Chinese stocks and American obesity both miss a step

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Lightdash, thanks to Accel … hurricane strength, regrettably … Hyundai, in India … appeals … leaving Amazon …

📉 Trending Down: Analyst predictions … AI … Chinese stocks, after a rapid ascent … Section 230, sadly … Roblox’s stock … flood insurance … earnings at Samsung …

Obesity in the United States (FT): I remain gobsmacked that GLP-1s are already proving so effective. And, frankly, given that the same class of drugs is helping people abuse substances less, it feels like we’re in a new chapter of caring for our bodies.

Venture takes its own advice: Recall when VCs preached financial restraint to their portcos when the ZIRP era reached a rate-ripping close? Well, it seems that VCs are now listening to themselves and reducing costs:

After Initialized announced plans to shake up its org, TechCrunch reported that NFX cut staffing as well.

Mix in capital surrenders from CRV, Founders Fund slimming down, and the other layoffs that we’ve seen from venture in the last year — remember OpenView? — and it seems that, yes, stresses in the venture industry, including the glacial pace of exits we’ve seen in recent quarters, are more than starting to bite.

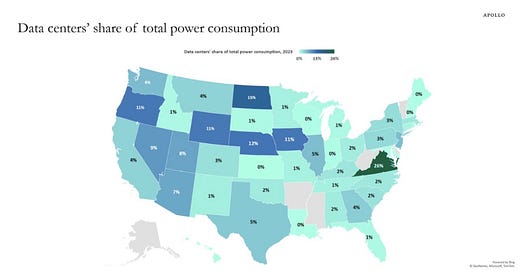

Why are startups like Fervo Energy and Exowatt stuck in my head? Because power demands for the next era of technology are going to be bonkers. The same trends that are driving demand for Nvidia tech are pushing these figures up:

Six states saw more than 10% of their power demand come from data centers last year. I bet that that figure reaches ten shortly, and twenty inside the next five years.

Don’t worry about it too much. Either we’ll sort out the power and water needs or we won’t, but our species is making a wager that building more digital brains and finding new ways to make steam to power them will allow us to do a lot more, more quickly. That’s a carbon budget — debt? — I’ll gladly cover.

That said, we need to make sure that major companies don’t simply plop down data centers in areas anywhere around the globe where local resources are stolen from the folks who live there, so that other people can scroll TikTok. You should use your own water and power for memes.

So much for the afterglow

CO has a minor obsession with the Chinese economy, leading us stories like the attempt by the country’s central government to resurrect its venture capital industry. Thus far, with venture totals in Asia setting decade lows, that effort doesn’t seem to have had much impact. Yet, at least.

But the Chinese government does know how to turn sentiment around, as it recently showed. The issue with its methods, however, is that they can prove more sugar high than anything longer-lasting.

What’s going on? One issue with state-controlled economies is that the state’s words wind up carrying more weight than fundamentals. That’s why a recent rally in Chinese equities was predicated on expectations of further stimulus. And, as hopes for further goodies from the state faded, so too did shares.

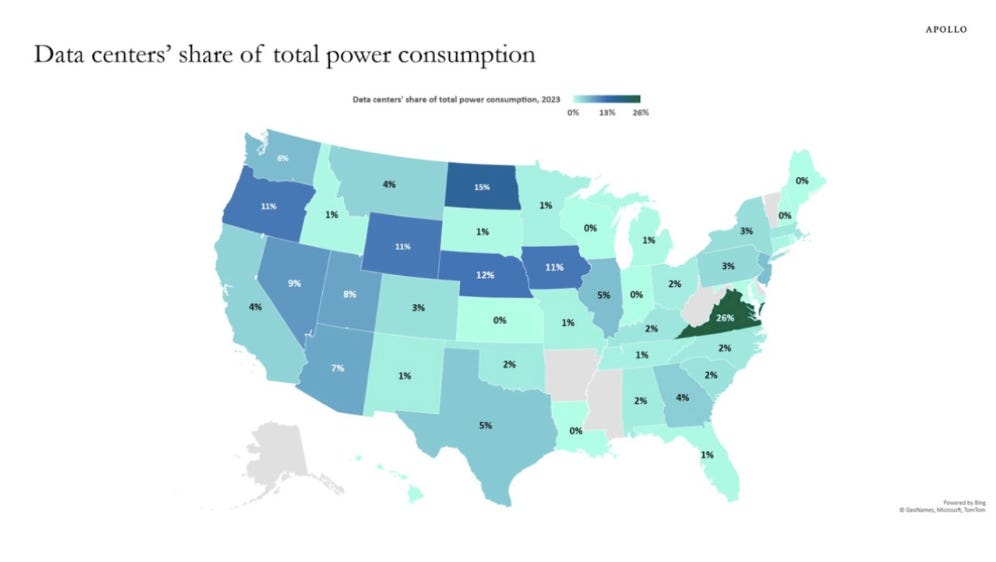

Here’s a chart of the MSCI Golden Dragon Index, showing the dramatic, recent runup in the worth of Chinese stocks:

That vertical rise was not due to rapidly improving economic data, but, instead, as Goldman Sachs put it:

The CSI300 Index of equities listed on the Shanghai and Shenzhen exchanges […] had its best five-day return since the Great Financial Crisis in 2008 as policymakers announced a range of stimulus measures. These included a primary policy rate cut, an interest rate cut on existing mortgages, and an asset swap facility for non-bank financial companies to buy stocks. Authorities confirmed that a stabilization fund to support the equity market is under consideration.

Today, after the Chinese state failed to announce more market-anticipated “fiscal stimulus measures,” as the WSJ put it, some of the country's recently rallied companies have given back gains.

What a faff. None of the above will solve the issue of too many houses built for a falling population, a declining working-age cohort, geopolitical isolation, some losses in manufacturing primacy, and a local debt crisis. Throw in the fact that it appears that new business formation in the country has cratered and you are left looking at democracy and capitalism and thinking damn, maybe we have something special.

The optimistic take here, as best as I can muster, is that contradictions in the current CCP economic model will break the back of the party and, in time, single-man rule in the country will end.