Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Good morning, friends! Welcome to Wednesday. Earnings are still light this early into the quarter, but there’s IPO news, new venture data to parse, and lots more to boot. After yesterday’s somewhat depressing entry, let’s have some fun? — Alex

📈 Trending Up: Lyft, which has recovered its gumption … retail sales … transphobia … Hammerspace … whatever this is … thinking of the rich …

📉 Trending Down: Dealmaking … cybersafety … press freedom … press freedom in Russia …

Figma, what are you doing?

Good news! Figma has filed to go public. At long last. More notes on its growth and history tomorrow, but even seeing a major private tech company continue with work towards a listing is good news. (The design unicorn is still in the confidential filing stage of listing, so we don’t have its raw data. Yet.)

However, Figma is also putting the screws on smaller companies over trademarks that seem pretty generic. Lovable, the quickly-growing, AI-powered digital building service shared a letter from Figma’s lawyers demanding that the smaller startup stop using “Dev Mode” as the “name for a software tool that helps bridge the gap between design and development.” Figma claims trademark over “DEV MODE,” it turns out.

Really.

On one hand, it’s good to know that the entire “delete IP law” idea from Jack is about as popular in mainstream tech circles as sushi left out over a weekend. All the same, this sort of scrap makes Figma appear more worried than benevolent in its request to resolve the issue amicably. You don’t punch down for no reason, right?

Meta failed to buy its way out of court

“You have to play the game on the field.”

Of all the accountability sinks out there, this one might be the most irksome. I once asked a venture investor why so many startup rounds had been executed at historically-indefensible valuations back in the ZIRP era. “You have to play the game on the field,” they said.

In a sense, the investor was correct. Firms raise funds to invest from, not sit on. Carry, not fees. And if prices are high, well, you hold your nose and cut checks. On the other hand, playing the game on the field can look a bit more like following the herd if you squint.

Regardless, playing the game on the field becomes a very interesting concept when we consider a transactional White House. That’s a polite way of saying a White House that is willing to be bought.

The crypto industry realized that if their pitch for a different regulatory regime could make the Trump family money, it had an in. That worked. Apple CEO Tim Cook gave a milly to Trump’s second inaugurartion. It probably helped! Nvidia somewhat scored in a similar fashion, though it’s not having that much fun due to other factors.

Then there’s Meta. Which tried to buy its way out of a trial with the FTC. After a huge press of lobbying, donations, and CEO time, however, the FTC and DoJ managed to keep enough spine inside the President to avoid direct intervention. Here’s the WSJ:

The FTC wanted $30 billion, but would settle for $18 billion and a consent decree. Meta wanted to pay $450 million to $1 billion, with Zuck calling the FTC head in March sounding “confident that President Trump would back him up with the FTC,” the Journal added.

Nope.

Playing the game on the field is a great way to do something you might not normally want to defend — buying justice, say, or paying 200x ARR at Series A — without much guilt. The problem when it comes to transactional administrations, however, is that they are never purely for sale. Meta is now facing material legal risk, and is seemingly still on the outs with MAGA. Winning.

The state of Global Venture

It’s report roundup time!

From Crunchbase News: Global M&A results, cybersecurity investment data, most active investors in the quarter, European venture data, updates from Latin America, and Asia.

From Dealroom: UK data, South East Asia results, what China managed in the first quarter, and notes on European results.

Here on our pages we’re going to focus in on a few datapoints that underline the state of venture here in the United States. (If you want CO to go deeper on specific regions’ venture results, let us know!) Pulling from PitchBook’s full Q1 report with the NVCA, let’s talk charts.

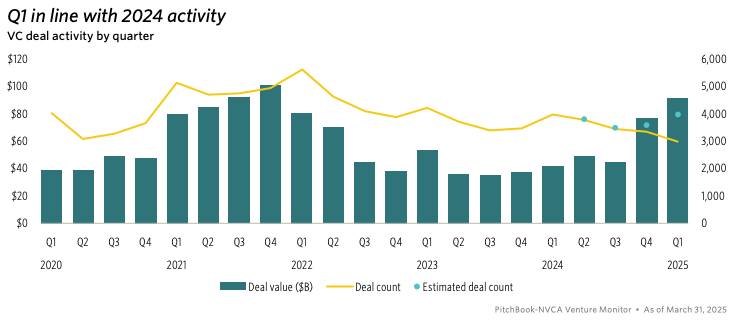

Venture totals in the United States during Q1 soared:

The headline number from PitchBook is that $91.5 billion was raised by US-based startups in the first quarter. That’s nearly 19% more than Q4 2024, and “the highest level since Q1 2022” per the data company.

Seeing venture totals rise (nearly) sequentially in recent quarters is very bullish. However, if we look even a single layer deeper we discover that the above data is incredibly top-heavy.

Venture results in Q1 2025 were driven by a handful of deals, exits

PitchBook reports that the ten largest venture deals in the United States during the first quarter were worth just over 61% of all dollar volume we see above. And even if we strip out OpenAI’s $40 billion transaction, the “the other nine deals still account for 27% of the total” we see above.

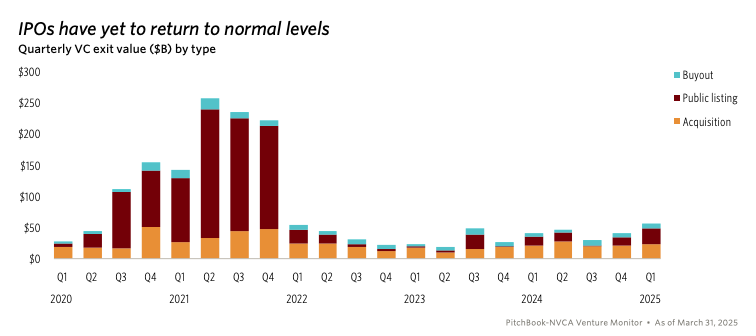

The story is the same on the exit side of the fence, with Wiz selling to Google and CoreWeave going public (our notes here, and here) “collectively generated more exit value than any quarter since Q4 2021.” Good, but not exactly the wide-spread rain of liquidity that many had hoped for.

Worse, the “best since Q4 2021” datapoint is predicated on every quarter since having proved dismal for exits. Though, we knew that already:

The money is flowing to later-stage AI deals

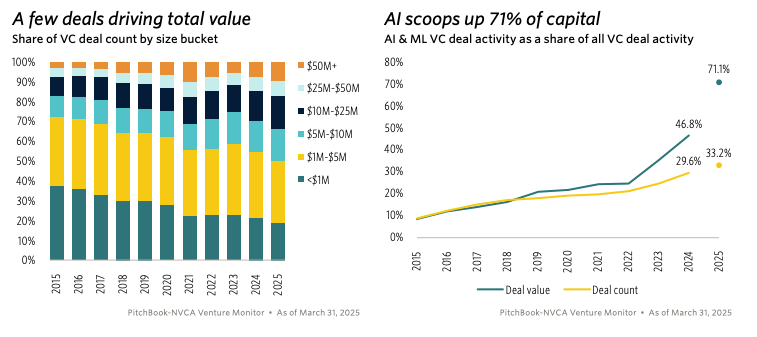

Even apart from the seemingly-regular OpenAI, Anthropic, xAI and other foundation model companies, the venture market is currently focused on putting huge sums into AI startups. The following two charts show the rising share of venture deals that are larger than $50 million, and the share of rounds that are AI-predicated here in the States:

A one-third deal share attached to a two-thirds dollar share of venture activity in the largest venture market in the world in the first quarter I think, is the best summary of the United States’ startup market, and thus the world’s.

San Francisco vs. Everybody

The United States’ venture market is the world’s largest. On a purely country-by-country basis, it’s not even close. All of the EU raised a fraction of what America pulled off in the first quarter.

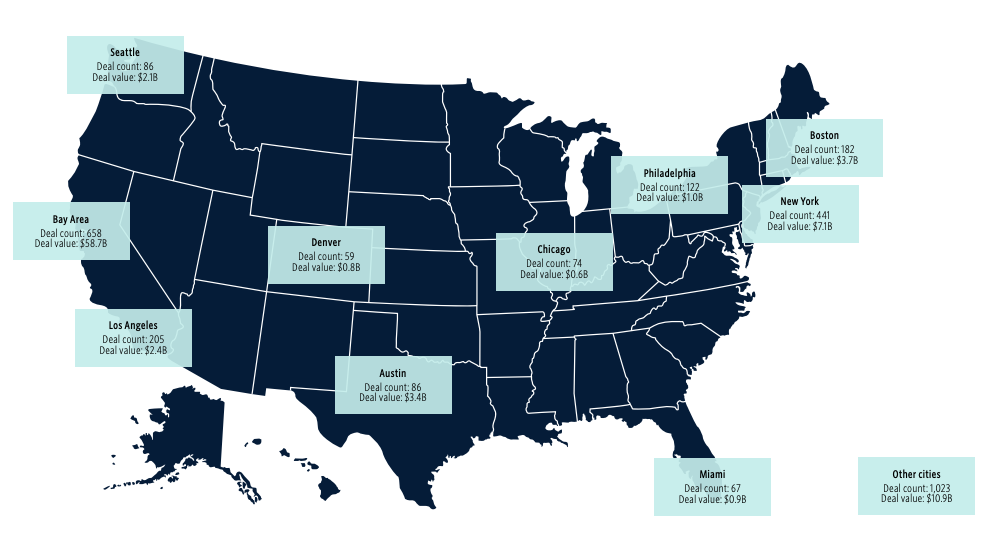

The same power-law story continues domestically, however, with rival hubs Boston and New York City foundering compared to the sheer fundraising might of the Bay Area:

If anyone tells you that Miami is still on the come up, ask them why startups in the city failed to outraise Philadelphia. That will help you make friends.

It’s not a great time to be a woman raising venture capital

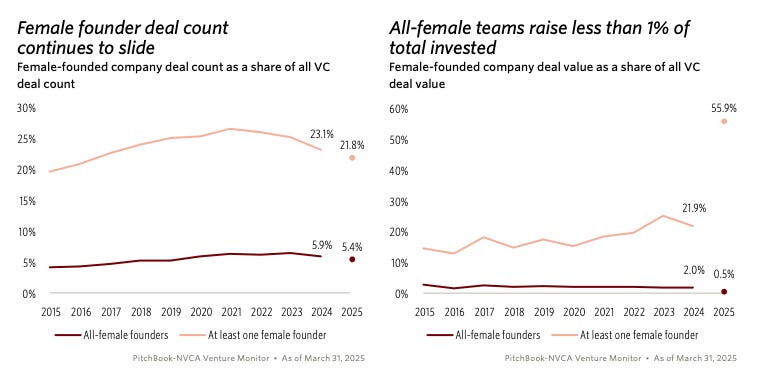

Closing this little riff — we talk about venture so much day to day here at CO, that I doubt you want me to go through every single number, yeah? — women raising money in Q1 is a two-part story. There’s OpenAI’s huge round which counts thanks to it having several women amongst its founding team. Then there’s everything else:

Generally speaking, female-founded startups command a smaller parcel of total deal volume, either as all-women teams or even mixed-gender teams. In dollar terms, well, the chart on the right speaks for itself, but the trend lines otherwise seem clear. Venture deals are getting more male, again.

What should we takeaway from the above? Given how mono-flavor venture investment is today — AI, and then everything else — discussing the venture market is more a conversation on the potential profitability of enterprise and consumer AI more than it is a vote on venture itself. So, we’ll keep covering AI like ivy on an old university building, while keeping an eye out for other sectors that might perk up and start to make more noise of their own as Q2 rolls along.

Chips, chipped

Shares of Nvidia are getting hammered in pre-market trading, off some 6% this morning. Why? The US government just clipped its wings in China even closer to the joint. From an Nvidia 8-K filing:

On April 9, 2025, the U.S. government, or USG, informed NVIDIA Corporation, or the Company, that the USG requires a license for export to China (including Hong Kong and Macau) and D:5 countries, or to companies headquartered or with an ultimate parent therein, of the Company’s H20 integrated circuits and any other circuits achieving the H20’s memory bandwidth, interconnect bandwidth, or combination thereof. The USG indicated that the license requirement addresses the risk that the covered products may be used in, or diverted to, a supercomputer in China. On April 14, 2025, the USG informed the Company that the license requirement will be in effect for the indefinite future.

The Company’s first quarter of fiscal year 2026 ends on April 27, 2025. First quarter results are expected to include up to approximately $5.5 billion of charges associated with H20 products for inventory, purchase commitments, and related reserves.

This is a surprise. Nvidia spent time lobbying Trump to keep H20 sales flowing, including Jensen spending $1 million to attend a ‘dinner’ at the President’s personal residence. It seemed to work. Until it didn’t.

The American chip industry’s woes do not only stem from domestic export controls. US tariffs are taking a bite out of the semiconductor equipment industry as well. Reuters reports that the damages could pass the $1 billion mark.

Even some of the good chip news has a negative tinge to it this week. ASML, the Dutch company known for building complicated machinery for chip manufacture, is taking blows. Despite €7.7 billion worth of Q1 revenue landing within its own expectations along with gross margin overperformance compared to guidance, shares of ASML are lower. Why? Bookings came in light, and the company’s CEO told shareholders that:

Our conversations so far with customers support our expectation that 2025 and 2026 will be growth years. However, the recent tariff announcements have increased uncertainty in the macro environment and the situation will remain dynamic for a while. As previously shared, artificial intelligence continues to be the primary growth driver in our industry. It has created a shift in the market dynamics that benefits some customers more than others, contributing to both upside potential and downside risks as reflected in our 2025 revenue range

That’s gross for a company that should be currently enjoying its salad years. Imagine getting to your party only to find out that someone has put up a rope line and is charging a cover fee! You’d be incensed. I would be. Well, if I went to parties. But you get me!

Hello Alex,

I hope this communique finds you in a moment of stillness.

Have huge respect for your work.

We’ve just opened the first door of something we’ve been quietly crafting for years—

A work not meant for markets, but for reflection and memory.

Not designed to perform, but to endure.

It’s called The Silent Treasury.

A place where judgment is kept like firewood: dry, sacred, and meant for long winters.

Where trust, patience, and self-stewardship are treated as capital—more rare, perhaps, than liquidity itself.

This first piece speaks to a quiet truth we’ve long sat with:

Why many modern PE, VC, Hedge, Alt funds, SPAC, and rollups fracture before they truly root.

And what it means to build something meant to be left, not merely exited.

It’s not short. Or viral. But it’s built to last.

And if it speaks to something you’ve always known but rarely seen expressed,

then perhaps this work belongs in your world.

The publication link is enclosed, should you wish to open it.

https://helloin.substack.com/p/built-to-be-left?r=5i8pez

Warmly,

The Silent Treasury

A vault where wisdom echoes in stillness, and eternity breathes.