Dead Cat Bounce

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Trade wars … farmer concern … video game costs … 10x revenue exits … Samsung revenue … tariff pain … Canadian startups …

📉 Trending Down: Democracy … encryption … crypto enforcement … protest in Redmond … PE’s risk-adjusted returns … Meta’s AI rep … transparency in government … Broadcom’s float …

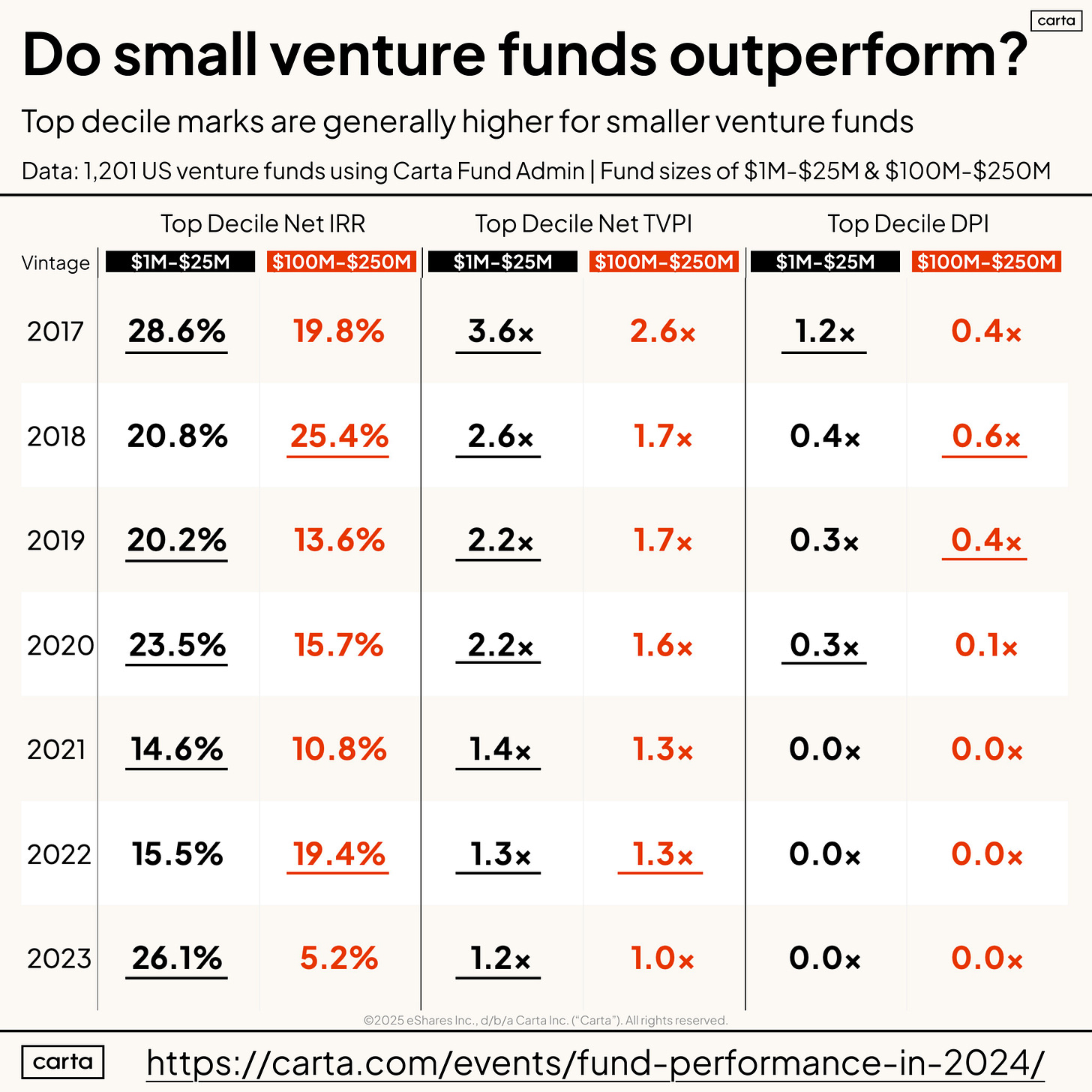

Chart of the Day: From Carta’s ever-lovely Peter Walker:

Top decline DPI — cash returns — of zero from 2021-2023 vintage funds is painful. But more to the point, smaller venture funds really do seem to outperform their larger peers. Larger funds can ingest larger checks, so the client base is a little bit different, but all the same it’s good to see the data.

If anyone has open allocation to a <$25M venture fund that intends to post top decile IRR à la what we see in the 2023 column, CO has $47 and is ready to invest.

Where we stand

Good morning! After spending several days selling off in the face of rising trade barriers, stocks are up today in the face of yet-rising trade barriers.

The state of play is simple:

European stocks ripped higher today (Stoxx 600 +2.7% as I write to you).

Asian stocks ripped higher as well, with strong gains to be found in China, Japan, and Vietnam, to pick a few examples.

Domestic shares are also set to rise at the open, with the DJIA looking at a gain of around 2.8%, the S&P500 gaining 2.4%, and the tech-heavy Nasdaq putting up +2.3%.

At the same time, the morning is papered with headlines that fail to indicate that the escalating global trade fight kicked off by the United States is in any way about to sort itself out:

“Trump threatens new 50% tariffs on China” after the country responded to new US trade barriers with similar barriers of its own.

“China calls Trump’s new tariff threat ‘a mistake upon a mistake’ and looks for opportunity in global trade war” CNN writes, adding that the Chinese government vowed to “China will fight to the end.”

If you wanted to speedrun a US-China decoupling, this is a great way to go about it.

With trade tensions still rising, why are markets higher today? Partially due to the price mechanism. When stocks sell off, they become cheaper compared to trailing results and recent forward guidance. Sell off enough, and even amidst chaos you might find some interesting buys. So, after a massive selloff, seeing a rebound is not a shock.

But there are rebounds, and rebounds. We don’t have the banality that some rallies are dead cat bounces for no reason. Is today simply the deceased feline learning gravity, or is there actual optimism that things are about to smooth over and get back to normal?

We’ll find out, but the business community has consistently downplayed the risks of Trump’s views on trade — that comparative advantage doesn’t exist, and that the United States’ trade deficits are indication of rapacious greed by our trading partners — actually impacting policy. Oddly, despite everything, business folks still think that we’ll unwind the current morass in short order because stocks are going down.

Well, they went up today. Try to get Trump to back down when the Dow is up.

Tariffs hit hardware hardest

If you sling atoms, tariffs are a real fucker. Companies from Nintendo to Framework are changing their sales plans to take into account new trade costs. Nintendo pulled pre-orders for its Switch 2 console which had been priced before the tariffs came ‘round. And Framework, the venture-backed hardware startup known for its modular computers, announced that in light of the “new tariffs that came into effect on April 5th” the company is “temporarily pausing US sales on a few base Framework Laptop 13 systems.”

Why? The company answered the question on Twitter, explaining that it had priced its laptops “when tariffs on imports from Taiwan were 0%.” Now, with a 10% tariff — and a higher duty due tomorrow — the company would “have to sell the lowest-end SKUs at a loss.”

Selling at negative gross margins is a bad idea, so I feel for Framework here.

But what if you don’t sell atoms? What if you sell bits? Times are better for you.

Software has some notable protections that could keep it mostly clear of trade disruptions — though not entirely, as we’ll see in a moment. WTO members voted to extend a 1998 agreement to not put duties on “electronic transmissions” for a period of two years through early 2024. That means that until 2026, there’s a general agreement to not place tariffs on software. (The agreement could get renewed again, but it’s not clear if it will.)

The Logic also points out that the “United States-Mexico-Canada Agreement (USMCA), signed during Trump’s first term, also includes a carve out for digital goods.”

So, if you sell software, all things are fine, yes?

No. A few things stand out as problems for software companies large and small that could slow software sales growth:

If tariffs hold, building data centers in the United States will become more expensive, potentially limiting compute buildout. For companies that rent compute and storage from cloud providers, costs could rise — or fall more slowly than anticipated. That’s not great.

If tariffs hold, many software customers will find themselves less profitable, and less certain. Both are a recipe for more limited financial outlay on new tooling. Even with low to no direct tariff impact, software companies could take slowing economic activity on the chin.

Both Newcomer and The Information report that VCs expect investment to slow, though it seems that breakout AI startups have little to worry about.

There are worse, less likely situations that could crop up. If the EU-US trade spat gets super nasty, American companies could find themselves losing out to EU-domestic tech companies selling to local customers who have more faith in what’s nearby than what is across an ocean.

We’re already seeing this play out in cloud services, and defense spending.

But it’s still a far better time to be a software company than one currently trying to get boats with goods to port without bickering governments taxing your entire profit margin on a whim.

One final note here, and I promise that unless the world goes nutty we’ll get back to more fun topics on the ‘morrow: If companies are worried about spend as their costs rise, wouldn’t investment in AI solutions be a great way to try to save money? If so, perhaps the AI wave won’t get tumbled too hard by the macro mess we find ourselves in.

The call is coming from inside the CEO’s office

Closing out today’s cheery outlay, let’s talk about AI in the corporate world. Shopify CEO Tobi Lutke — who by the by is a Factorio player, and therefore a good person — released an internal memo that he sent to his team regarding use of AI tooling inside of the ecommerce giant.

Condensed, and reordered, here are the two thematic thrusts I want to highlight for you:

Use AI or get left behind:

“Reflexive AI usage is now a baseline expectation at Shopify.”

AI is a “skill that needs to be carefully learned by… using it a lot.”

Lutke is not kidding about Shopify staff needing to use AI, adding that “using AI effectively is now a fundamental expectation of everyone at Shopify. It's a tool of all trades today, and will only grow in importance. Frankly, I don't think it's feasible to opt out of learning the skill of applying AI in your craft.”

The CEO believes this so much that the company will tie AI usage to pay: “We will add AI usage questions to our performance and peer review questionnaire.”

But don’t think that Lutke merely wants more from his staff. Instead, he views the AI tooling as a way to defend growth: “In a company growing 20-40% year over year, you must improve by at least that every year just to re-qualify. This goes for me as well as everyone else. This sounds daunting, but given the nature of the tools, this doesn’t even sound terribly ambitious to me anymore.”

Don’t come to me asking for humans if you haven’t tried robots:

“Before asking for more Headcount and resources, teams must demonstrate why they cannot get what they want done using AI. What would this area look like if autonomous AI agents were already part of the team? This question can lead to really fun discussions and projects.”

All companies want lower costs and greater profits. But the above doesn’t strike me as short-term profitmaxxing. Instead, Lutke’s memo reads more like a foreshock of a greater quake to come. If AI tooling continues to improve, then all staff at market-leading companies will use it to ensure that they are at least as fast as their competitive peers, and therefore it’s best to get deep into the AI weeds now.

Looping back to our bits-versus-atoms riff from above, Shopify’s memo is all gas, no brakes when it comes to using AI at work today, tomorrow, and the rest of our lives. I suppose it’s time I spent more time tinkering with the AI tools I already pay for.

Onward, and may the markets stay green today. — Alex