All hail nuclear power

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Production Note: This is yesterday’s newsletter. It got stuck along its way to your inbox. Here it is! Today’s newsletter out shortly. — Alex

📈 Trending Up: Inflation in the United Kingdom … venture capital funds helmed by Villi … mineral wars … the Substack-Beehiiv beef … humans selling AI to corporations so they can hire fewer people …

📉 Trending Down: Treating people like people … separation of church and state … U.S.-China tech relations … no, really …

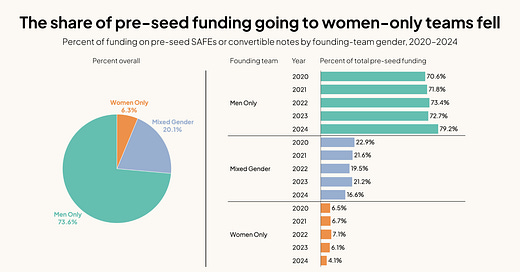

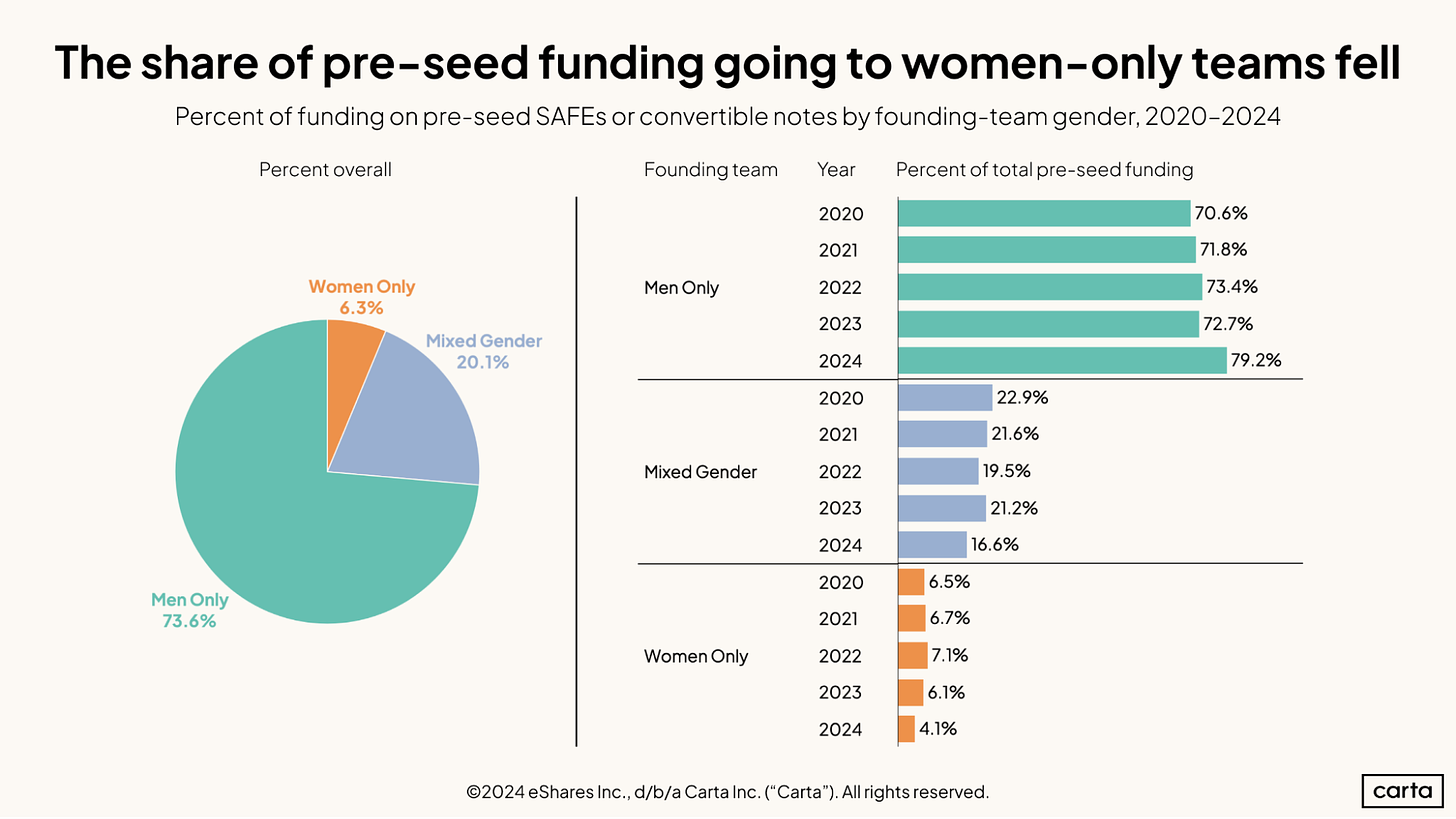

Diversity in startups: New Carta data indicates that in recent years, startup founding and fundraising has become a bit more male. The “percentage of all new founders on Carta who are women” in 2024 per the equity management platform fell from 15.9% in 2020 to 14.5% in 2023 to 14.3% in 2024. The portion of new founder teams that are all-male rose from 71.1% in 2020 (8.0% women-only, 20.9% mixed-gender) to 76.6% all-male in 2024 (7.2% women-only, 16.2% mixed-gender).

And women are seeing their share of venture dollars fall:

While it appears that Silicon Valley writ large is getting more male, again, it’s also becoming less white. The share of white founders in Carta data fell to 54.5%, from a recent high of 65.0% in 2018.

Un-cautious optimism

Data from Bank of America's fund manager survey — summarized here — indicates that amongst capital allocators, cash is bullshit and U.S. stocks are what you want to hold. Given the GDP growth differential between the United States and some of its economic ~peers, I get it.

Whenever the entire market is pointed in one direction, it’s a great moment to doubt the conventional wisdom. The problem with that is simple: To argue that one capital allocation method is flawed, you have to have an alternative in mind; with real returns from holding cash (money market fund average rate minus inflation) minute, Europe trying to sort out its next few decades, China floundering, and India dealing with a set of its own issues, you have to go pretty far down the national GDP rankings to pick a new target.

Nuclear goes up, to the right

After a number of American megacap tech companies announced or teased plans to get their hands on nuclear power to help provide their growing fleets of datacenters with critical juice, you might have expected a lull to form. Many of the announcements dealt with projects that would take years to complete or otherwise get online, so a break in news would not have shocked.

Nothing of the sort has happened. This week Oklo — a nuclear power startup that went public via a SPAC earlier this year — announced a deal with datacenter company Switch for “12 gigawatts of Oklo Aurora powerhouse projects through 2044.” Shares of Oklo are up 14% this morning on the news.

And then there’s Meta, which has launched a “request for proposals for nuclear energy developers to help us meet our AI and sustainability goals,” which means it’s looking for “1-4 GW of new capacity, starting in 2030.” That’s a lot of new demand, and from a company with very deep pockets indeed.

Nuclear projects take a while, but the trendline is clear today: We’re going to split one hell of a lot of atoms to power our ever-growing digital brains. Which, if I may, excites my inner science fiction nerd.

Yesterday, CO argued that there are a few critical requirements for future national and bloc-level competitiveness, focusing on the EU’s recent decision to build its own satellite Internet solution. The corporate version of that riff would be something like this:

To be a top-echelon tech company in the future, you’re going to need your own data centers, AI models, and power inputs. If you wind up lacking those technologies and capabilities, you are just renting someone else’s gear, right? And who wants to fund their competition’s R&D?

How to save the EU’s AI agenda?

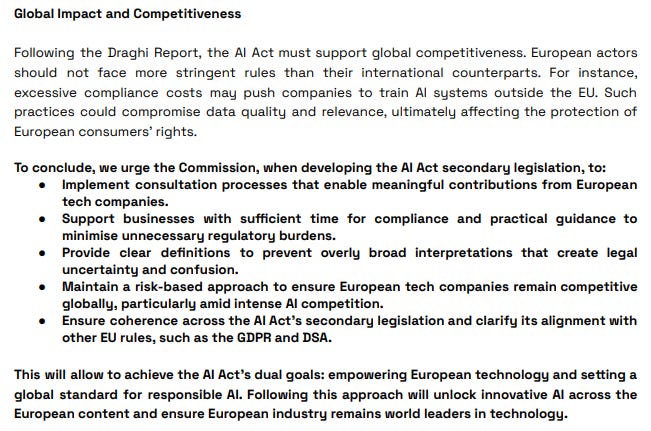

Yesterday, a letter signed by a host of European technology companies and a few national tech bodies argued that the EU’s AI regulatory stance — the EU AI Act, which you can learn more about here — is too broad, too harsh, and too rushed.

Here’s the critical final point of argument, and summary from Deliveroo, Klarna, Wolt, and others:

The point about compliance costs leading to extra-EU model training is critical; if all AI models are trained outside of the EU thanks to regulatory arbitrage, then the entire bloc will wind up building nothing, and owning little. The rest of the arguments are incredibly reasonable? And not contrary to the EU’s goal of containing certain risks when it comes to AI adoption.

If the above is not enough as the EU deals with economic stagnation to change the trajectory of AI regulation in Europe, you really do start to wonder why anyone would want to build a frontier-tech company there. The United States is just an afternoon’s plane ride away, after all.