Good morning, and welcome to Cautious Optimism for Wednesday, May 22nd 2024. Let’s talk startups, tech, and money!

Trending Up: The stock market, as the Nasdaq Composite and S&P 500 closed at new records … Microsoft’s tireless efforts to avoid missing a platform shift, like it did with mobile … AI companies pissing everyone off, and not understanding culture … fintech contagion, of a sort … France … crypto prices, with bitcoin back over the $70,000 threshold …

Trending Down: Oyo, which has once again canceled an IPO … AI hardware, as Humane reportedly seeks a buyer, already … the ability of the Chinese Communist Party to take over Taiwan’s chip industry … Box, which got an analyst downgrade … conservative AI calls …

What The Fuck: Former GOP candidate for president Vivek Ramaswamy has accumulated a 7.7% stake in Buzzfeed, the now-public media company that grew big in the era of easy social traffic. Ramaswamy is doing something that I have always wanted to try: Find a public company that has lost most of its value, buy a cheap >5% stake, and then try to make it do whatever I want. I do not know if Ramaswamy can turn Buzzfeed around — though I have a suspicion — but investors have bid the value of the company’s stock up by 60% this morning. That’s a tidy profit for a very short holding period.

Cautious Optimism: With a higher share price, Buzzfeed has more total wealth to play with; if it can put the money to work quickly, the Ramaswamy sideshow could wind up a net positive.

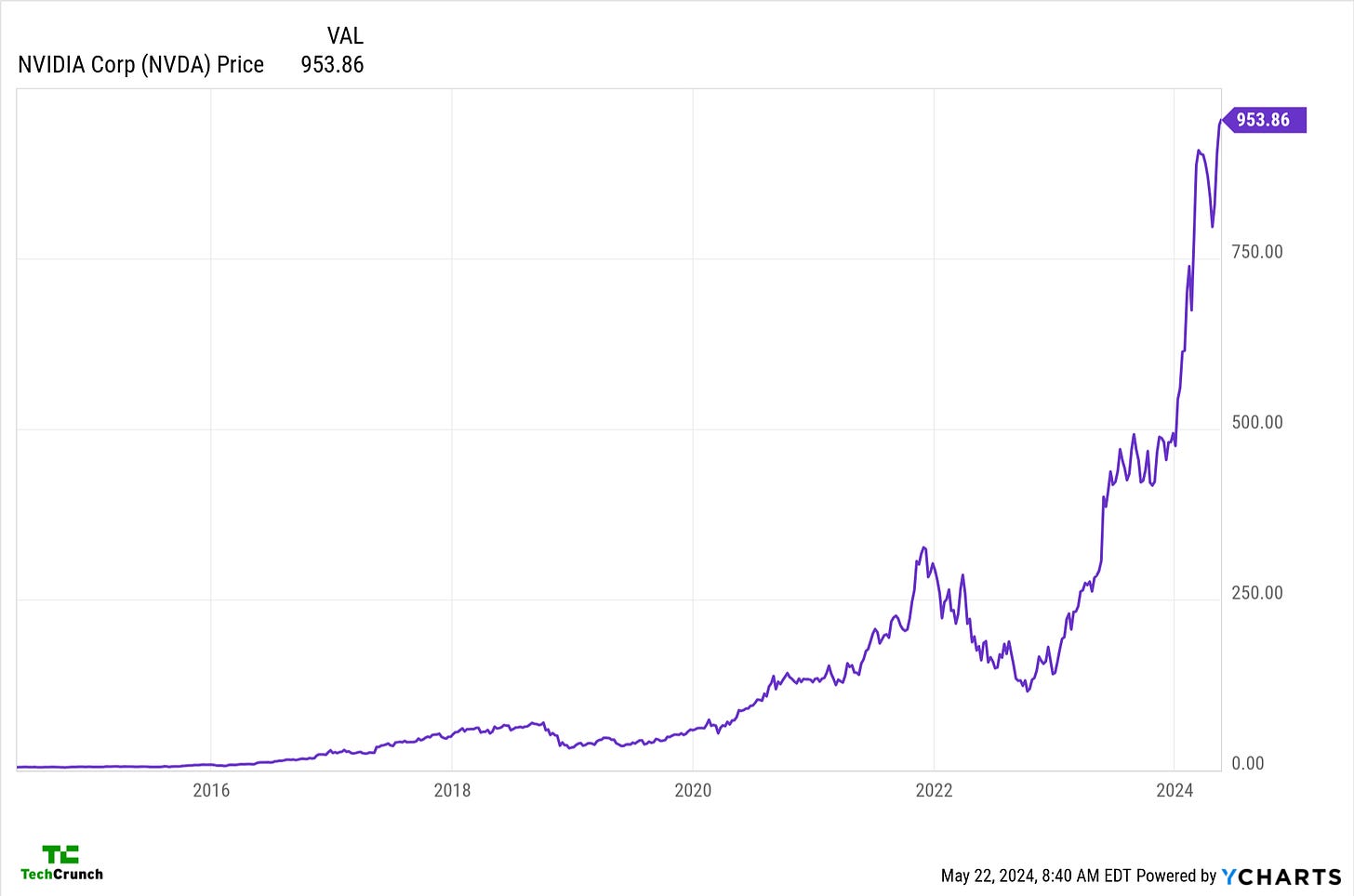

Up Next: Now that Microsoft’s Build event, Google’s I/O get-together, and OpenAI’s own shindig are behind us, it’s back to the earnings grind. Today, that means Nvidia earnings. (

and I are going live after the chip giant reports later today on This Week in Startups, tune in.)Expectations are sky-high for the company, with Reuters reporting that the street expects “a 242% jump in revenue to $24.60 billion for the fiscal quarter ending in April,” and “net income of $12.83 billion in the first quarter, up from $2.04 billion a year ago.” For the multi-trillion dollar company, the question before it is how long it can keep up its recent streak of insane growth and profitability. A few hundred billion are on the line this evening, at least.

Not that Big Tech is taking that sitting down: The Times has a critical report out on just how much money Microsoft, Meta, and Google are spending to build their own AI-friendly chips. “What’s revenue to Nvidia is a cost for the tech giants,” the Times notes. Yep. A good question at this juncture is are these Big Tech giants too big? To their credit, Nvidia is investing in a direct competitor to their cloud efforts.

Chew On This

This week, we’ve seen a number of massive new AI rounds that need to be considered as an aggregate:

$220 million for H, a new French AI company that wants to build AGI; it will compete with the other French AI giant, Mistral for both capital and intra-bloc AI model market share.

$125 million for Suno, which allows users to use AI to create music. I know this company because my friend, Axios’ Ryan Lawler, keeps sending me new songs he came up with.

$1 billion for Scale AI, the data labeling company now worth $14 billion. The FT reports that it had $700 million in revenue last year, which is a lot. If it doubles this year Scale would have a trailing revenue multiple of 10x. Not that crazy, and evidence that folks not building AI models can still make gobs of AI money. (Coactive Systems is not going to let Scale scale sans competition, however.)

$27.5 million for WitnessAI, and the list goes on.

To understand the current venture funding rush for AI startups, you have to segment the market. There are the big model companies, including Mistral, Anthropic, and OpenAI; the companies helping power AI work at other companies, including Scale and Coactive, Skyflow and Weka; and AI application companies, applying LLMs to specific use cases, like Retell, and the larger vertical AI push that Cowboy Ventures discusses here.

Why do we need to segment? Because it’s not clear where the value is going to pool for startups trying to snag a piece of the growing AI pie. At the model level? By helping other companies work with AI? Or, from applying AI to a particular market category? Big Tech companies want to own as much of the future AI market as they can, and they will win at least part of it. Startups need to make sure that they don’t wind up crushed under the boot of, say, Redmond or Mountain View by picking the wrong slice of our AI future to compete for.

There’s lots of money to be made, but also a pretty big chance that a whole class of startups is going to run up against the nearly infinite wealth of major tech platforms that also have mature enterprise sales channels. And lose.

For consumers like myself, all this fighting for market share, present and future, is great news, as we’re going to keep seeing quick innovation and falling AI prices. For those competing, it’s going to be a lot messier.

Liquidity Watch: Tempus AI is going public in the United States, and Raspberry Pi is going public in the UK. However, the IPO calendar is more barren than bursting. Still.

More to come tomorrow. Feel free to say hi: alexwrites@protonmail.com. Now, it's time to get the notes for the next This Week in Startups started! — Alex

hi