Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Internal accounting … Tesla in Europe … trade barriers … fake friends … domestic semi production … Chinese AI? … Waymo … Cloudflare’s stock … AI automation …

European clouds like Elastx and Exoscale are seeing a rise in demand for their services as companies and governments in the area seek to shift their spend away from United States’ technology companies, Wired reports. This is great news for European clouds, and miserable news for American tech shops who have made large investments in capacity and localization in Europe.

📉 Trending Down: Apple-EU squabbling … DC job postings … Napster …

11x, a heavily venture-backed startup offering ‘AI SDR’ services. The company claimed quick ARR growth. TechCrunch’s Dominic-Madori Davis

and Marina Temkin, however, report that the company may have used third-party logos on its website that were not actual customers. And 11x offered a three-month break clause in its yearly contracts, turning them into trial periods of a sort while reporting full ticket ARR even “after prospects used the break clause to end their trial — and their payments.”

The story goes on to note heavy employee churn, what appear to be aggressive management tactics even in a startup context, and more.

Cybersecurity, after The Atlantic’s story on the leak heard ‘round the world dropped. Catch up on here on attempts at damage control, and the potential fallout here.

Is that data center a good bet?

Bloomberg has a series of quotes up from Alibaba’s chairman detailing his concerns regarding global AI buildout that I have combined into a single bloc:

“I start to see the beginning of some kind of bubble […] I start to get worried when people are building data centers on spec. There are a number of people coming up, funds coming out, to raise billions or millions of capital […]

I’m still astounded by the type of numbers that’s being thrown around in the United States about investing into AI […] People are talking, literally talking about $500 billion, several 100 billion dollars. I don’t think that’s entirely necessary. I think in a way, people are investing ahead of the demand that they’re seeing today, but they are projecting much bigger demand.”

I think this is a reasonable concern if you are a company building out mass-AI compute on credit without having a stable source of internal demand. To make that more concrete, Microsoft spending $80 billion on its own datacenter buildout this fiscal year bothers me not at all. Why? The company is cash rich, enormously cash generative, has a cloud business outside of AI workloads, and has its own internal AI compute needs. If Redmond winds up with a little extra capacity, it’ll grow into the racks soon enough.

But if I was, say, CoreWeave or similar, overcapacity is a real threat. Over a long enough time horizon — say ten years — I doubt that we’re going to find ourselves awash in spare compute. But along the way, companies that lever up to purchase depreciating GPUs and similar chips on anticipations of growing demand could get hammered. Think of it like this:

Setup: The market demands more and more AI compute, so companies borrow to invest in that capacity.

Scenario 1: Market demand mostly matches expectations, meaning that the gap between AI compute supply and demand remains tight, allowing for meaningful cloud margins.

Scenario 2: Market demand undershoots expectations, meaning that the gap between AI compute supply and demand becomes elastic, forcing clouds to fight more closely on price; margins collapse, debt service becomes existential, and companies zero-out with their tails tucked.

So, yeah, Alibaba’s chairman has a point. For some. And if AI compute demand growth slows materially. We’ll see. But it is worth noting that current AI datacenter buildout spend absolutely dwarfs what we saw during the fiber boom of the 90s.

eToro is going public!

With CoreWeave expected to price Thursday and start trading Friday, we’re about to kick off IPO season. And with Klarna already filed and StubHub hoping to make its way back to the public markets, we have one more name to add to the list of flotation hopefuls: eToro.

If you are confused at eToro filing to list, recall that while the company did pursue a SPAC-led debut back in 2021, that deal fizzled to zero. The consumer trading service went on to raised a $250 million venture round in 2023 at a $3.5 billion post-money valuation.

In its SPAC deck, eToro pitched a roughly $10.4 billion equity valuation and an enterprise worth of around $9.6 billion

What’s great about eToro having previously taken at a shot at going public is that we have the data it shared at the time. And as SPAC pitches include financial projections, we know what eToro had said previously it was going to be able to manage. So, let’s compare the SPAC data to the company’s now-arrived F-1. This will be fun!

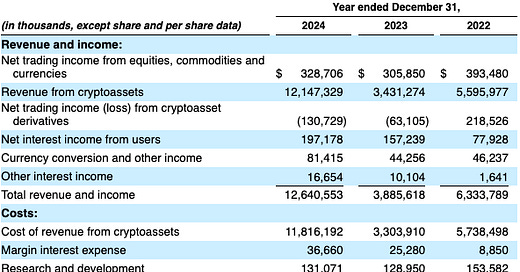

From the company’s F-1, here’s its raw financial results from 2022, 2023, and 2024:

Yes, we’ll start by explaining the exchange’s huge crypto revenues. The way the accounting works in eToro’s case is simple. When its customers buy and sell crypto assets, the activity counts as revenue:

We generate Revenue from cryptoassets, which substantially includes revenue generated from the sale of cryptoassets to users and counterparties, and to a lesser extent, revenue generated from staking rewards and blockchain rewards.

The company is not trying to be wily here. It explains plainly how the accounting works:

Cost of revenue from cryptoassets is comprised of the cost of cryptoassets purchased from our users and counterparties, and the portion of the staking rewards and blockchain rewards distributed to users. In addition, cost of revenue from cryptoassets includes the net change in fair value of cryptoassets held, which is derived from the changes in the fair value less cost to sell, of our cryptoassets inventory as of the end of the period.

And it breaks out what it calls “Net Trading Contribution (Cryptoassets),” which is calculated as “equal to Revenue from cryptoassets plus Net trading income (loss) from cryptoasset derivatives less Cost of revenue from cryptoassets, excluding the net contributions from staking activity and blockchain rewards.” Fair enough.

Bear in mind that Block has similar accounting nuance with its own user bitcoin buying and selling. It’s a quirk of sorts that is known.

Even with those caveats, net trading contribution (akin to net revenue in this case) from its users buying and selling crypto assets rose from $22 million in Q4 2023 to $95 million in Q4 2024. That’s a nice chunk of change.

Get back to the rest of the income statement!

Your wish is my command.

If we exclude crypto from our sightline for a moment, we can see in the above table that eToro’s net trading income from traditional asset trading (equities, currencies, commodities), rose from $306 million to $329 million from 2023 to 2024, or about 7.5%. That’s modest growth, and the company’s revenue from trad asset trading in 2024 was sharply lower than what eToro saw in 2022.

Interest incomes rose from from $78 million in 2022 to $157 million in 2023, to $197 million in 2024. That’s a very pleasant ramp.

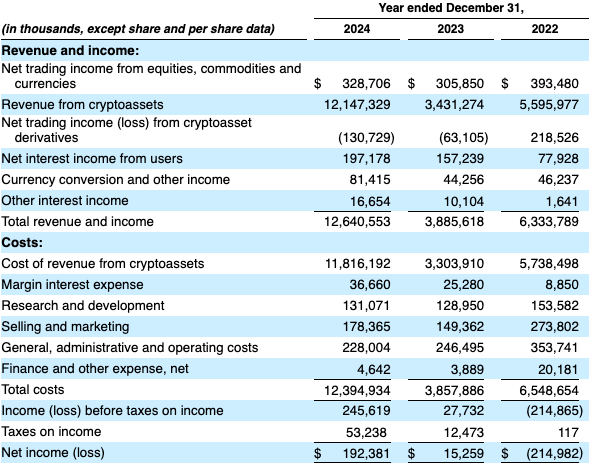

When we tally ally all operating incomes and expenses, eToro saw its “income (loss) before taxes on income” rose from -$215 million in 2022 to $28 million in 2023 to $246 million in 2024. That’s lovely, frankly, and indicative of a business that has its head screwed on straight.

We can infer competence from how eToro managed its pre-tax profitability ramp:

Note that eToro’s R&D costs were slashed in 2023 and barely budged in 2024. Both figures are smaller than what the company spent in 2022 (the far right column). Mix in dramatically smaller S&M costs in 2024 compared to 2022, and continued G&A spend discipline, and we can see a company here that is keeping close tabs on its own costs.

What’s the other side of what might appear a shiny credit token? Revenue lumpiness. Because eToro calculates crypto trading as revenue — recall that it’s being upfront about the math — its top line gyrates. To wit:

eToro Q3 2023: Total revenue and income of $1.56 billion (crypto revenue of $1.40 billion), costs of $1.52 billion, and a comprehensive profit of $39.1 million

eToro Q4 2024: Total revenue and income of $5.85 billion (crypto revenue of $5.81 billion), total costs of $5.76 billion, and a comprehensive profit of $60.4 million.

The street is going to have to sharpen its pencil to put the right valuation on eToro. But, it’s a growing, profitable company that is benefiting from an active crypto market. So much so that it’s going public on the back of a crypto-boosted quarter; which is smart, mind, you want to go out when you look good, not bad.

So what about the SPAC?

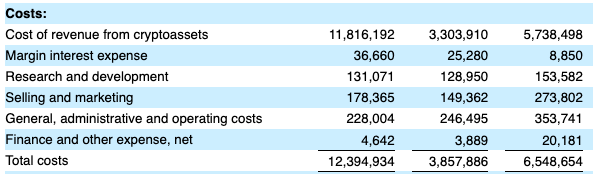

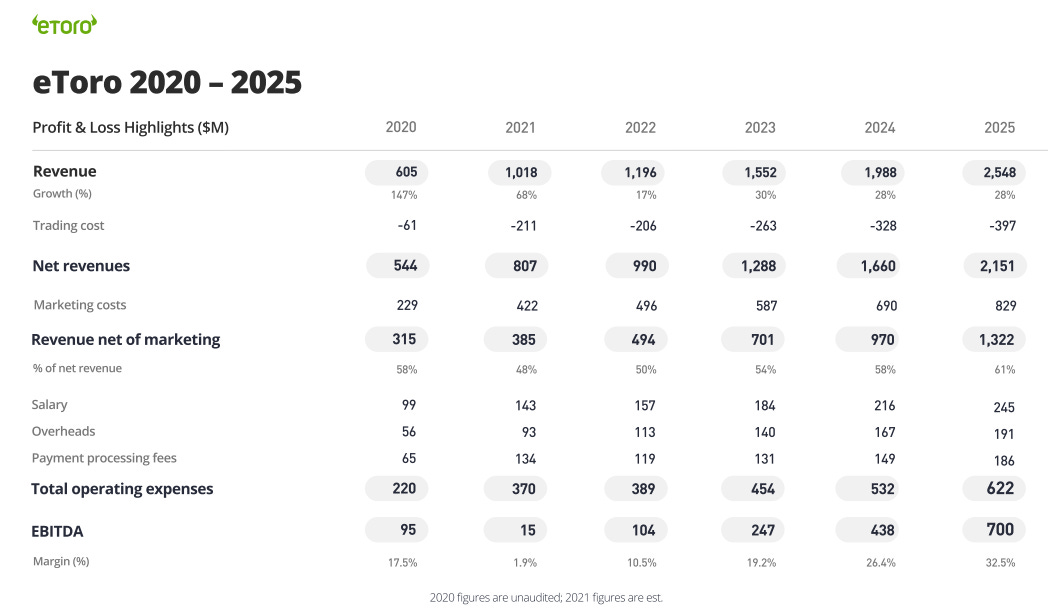

Here’s eToro’s old SPAC predictions for its future growth:

The problem we have is that we lack a granular breakout of how crypto revenue is counted in the above, so our ability to compare predicted top line numbers to what eToro shared in its F-1 is limited. That said, we’re able to compare EBITDA results in the above to what we actually see in the company’s filing:

eToro EBITDA 2022: -$42.8 million (adjusted, actual) versus $104 million (unadjusted, projected).

eToro EBITDA 2023: $117.4 million (adjusted, actual) versus $247 million (unadjusted, projected).

eToro EBITDA 2024: $303.9 million (adjusted, actual) versus $438 million (unadjusted, projected).

As far as SPAC estimates to real-world results, that’s not too bad! I don’t mean to grade on a curve, but compared to some SPAC decks and their constituent pledges, eToro looks almost conservative in retrospect.

So what should we think?

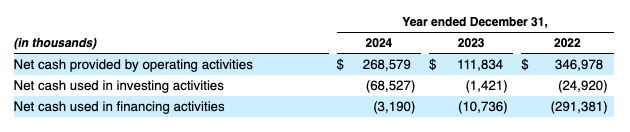

eToro generates a lot of cash:

A few hundred million worth of 2024 free cash flow is nothing to sneeze at, especially when it’s an effective doubling of what we saw from eToro in 2023. From this perspective, the company is healthy.

Mix in heady times for cryptocurrencies and speculative betting trading around the world, and it’s not such a bad time for eToro and its peers. Shares of Robinhood are up about 25% so far this year, and and 160% in the last year. Those are warm waters for eToro to swim in.

So, the IPO timing makes sense from a company performance perspective (big Q4 results), market performance ($HOOD’s appreciation), and consumer vibes. All told, the IPO should cause waves. And potentially big returns for the company’s backers, which put nearly $700 million in the business, per Crunchbase data.

Who wins?

To close, a lot of folks: Spark Capital, BRM Group, Turkoman Partners, SBT Venture Fund (which is under sanction), and CM Equities are each listed owning at least 5% of the company. Of those, Spark Capital is the most pertinent to our interests, of course.

We’ll have to wait a bit to see just how much of eToro Spark owns, and at what valuation the company might exit at — but it’s still good to see a glimmer of even more venture liquidity. They need it.