Defense funding, Lyft earnings, inflation data, and the sad state of IPOs

📈 Trending Up: Foxes guarding henhouses … more foxes, more henhouses … victory laps … Google I/O … bluster … Apple-Alibaba … accounting! …

📉 Trending Down: Press freedom … press freedom … Tesla’s stock, which has now lost enough ground to warrant note … market forces …

Dataset of the day: The TWiST500, a list of the most interesting private-market companies in the world measured by our view of how big they could become in financial terms, is just about half full. I’ve helped spearhead the project, so the list does reflect my views to a degree. We’re digging into the back half starting today. Take a peek!

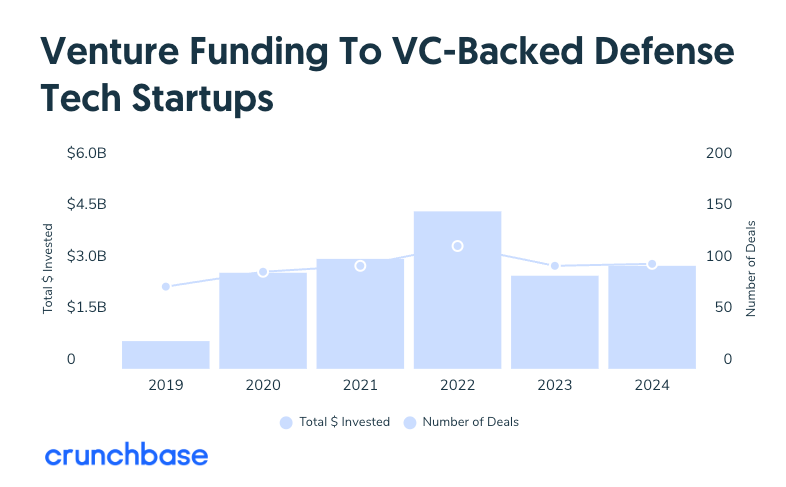

Chart of the day, from the fine folks at Crunchbase News:

Surprised that 2024 wasn’t the all-time high? Keep in mind that 2022 included a bit of 2021-era enthusiasm. And 2025 should set a new all-time high regardless, with Andruil alone said to be seeking $2.5 billion in new capital.

Inflation update

CO needs to go to its editor, so we’ll be brief. As we wrote this morning, new inflation data dropped. Here’s the data via CNBC:

The consumer price index rose 0.5% in January, and 3.0% over the last 12 months, according to the Bureau of Labor Statistics. Economists surveyed by Dow Jones were expecting a monthly rise of 0.3% and a 2.9% increase year over year.

Core CPI, which excludes volatile food and energy prices, rose 0.4% for the month and 3.3% over 12 months. Economists had penciled in core price increases of 0.3% in January and 3.1% year over year, according to Dow Jones.

That’s not good if you want lower interest rates in the near-term. Investors are currently convinced that no rate cut is coming in March. A few more inflation prints like we saw this morning and we could wind up with an even longer rate plateau. Yikes.

Lyft, dropped

When Lyft announced plans for a self-driving taxi fleet that would come to market in 2026 just before it dropped earnings, my eyebrows took flight. The announcement looked very much like a company working sentiment ahead of financial results that would not excite investors.

Cynicism aside, the company’s Q4 earnings were not well-received: