Small startups, doing too much to stop too little, and Chinese tech waking up

📈 Trending Up: AI at YC … good descriptions of AI agents … wait, I thought they were suing … freewheeling AI … MENA AI …

📉 Trending Down: VC interest in bio? … memecoins? … free speech on X … really good Factorio jokes … Intel … the free press … TMTG …

Today in WTAF: Hating on the concept of having allies … gutting staff at our nuclear arsenal … undercutting the free press …

And most critically: We do not have a king. Yes, you have to listen to the courts — that’s how the national system of government was built — and no, you don’t get to disregard the law to do whatever you want so long as you think you are doing the right thing. That’s what a monarch gets to do. This nation was founded on telling kings to get bent, not bending the knee.

And the Chinese technology industry cheered

Over in China, the mood for technology companies and technology progress and technology earnings is heating up.

Surprised? After all, Chinese venture capital has hit the skids, chip bans are working to throttle its AI development, its real estate market is still in crisis, its population in decline, and so forth. I could go on, but let’s be honest.

What changed? DeepSeek. Let me illustrate via dueling headlines:

January 28, 2025: DeepSeek tech wipeout erases more than $1 trillion in market cap as AI panic grips Wall Street.

February 16, 2025: DeepSeek drives $1.3 trillion China stock rally as funds pile in.

DeepSeek has had impacts here in the States — concern that AI infra spend could be an overshot — Europe — hey if China can advance in the face of headwinds, why can’t we — and now China, where it seems that DeepSeek has awoken very snoozy animal spirits.

As someone who supports democratic systems of autocracy, I do view the United States-China relationship through a competitive lens. But if Chinese tech folks want to build kick ass open source technology that the whole world gets to benefit from, I do not have many complaints.

That said, one nation probably does. From the same February Bloomberg piece (emphasis added):

Hedge funds have been piling into Chinese equities at the fastest pace in months as bullishness on the DeepSeek-driven technology rally adds to hopes for more economic stimulus. In contrast, India is suffering a record exodus of cash on concerns over waning macro growth, slowing corporate earnings and expensive stock valuations.

Shade.

And the European defense industry cheered

Much hay has been made regarding the New Defense Industry here in the United States. Andruil’s rise has not been singular. Over on TWiST, we’ve yammered with Skydio, Vatn Systems, Allen Control Systems, the list goes on. Activity is so hot that reporters are heading to El Segundo to try to take the temperature of what some call a new, defense-flavored Silicon Valley, replete with startups, venture capital, and swagger.

The rise of venture investors backing startups that either make things explode — or prevent said explosions — is something that Europe could look forward to, too.

To wit, the United States is currently trying to decide the fate of Ukraine with Russia in Saudi Arabia, with as little as no input from Europe, let alone Ukraine itself. The United States has also made it clear that it’s moving away from guaranteeing European national security. The world order we’ve known for decades is changing rapidly.

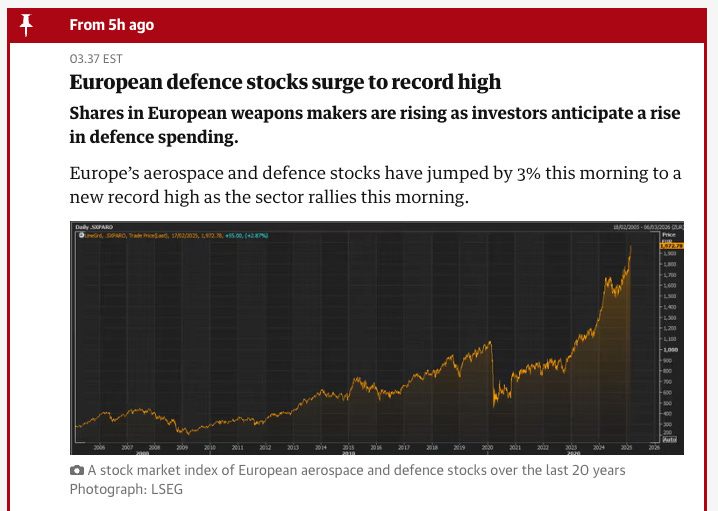

The resulting vibe is that as the United States’ military steps down from its European vigil, defense spending in Europe will rise. How can we tell that? Simply by watching what’s afoot with European defense companies. Here’s The Guardian:

That’s quite a rise apart from even today’s gains.

But while holders of European equities will be content to see their equity positions accrete, I think there’s a more interesting potential story here. Namely, the same New Defense Industry effort we’re having here at home could play similarly in Europe. That would mean lots of venture capital flowing into companies building advanced, modern, and less expensive military tech.

We’re already seeing some of this. Recall that Mistral (French foundation model startup) and Helsing (German drone-and-defense startup) are teaming up to help bolster European war fighting capabilities. More, please.

I joked the other day that the EU is coming around to the United States’ perspective on AI — that’s its better to build now and regulate later to avoid losing a march to China. Now we’re also exporting our Neo-Cowboy defense startup concept along with founders that are hellbent on growing huge new companies in Europe, regulation be damned.

It’s worth noting at this juncture that CO does not take the ‘stop fining our companies or else’ perspective on the EU that the VP does. No. But, at some point, you have to look at anemic GDP growth and wonder if you are doing too much to stop too little and not enough to help so very much.

A more sharply befanged Europe would be toothsome to our collective democratic arsenal. To the teeth, Brussels.

Small teams + AI > SaaS?

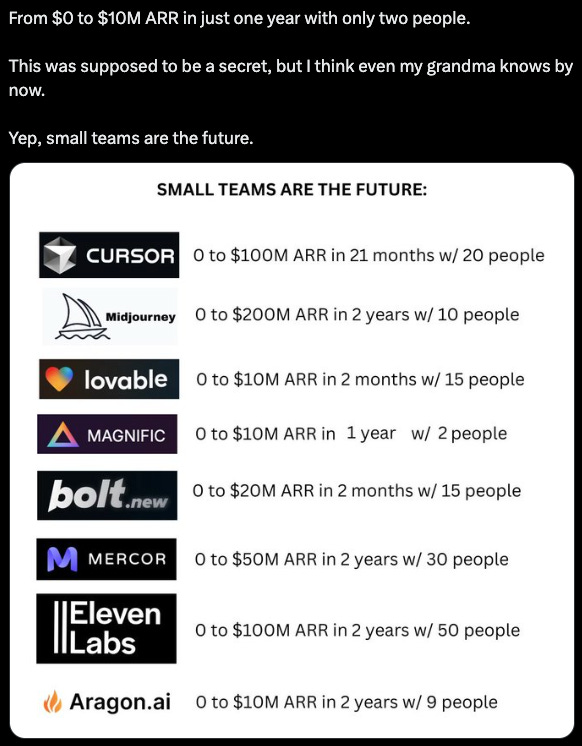

Javi Lopez of Magnific posted the following image on X recently:

I have not vetted every single datapoint on the table, but I can confirm that lots of it comports with what I’ve read. The takeaway is that not only are technology companies scaling more quickly than before in revenue terms, they are also often doing so with a very, very small set of staff.

In a sense, this is the promise of the Internet come to life. Instant, all but zero-marginal cost distribution means that you can reach the whole world for effectively nothing. Cross that with a new technology wave cresting and ever-more efficient tooling for building companies and delivering services, and there has never been more operating leverage available for startup founders.

Some startup founders, I hasten to add.

The above list is AI-heavy. You don’t see much traditional SaaS in there. No, the ‘find a business inefficiency, build a software product that solves it, and charge customers by the seat’ method of startup value creation looks mighty dated today. There is probably some venture-pricing arbitrage to be found in SaaS investing, but if the above image holds as more than a temporary meme, venture dollars will naturally shift to AI-first, small-team startups.

The old model of scaling SaaS startups with big checks, stiff cash burn, and a slowly improving profit arc contrasting revenue growth deceleration all the way to an IPO is passe. Killed not only by falling SaaS revenue multiples but also the fact that you need a lot of bodies to sell trad SaaS. And sales teams are expensive. Why not just scale to $100 million ARR in a third of the time without a sales team?

That’s a mighty compelling pitch. It’s also one that probably requires less capital. Not that we’re seeing AI-first startups eschew checks, but I think some will. Why not hold more equity if you are growing so quickly? Every share you don’t sell prints cash!

The startups listed above will hire more. And they will in time look more like regular tech companies. But so long as there is a path to nine-figure ARR sans a large headcount, expect venture capital to come calling, checkbooks open.