Coreweave is going public!

Also: Dear lord GPUs are expensive

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Free speech battles … Xpeng … EVs in China more generally … 12 figures between friends … trade wars …

📉 Trending Down: Consumer spending? … Nvidia, following new tariffs … the special relationship … American vibes …

Welcome to Tariff Town

So much for a pure negotiating technique. Starting today, 25% tariffs on imports from Canada and Mexico were paired with another 10% on Chinese imports, making the full Trump tally 20% since taking office.

Other trade-based threats that remain on the loom include tariffs on the EU, and Taiwanese semiconductors.

Since Trump won, the market has not been sure how to read the then-incoming and now-current President’s plans. “Surely,” the business folk thought, “he’ll listen to us—and the stock market—and avoid any material changes to the flow of goods around the world. Free trade is good; we like it. Why would a business guy mess up business for the guys?”

The other perspective was simpler: “Trump is probably going to do tariffs on a lot of stuff because he said that he wants to put tariffs on a lot of stuff.”

The old saw that you need to take Trump seriously but not literally does not apply here. Seriously or literally, the man was going to do at least a lot of tariffs, even if he wouldn’t hit his largest pre-term pledges.

But the market took perspective one, presuming that Trump was its guy. Not so much:

U.S. stock futures slid on Tuesday after a big sell-off on Wall Street, as President Donald Trump’s tariffs on Canada, Mexico and China took effect — leading to retaliation from some of those countries.

Expect higher consumer prices, higher input prices for farming materials, you get the idea. By the by, a falling stock market doesn’t an IPO climate make.

Elsewhere in 47, we’ve cut off military aid to Ukraine (the nation under attack) while we work to lessen economic pressure on Russia (the attacking nation). All because, and I shit you not, the President got his feelings hurt.

I wouldn’t expect more from my two year old, but by the time she’s three, I do anticipate a bit more maturity.

Inside Coreweave’s IPO filing

That was quick. After reporting indicated that Coreweave was prepping an IPO filing — details from which leaked ahead of time — the neocloud has filed to go public.

You can read the full document here. Today we’re breaking down what Coreweave offers, its growth, and its underlying economics, and customer concentration concerns the market might fret over. To work!

What’s a Coreweave?

Coreweave is a member of the neocloud cohort, a collection of startups building GPU-based infrastructure offerings that can handle AI workloads. While major trad cloud providers — GCP, AWS, Azure, etc — offer extensive AI cloud computing tooling and services of their own, neoclouds were built for specifically for AI workloads.

Other neoclouds include: Nebius, Crusoe, GroqCloud, TogetherAI, Tensorwave, and Lambda Labs

According to Coreweave, being purpose-built a big deal. Noting the “highly specialized infrastructure that is required to unlock the potential of AI is immensely challenging to build and operate, especially at scale,” the company says that “generalized clouds operated by hyperscalers were not built to serve the specific requirements of AI.”

The problem with using legacy tech, Coreweave tells investors, is that it loses some of its bite if not designed for AI workloads in particular. After stating that the “complexity of managing AI infrastructure means that a majority of the compute capacity embedded in GPUs is lost to system inefficiencies, with empirical evidence suggesting observed levels of performance within the 35% to 45% range,” Coreweave argues that “organizations need access to a fundamentally different GPU-based compute infrastructure that is built from the ground-up for AI and proven to perform at the scale and efficiency required to deliver AI” if they want to prevent an “Efficiency Gap.”

Enter Corweave, whose cloud platform is “an integrated solution that is purpose-built for running AI workloads such as model training and inference at maximum performance and efficiency.”

We go through all of that to point out that clouds are not fungible. Sure, if you want to spin up some generic storage or compute, you have your pick of providers and can follow your nose on a cost-only basis. But in the AI-focused neocloud game, you have providers that are busy building a new type of massed compute node, and they are pretty proud of what they have cooked up. To wit, Coreweave’s “Cloud Platform [broke] performance records, including setting an MLPerf record that was 29 times faster than competitors in 2023,” the company crowed in its S-1.

To vet if Coreweave is correct, we must get a handle on its economics. If the company is correct that the market demands AI-specific cloud computing capacity and that its offering is market leading, we should see quick top-line expansion (an expression of demand, or product-market fit if you want) from the startup and reasonable gross margins (an expression of pricing power, or even more fine-tuned product-market fit).

Do we?

The numbers

Yes. Here’s the income statement:

That’s amongst the fastest growth I have ever seen from a company at scale. From solid Series B revenues in 2022 to IPO-ready revenues in 2023 (+1,346%) to scale sufficient for S&P500 inclusion at tech multiples (+737%) in 2024.

Even better, the company’s gross margins scaled from poor, to good, to good+ over the same three-year interval:

2022 cost of revenue: $12.1 million, or 77% of revenue.

2022 gross margin: 23%.

2023 cost of revenue: $68.9 million, or 30% of revenue.

2023 gross margin: 70%.

2024 cost of revenue: $493.4 million, or 26% of revenue.

2024 gross margin: 74%.

Those are SaaS margins on a hardware-software business that is growing at hundreds of percent per year! Incredible.

On a quarterly basis, Coreweave is insane. During 2024 Q1-4, the company’s revenue scaled from $188.7 million ($129.2 million net loss), to $395.4 million ($323.0 million net loss), to $583.9 million ($359.8 million net loss), to $747.4 million ($51.4 million net loss).

And the company managed to bolster its gross margins from 72% in Q2 to 76% in Q4!

The fat margins discussed above come with a catch. Coreweave is spending through the nose to build out its GPU footprint around the world. Here’s the company’s investing cash flow statement, from 2022 on the left and 2024 on the right:

$8.70 billion worth of buying stuff in a year. Is that an insane level of spend for a company that is unprofitable? It depends.

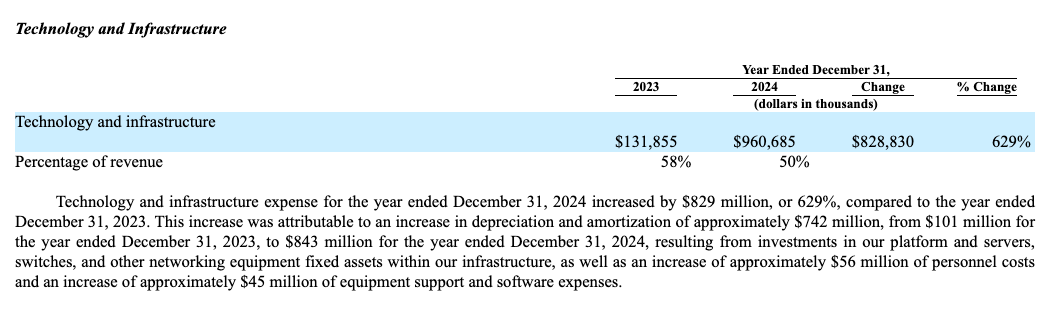

Coreweave reports depreciation and amortization of its gear as part of its ‘Technology and infrastructure’ line item. Here’s how the company discussed those costs’ change from 2023 to 2024:

Therefore, when we consider the company’s net losses, were already taking into account the costs of its purchased hardware losing value. Fair enough.

If you want to know how the company looks without those costs, we can turn to adjusted EBITDA which strips out those expenses and others. Hence how Coreweave can tout $103.9 million worth of adjusted EBITDA in 2023 (45% margin) and $1.22 billion in 2024 (64% margin).

Let’s not do that. That’s a silly way to do math.

The reason why you might choose not to worry about Coreweave’s huge hardware spend (and debt servicing costs thereof), is that the company claims a reasonable payback period for its spend (emphasis added):

Additionally, we benefit from rapid time-to-value on our infrastructure investments. Using committed contracts that were in effect as of December 31, 2024 as a basis, we anticipate that our average cash payback period, including prepayments from customers, will be approximately 2.5 years. Our cash payback period is the time we anticipate it would take to break-even on our investment in GPUs and other property and equipment through adjusted EBITDA.

Is 2.5 years a long time? Nope. In fact, Microsoft pushed its cloud server lifespan from four to six years back in 2022; more recently, Amazon “extended the useful life of its cloud servers by one year,” while Meta is targeting a five year lifespan for its servers as of 2023.

So, the gear that Coreweave is buying and installing and running should be able to earn back its costs and then some under its current economics. Not bad.

All told, if the company can ensure strong long-term demand for its services, it has a constructed a model that ingests capital, builds digital brains, and earns a good profit renting those silicon craniums to customers.

If demand slips, however, Coreweave could find itself unprofitable and sitting on unused gear that was kicking off GAAP costs like a dog sheds water. That would be a catastrophe.

Demand

It may feel silly to fret about demand when we consider Coreweave’s rapid growth. Of course the market wants what it offers!

But there are warning signs worth considering. First, most of the company’s growth in 2024 came from existing customers. After noting its impressive $1.7 billion worth of additional 2024 top line, Coreweave told investors that “over 95% of the increase in revenue was attributable to expansion within our existing customer base and the remaining increase was attributable to new customers.”

And, worse, a lot of the company’s growth comes from its deal with Microsoft (emphasis added):

We recognized an aggregate of approximately 77% of our revenue from our top two customers for the year ended December 31, 2024. None of our other customers represented 10% or more of our revenue for the year ended December 31, 2024. For the year ended December 31, 2022, our largest customer accounted for 16% of our revenue. For the years ended December 31, 2023 and 2024, our largest customer was Microsoft, which accounted for 35% and 62% of our revenue, respectively.

The company states elsewhere in its filing that it “recognized revenue of $81 million and $1.2 billion for the years ended December 31, 2023 and 2024, respectively, pursuant to the Microsoft Master Services Agreement.” Damn!

Why is it bad to sell to Microsoft? The company’s making a huge AI push, is close with OpenAI, and is itself super wealthy. Well, Microsoft doesn’t see itself as a forever customer of Coreweave. Pulling from the transcript of Microsoft CEO chatting with the BG2 crew (emphasis added):

What happened in November of 22? Like [ChatGPT] was just a bolt from the blue, right? So therefore we had to catch up. So we said, hey, we are not going to in fact worry about too much inefficiency. So that's why, whether it's Coreweave or many others, you know, we bought all over the place.

[…] And that is a one time thing and then now it's all catching up and you know, and yeah, so that was just more about trying to get caught up with demand.

It’s not great to have your largest customer say publicly before your IPO that their deal with you is a one-time thing. (You can read the Microsoft-Coreweave Master Services Agreement here.)

The company’s IPO actually resolves some of the company’s potential risks. If Coreweave goes public with a raise of around $4 billion as anticipated, it would have around $5 billion worth of cash ($4 billion + 2024 year-end cash of $1.36 billion - cash outflow during January and February). That’s enough duckets to, per the S-1:

“product development, general and administrative matters, and capital expenditures” and

“repay the entire outstanding amount under our Term Loan Facility”

Coreweave reports that its “Delayed Draw Term Loan Facility 1.0” has $1.98 billion worth of debt, its “Delayed Draw Term Loan Facility 2.0” some $3.79 billion, and another $985.2 million in a “Term Loan Facility.”

It’s that last one that Coreweave intends to pay off. Why? It will “mature on December 16, 2025,” which means the neocloud has a fat payment due later this year.

I was curious why Coreweave would go public now when the markets are so uncertain. Now we better understand its timing choice.

There’s more we could dig into. But now north of 2,000 words, I presume you are getting bored. Tomorrow: Who is selling stock, who owns the most, and what we might expect from other neocloud providers if the Coreweave IPO goes well.

https://open.substack.com/pub/goldenbearcapital/p/afterhours-tales-coreweave-inc-crwv?r=rpfpw&utm_medium=ios