Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Wednesday! Stocks are rallying again on the hopes that the current trade war will cool. More on that below. Today, we’re looking at domestic economic pessimism, what to do with Chrome, and a little bit on Tesla earnings. Oh, and Cursor is apparently still growing like all hell. To work! — Alex

📈 Trending Up: AI compute demand, via Vertiv … state control of media … financial incentives to have kids in the US? … NATO defense spending … karma … karma, redux … AI models … corruption … Supabase … concierge medicine … ignorable yapping … cookies … SAP earnings … healthtech unicorns … corruption, redux …

📉 Trending Down: Inflation in the EU … EU fines on major American technology companies … complaints about EU fines on major American technology companies trending down … Chinese AI models not being throttled by the CCP … domestic fertility … jobs at Intel …

Cursor at $10B? Sure

Back in March, reports surfaced that Cursor (d.b.a. Anysphere) was considering raising at a $10 billion valuation. That figure seemed steep, to put it kindly. But recall:

Cursor reached $100 million ARR at or around the end of 2024, making it one of the fastest growing software companies of all time.

Then, Cursor reached $200 million ARR in March, per Natasha Mascarenhas of The Information.

And then today, TechCrunch reports that Cursor’s “current average annual recurring revenue is about $300 million, according to the two sources.” It’s April.

If Cursor was one of the fastest-growing companies ever to $100 million ARR, its in even more rarified air given its 2025 triple in less than four months. So, $10 billion? I’d pay 25x current ARR for Cursor, content knowing that figure will get cut in half in a year’s time at worst. Right?

The above explains why OpenAI turned its eyes to Windsurf — the smaller company is cheaper. A lot cheaper.

Cursor, which offers AI-powered tools for developers, is a standalone company in the current market. There are few names in startup-land that can challenge its torrid growth. But its success is also evidence that the AI wave is not merely generating capex and cash burn. No. Its success proves that AI inside particular market niches can soar. That’s great news for founders and VCs alike.

American economic pessimism

At the start of the year, 61% of Americans thought that the stock market would rise either modestly or sharply. According to Gallup data, that figure is now 29%. A majority (58%) now expect the market to fall at least a little over the next half year.

Similarly, inflation concerns have risen, optimism for lower interest rates has waned, and views on economic growth have also flipped to being more negative (38% positive, 48% negative). The economic picture painted by recent polling is gross.

Are Americans too down in the dumps? There’s hope that some of the self-harm that the United States has executed recently on the international stage will alleviate or end. To what extent? Axios reports that the CEOs of “Walmart, Target and Home Depot — privately warned [POTUS] that his tariff and trade policy could disrupt supply chains, raise prices and empty shelves.”

That seemed to be enough to get Trump to make market-approved noise about trade deals that may or may not be in the offing. It’s notable that a simple return to where we were would be good for what, a 10% stock market bump? However, given recent declines in the value of ~ gestures around vaguely ~ we’ll take whatever help we can get.

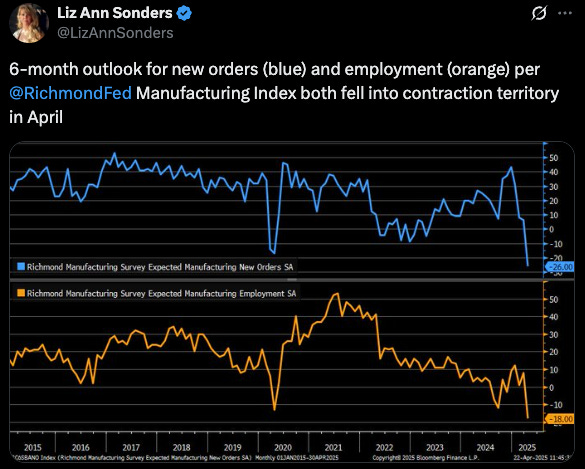

But the Americans worried are not fretting in vain. Here’s a chart from Liz Ann Sonders, CIO over at Schwab, showing Richmond Fed data:

That’s a shocking and swift fall in both expected manufacturing orders and employment. Some of the economic data in decline is predicated on the above showing up in people’s employment prospects. So much for a manufacturing renaissance. At least for now.

OpenAI, the troll

At present, Meta and Alphabet are fighting to keep their corporate empires in tact. The two wildly successful American technology giants have been found to hold and abuse their monopoly power in select markets. The final results of the cases is not yet clear as remedies are argued and appeals planned. But it may come to bear that Google is forced to divest Chrome, and Meta to divest Instagram, WhatsApp, or both. Google may also be required to share some search data with competitors. And that’s not including possible divestments from Google’s advertising case.

Let’s zoom in on Chrome. Arguments against Google being forced to divest the asset include the usual — it’s hard to rip out an integrated product from a platform company, the government is being rude, etc — and something special:

How would Chrome make money on its own?

After all, if Google is banned from paying for search primacy on digital platforms like mobile operating systems and the like, then the company presumably won’t be allowed to pay Chrome, The Independent Company to use Google search technology. Perhaps a rev share of sorts could be sorted out if allowed by the courts, or Microsoft could do a deal. But while Chrome has lots of value to Google, Chrome by itself is less certain a business than, say, search itself.

Enter OpenAI! Here’s Reuters:

OpenAI would be interested in buying Google's Chrome if antitrust enforcers are successful in forcing the Alphabet unit to sell the popular web browser as part of a bid to restore competition in search, an OpenAI executive testified on Tuesday at Google's antitrust trial in Washington.

ChatGPT head of product Nick Turley made the statement while testifying at trial in Washington where U.S. Department of Justice seeks to require Google to undertake far-reaching measures restore competition in online search.

The cackling you hear is me.

To wit, OpenAI could build a browser on its own. Doing so would be expensive, time consuming, and likely poor in terms of generating market share. After all, Chrome is the new Internet Explorer, the online de facto, replete with bloat and performance issues aplenty. Taking down Internet Explorer took, well, Chrome. Perhaps OpenAI could do similar, but wouldn’t it be simpler to just buy Chrome and make it super-duper AI?

Even more, OpenAI buying Chrome would give it a pretty good place to show off its own technology, allowing it to scoop actual search market share from Google. Google, naturally, doesn’t want that. But OpenAI has yet another advantage that would help keep Chrome healthy: 20 million paying ChatGPT accounts. OpenAI has revenue aplenty to keep Chrome’s development flowing while also, suddenly, owning the underlying portal that most of us take to the Internet each day. Forget chat.com being a coup; OpenAI getting its hands on Chrome would at once cut a leg out from Google and provide wings to Sam and company.

And then there’s Tesla

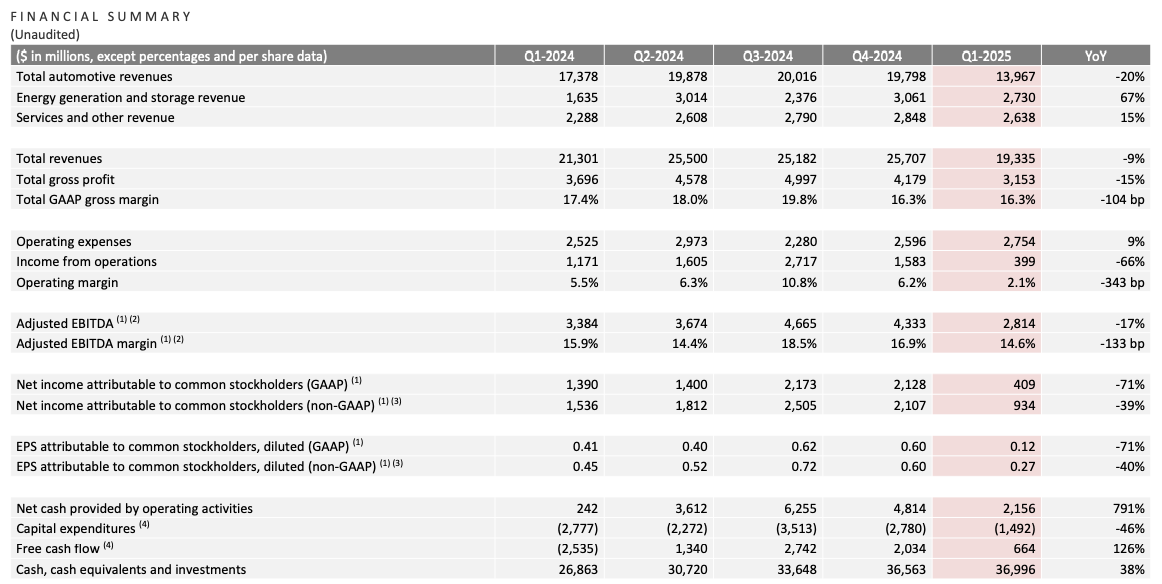

Yesterday’s Tesla earnings were very poor:

A 20% decline in automotive revenues was enough to bring total Tesla revenues down by 9%. At the same time, the company’s gross profit and gross margin fell from the year-ago period, as operating expenses rose. As you can imagine, that combination led to a contraction in both operating income and adjusted EBITDA.

Towards the bottom of its income statement, Tesla’s net income dropped 71% while cash generation grew YoY, despite coming in lower than what we saw from the company in Q2, Q3, and Q4 of last year.

The market cheered when Tesla CEO Elon Musk told investors during its earnings call that he’d be returning more of his attention to the company shortly, and winding down his time at DOGE. This is good for Tesla shareholders, twice:

When Musk gave Tesla a lot of attention, it grew from being a near-bankrupt EV maker with a limited lineup to a global leader in the EV industry and a contender in self-driving.

When Musk gave Tesla less attention, it lost market share, launched products that failed to live up to expectations, pitched its future on the back of self-driving tech — a segment where it is not the market leader — and saw its growth stall and profitability diminish.

When Musk gave DOGE a lot of attention, his brand took body-blows, leading to falling Tesla sales around the world after the CEO combined his personal, business, and political views into a single cocktail that proved less popular than he might have hoped.

When Musk gave DOGE less attention, he was less despised by lefties who might want to buy an EV. Just ask your friends.

So, having Musk back at Tesla is probably worth celebrating if you are betting on its future. (Sidenote: It turns out that Tesla is a top-ten holding in $FZROX, so I suppose that I am, also, a Tesla investor.)

The work remains ahead of the company, however. It must beat back domestic cars in China to recapture growth in the key automotive market, steady its brand in the United States and Europe, and nail its upcoming self-driving taxi launch. And its Optimus humanoid robot had better do well, too. Otherwise its share price makes no sense whatsoever.

Tall hoops to jump through? Sure. But I think the world will collectively breathe a bit easier when Musk is focused on things that roll instead of trying to make heads bounce and twist after being decapitated from the collective Federal desk.