Dating apps are cooked, and the per-capita Olympics

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Modestly upbeat.

CO took two days off earlier this week as trying to write a newsletter while on vacation with a toddler proved untenable. No paywall today, as an apology. To work! — Alex

📈 Trending Up: European regulators … Perplexity volume (FT) … AI consolidation … Trump as Fed chair? … The Ukrainian counteroffensive … HRtech … AI consolidation, continued … Substack v Medium …

📉 Trending Down: Apple’s reputation with European tech companies … AI prices … X in Venezuela … Unity revenue … Amazon in India …

🤔 What Else?

Glean is set to raise $250 million, the WSJ reports. With a $4.5 billion valuation in the offing, Glean is currently generating $55 million worth of ARR and “could reach $100 million by the end of the year.” Ok, great, but I actually had to use Glean back at Yahoo and, oh god, if this is what enterprise AI looks like in practice I really, really do not get the demand.

Dating apps are cooked

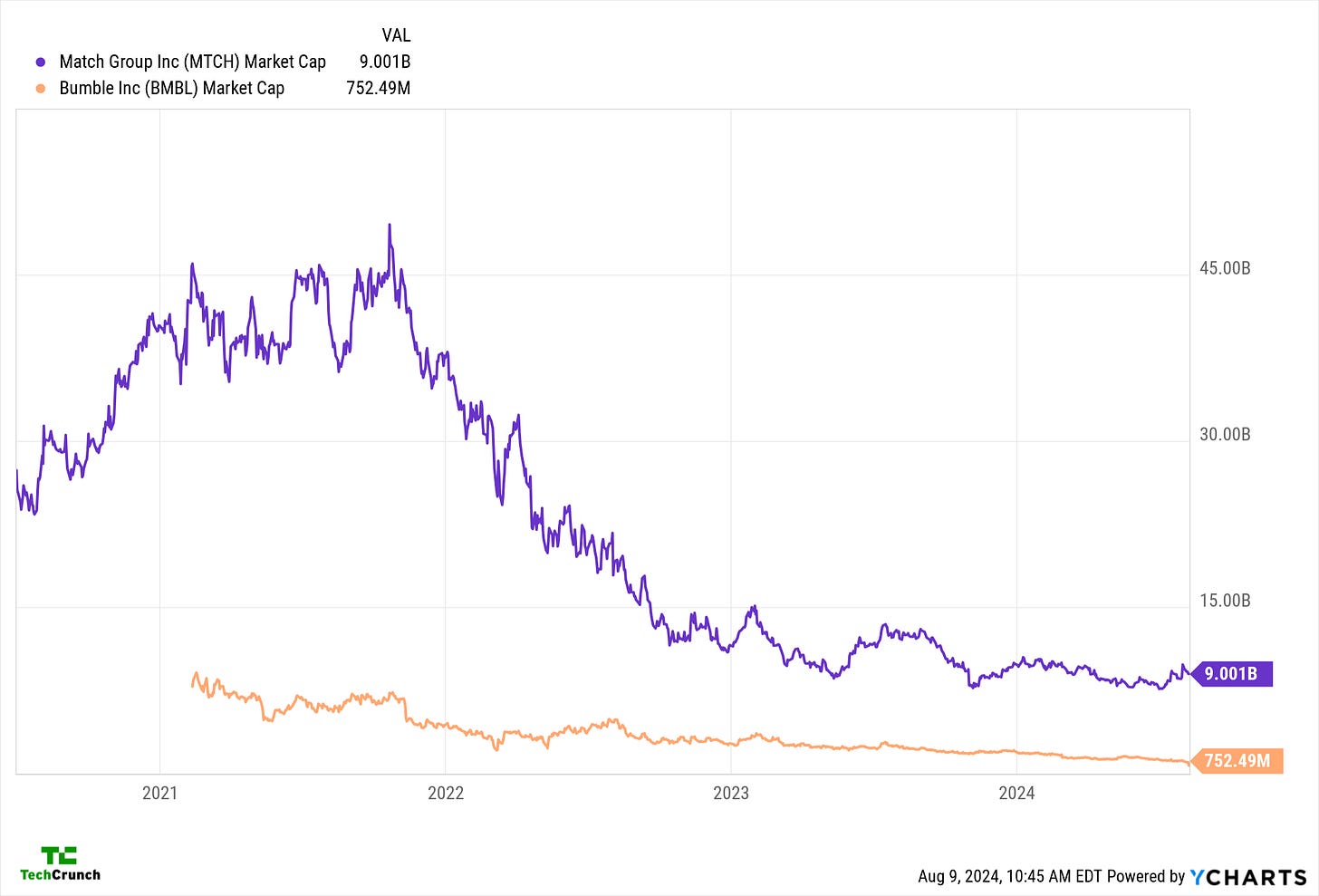

If you combine the value of Match (Tinder, Hinge, OkCupid, others) and Bumble today, you get a number under $10 billion. Compare that figure with the nearly $50 billion the pair of companies were worth back in 2021, and it’s clear that investors have fallen out of love with the data app giants:

Users similarly seem to be getting weary of what the companies have on offer.

Bumble made the most noise lately, losing around 30% of its value after reporting second-quarter earnings. It’s not hard to see why: Bumble reported $268.6 million worth of Q2 2024 revenue, under expectations of $273 million (CNBC). Worse, the company said that it expects revenues of between $269 million and $275 million in the third quarter. The street, in contrast, had expected about $296 million worth of top line in Q3. Whoops.

Notably, the company managed to grow its paying user count at the expense of falling ARPU; as a result, the company’s growth was a tepid 3%. With lower-than-anticipated forward top line expansion, Bumble looks like a slow-growth company in a volatile consumer sector with GAAP profitability that isn’t incredibly impressive.

That’s why Bumble currently has a price/sales ratio of about 0.8x. The number implies that the street doesn’t expect that Bumble will be able to reignite user growth. Mix in falling ARPU and it just isn’t that compelling a picture for Wall Street.

Match is also running sideways. Despite a far better price/sales multiple (2.8x), the company is still being valued like a zero-growth SaaS flop. What ails the venerable dating app conglomerate?

Falling global MAUs at Tinder:

And falling paying Tinder users:

Match is more than just Tinder, of course, but the app generates more than half of its total revenue so it’s an incredibly important service for the company. Tinder revenue grew 1% in the quarter, which was pretty shit.

While most other Match business groups shrank in the second quarter (Match Group Asia, Evergreen & Emerging), there was one bright spot: Hinge.

Good! But not enough to prevent overall paying users at Match falling 5% year-over-year.

If you compulsively read online forums as I do, you will run across criticisms of ‘the apps.’ Lots of folks find them to be over-monetized, overly-botted, cesspools of rejection or, gender-depending, toxic inbound. Perhaps middling demand is simply the result of services that have become overly optimized and monetized.

All told the dating app boom changed the world, shaking up how people met. But the data we’re seeing today indicates that the online dating and fucking boom has lost a good chunk of its luster to both users, and investors.

The per-capita Olympics

I become an ultra-nationalist during the Olympics. Spouse and I are massive fans of U.S. women’s soccer and basketball, which means we are consuming every moment of content we can about our two Olympic teams in those sports. And because the Olympics are fun, we’ve watched diving and table tennis and the kayak slalom and so much more. It’s great!

It’s also fun because the United States kicks ass. Here’s ESPN’s running chart of nations currently leading the medals chart:

This dataset should surprise you, as listed results do not track neatly to national population. You can see some large-population countries like China (#2 in population), the United States (#3), and Brazil (#7) at the top, and some small-population countries doing better than we might expect, like France (#23 in population), Australia (#55), and the Netherlands (#71).

For fun, I pulled some data to compare per-capita medal winnings. I am not going to break down between medal colors but instead focus on aggregate counts against aggregate populations. This will let us know which nations are punching the furthest above their population weight.

Of course, wealthier nations have more resources to invest in their athletes, so this is not a fair comparison. But please recall that during the Olympics I become an American apologist and thus do not care. Let’s have some fun!

Per-Capital Medal Stats

Population data via Worldometer; medal count via ESPN; refugee team not included given that it does not represent a single numerical polity; Taiwan accurately labeled Taiwan instead of whatever moniker the CCP wants to force onto it on the international stage.

The following table is ranked best to worst in terms of per-capita medaling thus far at the 2024 Olympic Games, with final results multiplied by 10,000,000 so that Datawrapper wouldn’t round every single number to zero and describe India’s result as “NaN,” or “not a number,” which felt rude.

What becomes clear at a glance is that countries with small populations that manage to snatch one or two medals can lead the world in medaling efficiency. Of countries with populations greater than, say, one million, New Zealand is the standout nation, followed by Jamaica, Australia, Croatia, Hungary, the Netherlands, and Ireland.

Not what you expected, hey?

Even more interesting, the leading nations in total medalling aren’t, at least when it comes to per-capita results. The United States and China, instead of first and second, rank 43rd and 72nd.

The real outlier of the mix is India, which is sporting a very modest medal count despite having the world’s largest population. Here we can see the result of gaps between national sporting interest and what games are included in the Olympics. Cricket is very popular in India, for example, and the country’s national team is very good. However, cricket was last played in the 1900 Olympics. It will be reintroduced in 2028, so expect India to put more points on the board. But this time ‘round, India didn’t get a shot to play the sport it might be expected to do the best at on the international stage.

All told I think that it’s good that the United States is winning the overall medal count, and has been largely tied with China for the lead in gold medals. Now we just need to boost our domestic medal production so that we can increase our per-capita rankings even more. USA! USA!

If we want, I could rerun the numbers using the number of Olympic competitors sent by each nation to calculate per-capita sending rates, and then also intra-team medalling efficiency? Might be fun. — Alex