Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Nvidia’s domestic chip production … the fediverse … can you hear me now … new AI scaling laws? … shade … Long Journey Ventures … Box-Weaviate, two of my favorite companies … US growth expectations … AI monopolies … media exits? …

📉 Trending Down: EU-US tech relations … no, really … tech in the classroom? … free speech in the United States … free speech in Turkey … academic freedom in the United States … free speech in the United States … shame … US births in 2023 … the Department of Education …

Big News that we can’t focus on today:

Tencent earnings: Read the presentation. Tencent is doing well in a number of areas, but it’s investment in AI towers above them. Capex at the Chinese tech giant has more than quadrupled in recent years, and the company is currently forced to limit external AI revenue in favor of internal GPU demand:

SoftBank goes shopping: With its enormous commitments to OpenAI on the table, I did not expect SoftBank to be this busy with its checkbook, but here we are. Masa’s company dropped $6.5 billion on Ampere. The Journal reports that Carlyle Group and Oracle owned about 92% of the American chip designer. Per a release, SoftBank argued that the “future of Artificial Super Intelligence requires breakthrough computing power,” and that “Ampere’s expertise in semiconductors and high-performance computing will help accelerate [SoftBank’s] vision.”

Nvidia goes shopping: I admit it, I have a blind spot when it comes to synthetic data in the AI game. The concept sounds dumb as hell to me. I presume that I am flat-wrong, and need to learn more. One way I can infer my wrongness is that Nvidia just shelled out nine-figures for Gretel, a startup that trades in synthetic data generation technology. For Nvidia the deal makes sense — why not own tech to help its various customers get more out of their AI spend?

Trump calls for inflation: After the Fed did not cut rates yesterday as the market expected, President Trump called for lower rates (potentially fueling inflation), while his tariffs take effect (potentially fueling inflation). With more tariffs expected on April 2nd (potentially fueling inflation), it appears that the President’s grasp of economics does not exceed his reach.

OpenAI drops o1-Pro: The latest model from OpenAI, a putatively better version of its well-known o1 reasoning model, is incredibly expensive. “OpenAI is charging $150 per million tokens (~750,000 words) fed into the model and $600 per million tokens generated by the model,” TechCrunch reports. Given AI price decline curves, o1-Pro should cost about 10% of that stick price in a year’s time. o1-Pro for $60 per million tokens generated even then would not be cheap.

Kraken snaps up NinjaTrader: With Robinhood getting into the prediction market game, it only makes sense that Kraken, a crypto exchange, would also like a piece of the fun. By dropping $1.5 billion on NinjaTrader, The Block reports that Kraken is now “a 24/7 platform for both traditional and crypto futures trading, alongside its spot crypto and other services.”

CoreWeave sets first IPO price range at $47 to $55 per share

The GPU neocloud — and recently name-checked IPO at Nvidia’s GTC event earlier this week — has set an initial IPO price range of $47 to $55 per share.

CoreWeave intends to sell 47,178,660 shares in its IPO, worth $2.2 to $2.6 billion

Existing shareholders intend to sell 1,821,340 share in the flotation, worth $85 million to $100 million.

So, how much is CoreWeave worth at its listed IPO share price range? RenCap reports:

At the midpoint of the proposed range, CoreWeave would command a fully diluted market value of $29.1 billion.

$29.1 billion at $51 per share translates to about $31.4 billion at the top-end of its projected price interval. That’s a nice upgrade from its final private price set during a late 2024 secondary that Crunchbase puts at a $22.4 billion valuation. It’s not the reported target of $35 billion — which is why I would not be shocked if the company took a shot at a higher price range.

The fact that CoreWeave is getting close to its pre-S-1 drop hopes is notable. The company’s IPO filing raised concerns that it was too dependent on Microsoft for revenue, especially after Redmond’s CEO said that his relationship with the GPU giant was temporary.

Worse, the FT reported that the Microsoft-CoreWeave relationship was rockier than known:

The FT, March 6th: Microsoft drops some CoreWeave services ahead of $35bn IPO

To which CoreWeave fired back:

Reuters, March 6th: AI firm CoreWeave denies contract cancellations with Microsoft

And then turned around to announce a big deal with OpenAI:

Reuter, March 10th: CoreWeave inks $11.9 billion contract with OpenAI ahead of IPO

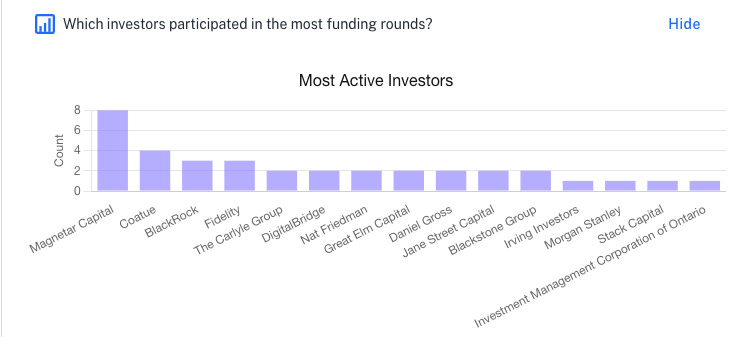

The market appears content. That sets the company on a path to a huge IPO, and a cashout for a host of investors. Crunchbase has 42 listed in its database, with the following making the most discrete bets on the GPU provider:

Cross the CoreWeave payday with the huge $32 billion Wiz-Google deal and we could see north of $60 billion unlatched for venture backers and other private-market investors in two transactions that come in quick succession. It’s great news for capital allocators. Even more, our news rundown above included another $8 or $9 billion worth of M&A. Not all of that volume will bolster venture DPI, but a lot of it will. And that’s cause for some celebration, if you want the great engine of American private investment to keep humming. Which we do.