Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Friday! We made it, y’all. Stocks are flat, but after a few days’ recovery I won’t complain. Alphabet earnings dropped yesterday afternoon, so we’ll yank out all the essential AI tidbits below. Also, a quick look this morning at national efforts to bolster venture capital inside their borders — as globalism declines, perhaps too the primacy of Silicon Valley? Let’s have some fun. — Alex

P.S. On May 8th, CO is taking part in a panel with Konrad and Inkhouse about alternative media. Come hang if that’s your jam.

📈 Trending Up: Meta’s enjoyment of the MSM …. bitcoin leverage? … Waymo! … suing OpenAI … Chinese AI development … Perplexity’s cost basis … subscription media … insulting offers …

Deep sea mining? I helped prep a TWiST interview last year with The Metals Company, which wants to suck deep-ocean polymetallic nodules off the sea floor. It seems that the startup, and its rivals, are about to get a boost.

📉 Trending Down: Free speech … climate change? … Intel, after earnings … Chinese dominance in global electronics manufacture … AI prices … crypto regulation … fool me once, shame on me … primary schools …

Google’s grip on Chrome? It’s not just OpenAI that wants Chrome, Yahoo might be in the mix as well. Which is hilarious.

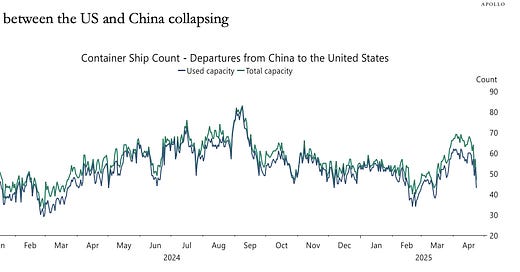

Chart(s) of the Day:

Via Apollo, a chart showing a sharp decline in the number of containers flowing from China to the United States. Note how, compared to 2024, Q1 2025 container levels were elevated (folks trying to beat tariffs), and now falling unlike a slow rise seeing last year. Welcome to tariff-town. We’re here!

Trade Updates

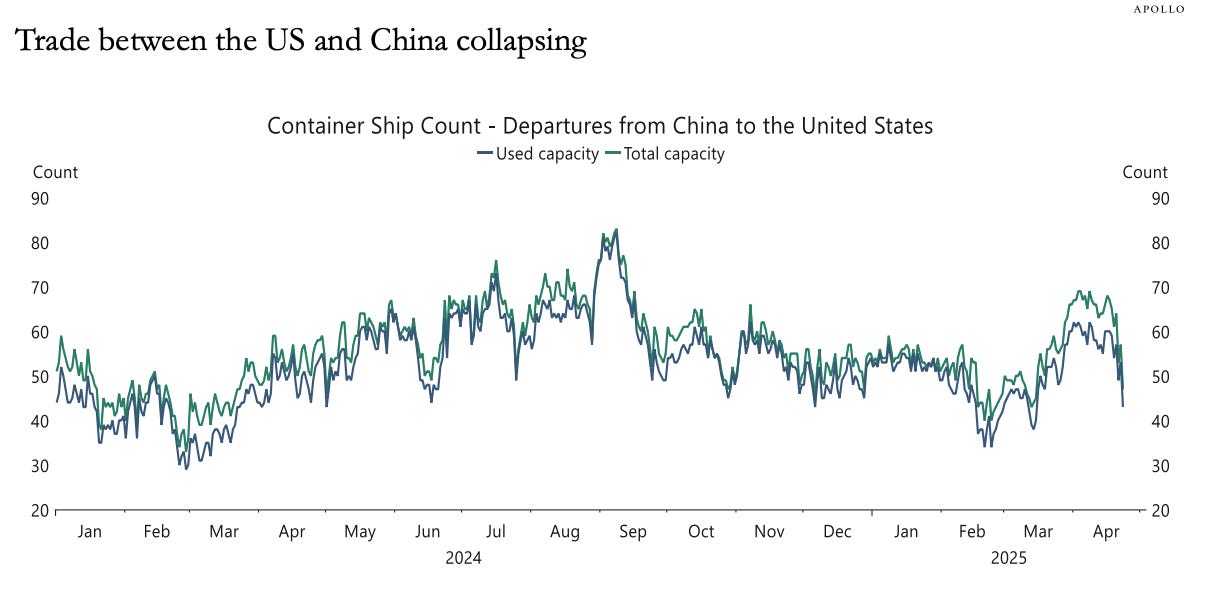

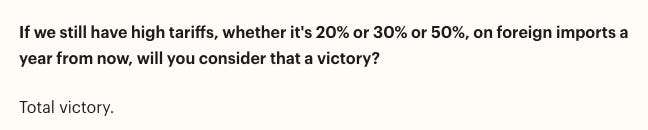

This morning, a Time interview with POTUS laid bare his long-term perspective on tariff rates. And it’s not precisely what the market wants. Here’s Trump on sticky tariff rates:

And here’s Trump on trade with China, continuing his view that trade is zero-sum:

Again, not what the market wants to see but amidst the bluster there’s also claims from Trump that many trade deals are nearly done? It’s a bit hard to parse his speech patterns, but investors might put stock in hope of quick agreements that can lower tariff rates on some countries. Maybe.

In good news, China is selectively lowering tariffs on certain American goods to help domestic industry. It’s not clear how material a softening in trade barriers the move represents, but it’s welcome all the same.

Alphabet’s AI earnings bonanza

Alphabet beat Q1 earnings expectations. Its shares are higher in pre-market trading.

The high-level numbers were encouraging. The street expected Alphabet to drop $2.01 in per-share profit off revenues of $89.1 billion. The company actually earned $2.81 per share off $90.2 billion worth of top line. That’s a comfortable beat.

Alphabet grew 12% in the first quarter of 2025, down from 15% in Q1 2024. At the same time its operating margin improved from 31.6% to 33.9% across the same timeframe. Net income rose 46%.

Alphabet also promised a 5% dividend bump and a fresh $70 billion buyback of its shares.

Most importantly, revenue from Google Cloud grew from $9.57 billion (Q1 2024), to $12.26 billion in Q1 2025. That 28% growth helped Cloud at Google deliver not the mere $900 million in operating income that it managed to start 2024, but a superior $2.11 billion worth of opincome in the first quarter of 2025.

How much did AI help? Here are the key opening quotes from Alphabet’s CEO during its earnings call, via a SeekingAlpha transcript:

[Regarding] AI Infrastructure, our long-term investments in our global network have positioned us well. Google's network is robust and resilient supported by over 2 million miles of fiber and 33 subsea cables.

We released Gemini 2.5 Pro last month, receiving extremely positive feedback from both developers and consumers. […] Active users in AI Studio and Gemini API have grown over 200% since the beginning of the year. […] Gemma models have been downloaded more than 140 million times.

Search at Alphabet is not dead. Indeed, the company is bullish on Google’s AI chops. Here’s its CBO:

Q1 marked our largest expansion to-date for AI Overviews, both in terms of launching to new users and providing responses for more questions. The feature is now available in more than 15 languages across 140 countries. For AI Overviews overall, we continue to see monetization at approximately the same rate, which gives us a strong base on which we can innovate even more.

Throughout 2024, we launched several features that leverage LLMs to enhance advertiser value, and we're seeing this work pay off. The combination of these launches now allows us to match Ads to more relevant Search queries, and this helps advertisers reach customers in searches where we would not previously have shown their Ads.

And here’s the CFO on AI expenses and return:

[Google Cloud] revenue increased by 28% to $12.3 billion in the first quarter, reflecting growth in GCP across core and AI products at a rate that was much higher than Cloud's overall revenue growth rate.

With respect to CapEx, our reported CapEx in the first quarter was $17.2 billion primarily reflecting investment in our technical infrastructure […] We still expect to invest approximately $75 billion in CapEx this year. The expected CapEx investment level may fluctuate from quarter-to-quarter, due to the impact of changes in the timing of deliveries and construction schedules.

Is Alphabet still capacity constrained regarding its cloud workloads, driven in part by AI demand? Yes, per Alphabet’s CFO:

Recall, I've stated on the Q4 call that we exited the year in Cloud specifically with more customer demand than we had capacity. And that was the case this quarter as well. So we want to make sure we ramp up to support customer needs and customer demands.

Is Alphabet seeing rising usage of AI inside its own walls? Again, yes, per the company’s CEO:

Obviously, I had mentioned a few months ago in terms of how we are using AI for coding. We are continuing to make a lot of progress there in terms of people using coding suggestions. I think the last time I had said the number was like 25% of code that's checked in involves people accepting AI suggested solutions. That number is well over 30% now.

My read of the above is that Alphabet, along with the company’s results and how it is positioned itself in its earnings release, is that we’re still full-steam ahead on the AI race. Not a shock, but a useful datapoint all the same. Recall that we’re seeing some pullback on aggressive data center deals on the edges of hyperscaler capex plans. That could be read as a decline in the growth of AI-derived compute demand. And yet, everything Alphabet just said.

Closing, Waymo is now at 250,000 weekly paid rides, and the company floated the idea of personal ownership of its vehicles during its earnings call. The latter is probably more digression than near-term product plan, but it brings me joy all the same.

Can anyone take on the Valley?

The global order of free-flowing capital and talent is changing. Borders are getting harder, economic lines of demarcation being drawn more sharply, trade is slowing, and nationalism is on the rise. I think that’s a fair summary.

One result of the above is that we’re seeing greater bloc, and nation-level investment in local tech companies. You can sort the move under the same umbrella as every major nation and bloc working to engender local chip production. No one wants to depend on others for critical national goods, including both technology hardware, software, and services.

The result of the shift we’re describing is not only rising local demand for local services — why I added NexGen Cloud to the TWiST500 — but also a push for more nations to get good at building big technology companies:

As noted in CO, Project Europe wants to help invest in, and mentor young European tech founders. France, meanwhile, is pouring attention and capital into building out its AI compute footprint. And the EU is working to cut regulations to help its technological-economic nexus flourish. The UK is also busy. (Germany made a big startup pledge last year, mind.)

More recently, South Korea is “reportedly seeking 600 billion won (around $420 million) for the fund, the second vehicle established under the “Startup Korea Fund” project,” PitchBook writes.

Build Canada is working on a series of tech-friendly regulatory positions, drumming up attention for a tech-backed agenda ahead of national elections.

A big list of Japanese firms is backing a new, $2.1 billion fund to invest in local startups.

China is putting together a monster 1 trillion Yuan vehicle to invest in its own local startups, too.

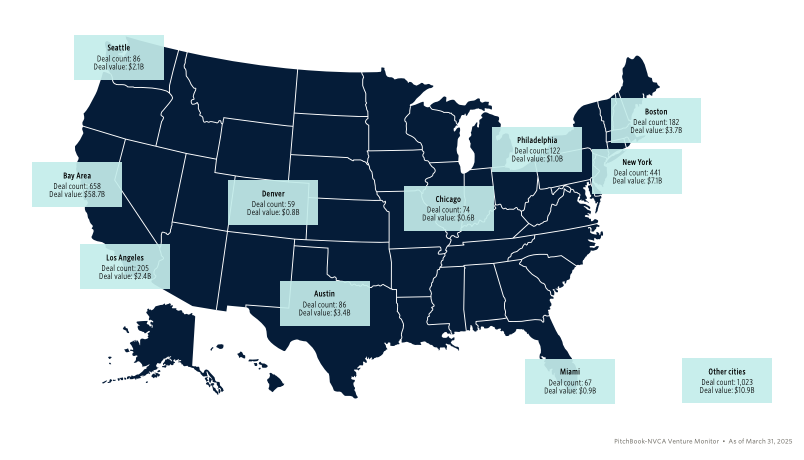

I think that this is the 45th time that the world has tried to challenge the power of Silicon Valley to foment giant technology companies. So far, not only has the world failed to topple the United States’ own dominance in venture investment and technology capital formation, but inside the United States the Valley itself still reins supreme (via PitchBook/NVCA):

Why might this time be different? Because the United States is currently doing its best to lose the global talent war. Currently, my nation is working to bounce anyone it deems guilty of thought-crime, or even the most minor of legal infractions, from our shores.

As a result of trade and political tensions with other nations, and rising intranational paranoia regarding folks from other nations, travel the United States is falling rapidly. Expect college and graduate school numbers to fall, too. So, other nations that might have seen their best and brightest flock to the States might now get to hold onto those minds. Our loss, their gain; if you were any other nation, this is the perfect time to get busy with the checkbook.