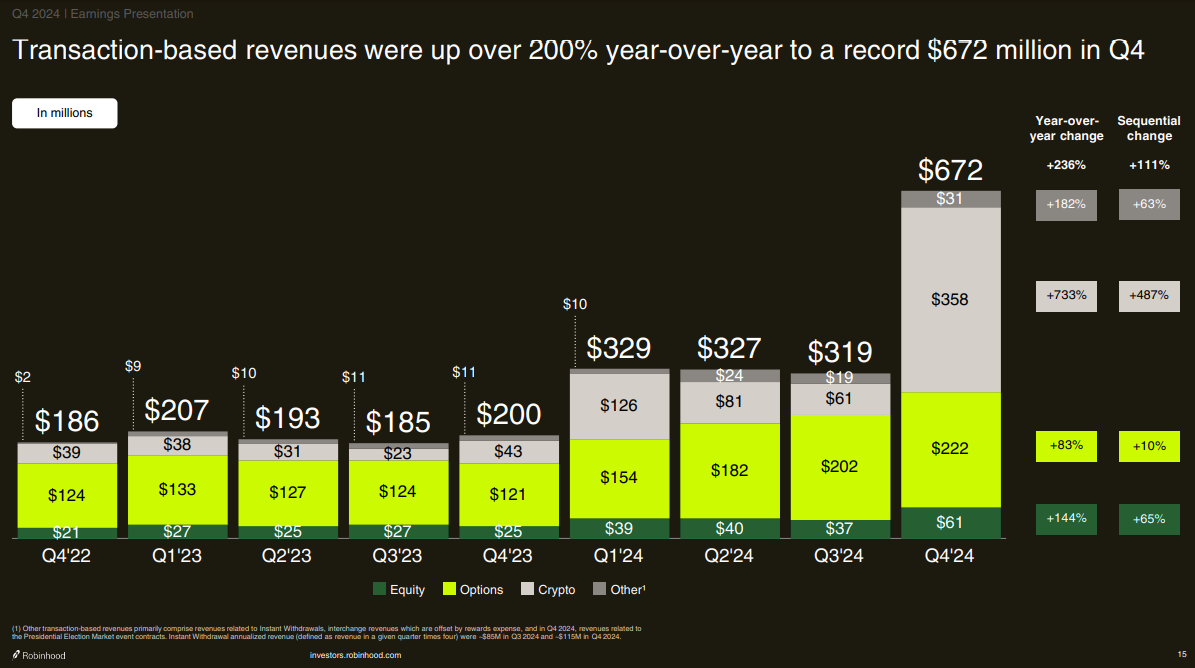

Robinhood: Crushed Q4 expectations. Its shares are sharply higher today. There’s a lot to like in Robinhood’s results — investor deck here — but the standout piece is this:

That’s a lot of crypto transaction revenue! Crypto markets have calmed down in 2025 but if you have exposure to trading platforms that deal with web3 tokens, it’s a good time to be you!

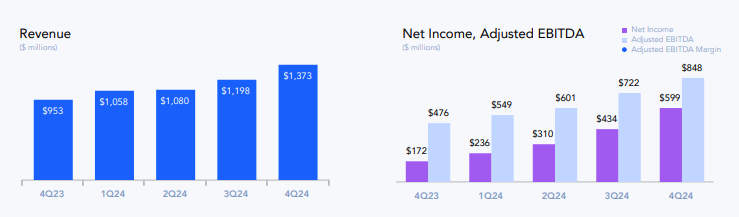

AppLovin: Shares of AppLovin are up more than 30% today as I write to you after it also smashed earnings expectations. The app discovery and monetization company reported 44% growth in Q4 (43% for the year), and 248% growth in its net income worth some $599 million in the final quarter of 2024 alone. I present to you two works of art:

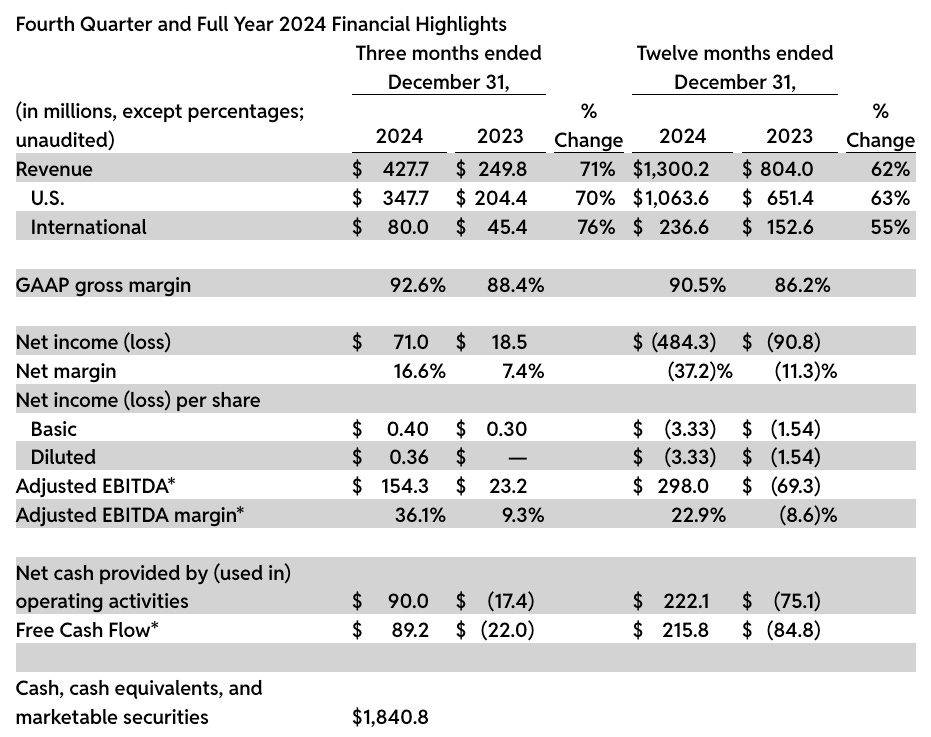

Reddit: And then there was Reddit. Shares of Reddit are off a few points this morning after its active user counts came in under expectations. Boo-hoo. Reddit is firing on all cylinders:

That’s just gorgeous.

And when you consider that Reddit is getting into the search/answers game in a real way, your tail might start to wag at the potential money to be made there. Google did show the world that search is lucrative, right?