Can you secondary your way to top-decile DPI?

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Tuesday! Today I had planned a rundown of venture capital data from around the world, but that’s on hold until tomorrow as we have to take a moment to discuss the current state of the nation. That said, there’s business goodies aplenty below for your enjoyment! — Alex

📈 Trending Up: Getting over your skis … ads in your AI search … Series A founder secondary? … Kaitlyn Chen … Japanese deterrence … UK-US economic ties …

On the subject of secondary transactions, the Setter VC Q1 report of the most sought-after private companies is worth your time.

Shockingly, it’s not all AI shops!

📉 Trending Down: Chamath’s stock on X … Chinese exports in Q2? … Chinese mercenaries in Ukraine … domestic oil profits? …

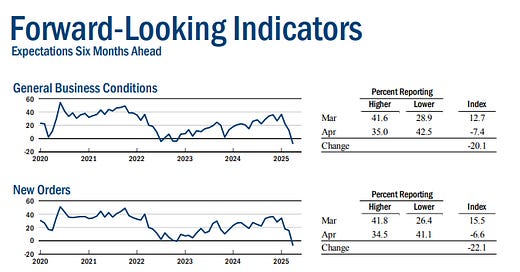

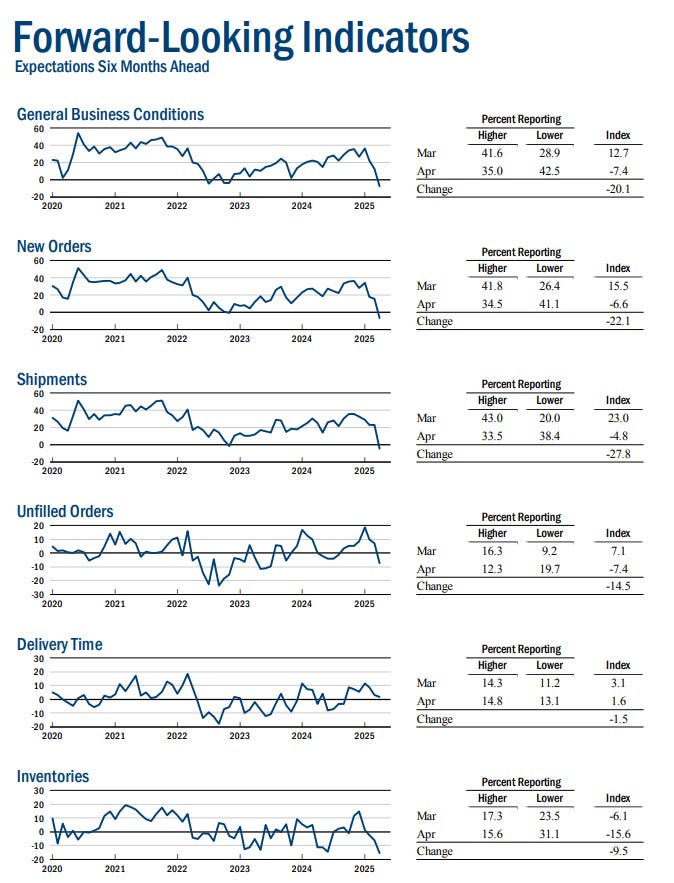

Chart of the day: The Empire State Manufacturing Survey is pretty grim. Tracking business activity and sentiment in New York state, the forward looking information points in a single direction:

If, like CO, you want lots of economic growth, the above is a dog’s breakfast.

It might be time to start worrying

Yesterday, POTUS blamed Ukraine for Russia’s invasion, saying that “Listen, when you start a war, you gotta know that you can win the war, right? You don’t start a war with someone who’s 20 times your size and then hope people give you some missiles? You don't start a war against somebody that's 20 times your size.”

I raise that quote because it underscores the quality of the current American premier; or his lack, if you will. The guy in charge thinks that the democratic nation under assault is the bad guy.

We’re not merely whining about the President’s lack of international savvy. No, this is the leader that a lot of folks think is great, and worthy of praise. Lots of folks in tech and business to boot.

I think it’s time to start worrying. Not merely because POTUS appears incapable of treating Russia as an adversary, but because the Bad Things are starting to accumulate:

Academic freedom is under direct threat, with the White House forcing universities to choose between financial pain and heavy-handed oversight. Given that we’ve seen from other MAGA higher-education efforts, there’s little evidence that the brains behind Trump University are ready to run, say, Harvard.

Business freedom is under direct threat, with the Executive Branch taking punitive actions against companies and sectors that it has historical — material or dreamed — complaint with. Business thrives on rules and consistency; a lawless business climate run on the patronage system is not how you retain superpower status.

Free speech is under direct threat, with access to the nation being circumscribed by thought. Support of Palestinian causes is now sufficient to get bounced from the country. And with POTUS openly pitching greater incarceration of citizens in foreign prisons, the trend lines here are incredibly negative.

The separation of powers is under direct threat, as SCOTUS told the government to work to return someone from El Salvadoran prison it was told by the courts not to deport. Now, the Trump administration is trying to get around the Supreme Court with a mix of intransigence, and aw-shucks denialism. We’re accustomed to political parties ceding some of their Constitutional authority to the President in terms of agenda-setting when their own group is in power. But seeing the Executive Branch to abrogate the Judicial Branch is terrifying; without court oversight and with a neutered Congress, that’s how how you backslide from democracy.

Corruption is rampant, with the President’s family and even his own person doing what seems to be as much as possible to cash in on declining crypto regulation and enforcement, to pick an example. There are others. And the risk of corruption thanks to the possibility of tariff relief by Executive fiat over our heads.

The trade stuff? That’s just bad policy. You have to eat bad policy at times in a democracy because quite often your team will lose. So goes the election

The above-listed concerns are different. They undercut critical protections of citizens from the state (speech, etc), and concentrate too much power in one branch — one person, let’s be honest — than our founding documents allow.

Panic? No. Worry? Yes. It’s time to start thinking what we’re going to do, so that when our kids ask later on we don’t have to answer I shoveled shit in Louisiana.

Can you secondary your way to top-decile DPI?

If you don’t speak venture, our little sub-headline asks can venture capitalists earn very strong cash returns on their investments without depending on traditional exit pathways like acquisitions or IPOs? The answer is we’re going to find out.

Much hay was made over the short-term pulse of IPOs that we saw in the first quarter, and the present dearth of similar transactions. Disregarding our present pickle, exits were pretty good in dollar terms in the first quarter, with PitchBook pinning the North American figure at $57.9 billion and the European number at $12.3 billion; both figures are above their year-ago comps.

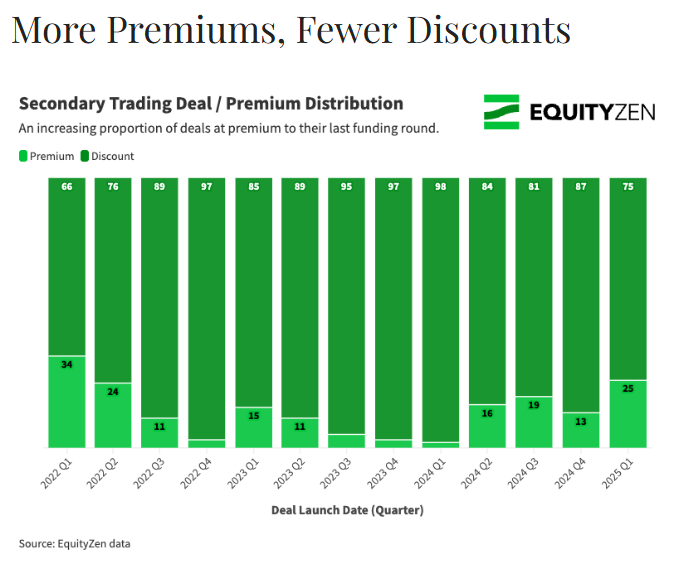

And yet, EquityZen writes in its own Q1 market report pegs “the current U.S. VC secondary market size between” $40 billion and $60 billion. About the size as a strong quarterly exit total for American startups.

Is a quarter or thereabouts a lot? Yes. Enough to replace IPOs? No, or at least not for larger venture capital funds. But as Precursor’s Charles Hudson writes, secondaries as material, consistent exit pathways for smaller, earlier-stage venture players is becoming the norm.

The situation isn’t great for incentive alignment, but can Seed-stage funds wait for more than a decade to return cash to their backers? Probably not. So, something had to give. If you are anti-secondary, you need to reduce IPO expectations and get some tourist late-stage money out of the market.

And if you are irked that secondaries are becoming all too primary an exit path, check this:

That’s bullish. Just not for traditional liquidity.

A SPAC? In this economy?

Yes, we’re not kidding. Self-driving truck company Kodiak is going public via a SPAC in a deal that values it at around $2.5 billion (equity, pre-money). You can read the deck here, but what’s astounding is that despite the company claiming:

It’s hard to chase down the numbers. Presumably because the revenues in question are so modest, but there’s nothing historical or forecasted in the deck. And after parsing through a pile of SEC filings this morning, the best I can find is this:

Which, you will note, is not the same thing as sharing them with us. I wanted to be kind here, as I will take any IPO-style transaction at this juncture. But here again we see a promising company with too little financial history and reporting to fully grok. SPACs. Will they ever change?