Welcome to Cautious Optimism, a newsletter on tech, business, and power.

CO was off yesterday because Alex was busy flying to New Orleans. It was off Tuesday due to an internal scheduling mixup. For fun, we’ve pasted the entire unsent Tuesday email (Grok 3! Creator investment!) after today’s. As always, when we go long, read what’s for you and skip the rest!

📈 Trending Up: ElevenLabs … AI hiring … OpenAI, with 400 million weekly active users … Codeium’s valuation in reported upcoming funding round … crow, eating thereof …

📉 Trending Down: Palantir’s stock, after some of the meme-dust wore off … Walmart’s stock, after its forecasts disappointed … expertise in government …

One Big Thing: In the wake of news from Google that its Willow quantum chip had made material strides in advancing the state of quantum computing, Microsoft has its own big news drop. Its ‘Majorana 1 chip’ claims the ability to create “more reliable and scalable qubits, which are the building blocks for quantum computers.” I recently added a number of quantum companies to the TWiST500 because it seemed the technology undergirding them was getting close to the point of commercial viability. Microsoft’s latest is making me feel quite right.

Plans, God’s laughter

CO was largely conceived to cover IPOs. The 2024 IPO cohort was a flop, but we despaired not. After all, the 2025 IPO class would arrive in a rush, right? Wrong, thus far, at least.

Sure, we’re only a few months into the year, but we’ve seen more unicorns pull their listings than drop a fresh S-1. And instead of an IPO wave, we’re forced to spend all our time sorting out how:

The United States’ premier became the largest mouthpiece of Russian propaganda in the world

The United States is now more comfortable with its geopolitical adversaries than its traditional, democratic allies

The United States is content to act as a colonial gangster, demanding blood money for upholding the liberal international order

The traditionally Chicago-school-esque Republican party became a political organization in favor of both tariffs and unforced business uncertainty

I am bewildered, incensed, angry, and depressed all at once.

Bewildered because even with my basement-low view of Trump and Trumpism I did not expect him to call a democratically elected ally fighting off external extirpation a dictator while stating clearly that a dictator is more worthy of our time, energy, and attention than the nation he’s trying to erase.

Incensed at the chest-beating abhorrence of Ukraine and its brave people who have consistently shown the world that grit, some external dollars, and one hell of a lot of drones can hold up against a putative global power. Imagine rooting for the bully, and decrying the victim. You think that makes you good?

Angry that I am paying tax to a government that won’t stand up for what it believes in unless it gets a cut.

And depressed in that my ability to change any of the above is zero. Nil. Nothing. A complete blank.

CO wants to get back to IPOs. But while my nation speedruns an end to the post-WWII order that helped create a simply record amount of wealth, delete a record amount of global poverty, and allow for the invention of the modern world, we’re going to have to keep paying attention.

Hello, new Crunchbase

Crunchbase rebooted this week. I interviewed its CEO — and my old boss! — Jager McConnell for TWiST about the relaunch. That may come out tomorrow, but I’m out of office until next Wednesday so I can’t be sure.

What matters is that Crunchbase took its historical product — captured and cleaned data on private market companies, capital, and transactions — and built an AI prediction engine on top of it. And a neat tool to turn English-language queries into searches thanks to AI processing. It’s actually quite neat.

But, enough about all that. A few business notes from the Series D-stage startup:

The WSJ reports that Crunchbase is at/around a $50 million run rate. That’s material, but not IPO scale.

Jager told me during our chat that when Crunchbase decided to pull back on sales and marketing a few years back so that it could focus on building the AI products it just released, it made a bargain with its investors. The gist — and please do watch the interview when it comes out — is that Crunchbase and its backers agreed the company could take its foot off the growth pedal, but had to become breakeven/profitable in the interim.

The company then went off to build, and is now ready to invest again, even though it does expect to get back to the black later this year.

We’ve asked a lot of questions about the state and health of unicorns. Crunchbase isn’t one, thankfully. It’s worth $350 million as of its last funding round, per PitchBook. So ~7x ARR today. If it was worth $1,000 million, the company would be in a pretty tough spot if it ever decided to raise more. Thanks to its pretty reasonable price tag, however, if Crunchbase can quickly return to growth-y ways, it’s actually well-priced to either raise more and shoot for an IPO, or sell.

In my hopelessly conflicted testing, I found the new Crunchbase features to be pretty good. Useful in my daily research flow. But never index all your views on your own experience; the market will tell us if Jager et al nailed the relaunch.

The Tuesday Newsletter That Wasn’t:

CO is off tomorrow as Alex has a flight. Regular service resumes on Thursday!

📈 Trending Up: I don’t even know … kids ability to do math without an abacus … rocks, hard places … a billion here, a billion there … money in politics … European animal spirits? … spine … Apple in India … Thinking Machines …

📉 Trending Down: Venture velocity? … flight safety … being a good ally … stock market affordability … low-priced laptops …

Grok3 v The World

As we count down to GPT-4.5 from OpenAI — its last non-reasoning model — xAI released Grok3. It also dropped DeepSearch, which appears to be similar to the Deep Research offerings from OpenAI and Google.

You have to be an X Premium+ user to access Grok 3 at the moment. Why does that matter? There’s extensive shared financial plumbing between xAI and X itself — “the artificial-intelligence company transferred hundreds of millions of dollars to the social-media company,” per the WSJ — so the link between paying more for Twitter and how does xAI make money is perhaps the same question asked twice.

I was curious. How much does Premium+ cost? I pay $8 per month for

TwitterX so that I can useTweetdeckX Pro. The higher-tier costs $40 per month now after the company raised prices (there is a discount on offer if you prepay for a year). That’s a lot. Double, in fact, what a standard paid OpenAI account costs. And twice what I believe I am paying to Google for access to its new AI products. Notable.

The new Grok 3 model from Musk’s AI foundation model company appears to be pretty good at several benchmarks when compared to GPT-4o (about to put to pasture despite some recent upgrades), DeepSeek-V3 (came out in 2024), and Claude 3.5 Sonnet (also set to be replaced shortly).

This is not a knock against the smart folks working at xAI. They spun up a pretty interesting competitor in the AI model game in record time. But is xAI’s new model about to change the world? We’re going to need a lot more data, but what the company is claiming thus far appears more market-normal than market-setting.

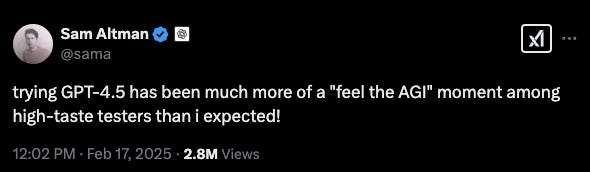

Elsewhere in model-land, Sam is hyping up his next offering:

Addendum: This dataset is very useful for tracking what models are leading the market in usage terms. The HuggingFace ‘Trending’ ranking list is also useful (right rail once you’re logged in). LLM-Stats is another that I have spent less time with, but would be remiss to not share as well.

Investing in creators

We had Sam Lessin on the podcast the other day to chat creators. Lessin’s venture firm — Slow — has a new dedicated $60 million creator fund that it intends to use to back creators in niches that are monetizable. You might shake your head at the idea, but I wonder if there isn’t some real coin to be made.

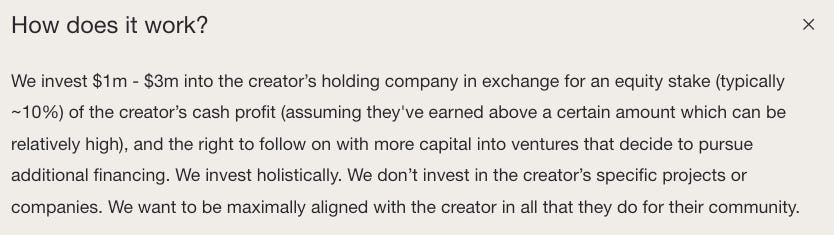

Deal terms will vary by transaction, I’m sure, but the concept, per Slow, works like this:

Offering up front capital in exchange for a chunk of the value of creative output is not a new model. It’s a tale at least as old as record deals. But what’s nice about the Slow model here is that it appears far less extractive.

That means Slow will need creators to shine to make its money back, let alone a venture-style return. Ergo, Slow will do well only if the folks it backs do super well. That’s nice and aligned.

And I don’t think that Slow will want for investment possibilities. A few, off top:

66Samus is a critical part of metal drumming YouTube with videos focused on drumming tips, challenges, interviews with other musicians, and similar. The fact that 66Samus is, in fact, a wizard behind the kit is a tip in his favor. The channel also shows off new gear in a way that is probably very monetizable.

DoshDoshington is my current crush. He’s better at Factorio than I am, and has built a community of video game dweebs that pay him to make videos. Again, with affiliate fees, subscription revenue, and YouTube income, DoshD is already multi-stream. And instructive that if I ever do play a death world, I won’t do it in the dark.

Scary Interesting has taught me that cave diving is not for me. Many people can’t help themselves, and demand to go into the dark water underneath the Earth. Some don’t make it back. And if they do not, Scary Interesting will be there to tell the story. In vivid detail. While you sit at home, safely on your office chair.

I have no idea if any of the above are Slow-appropriate, but I could keep going for a while I think. It’s a good thesis.

ty for not shying away from discussing what's going on right now outside of just tech. because it matters.