Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Monday. Let’s start with a question:

Could you explain current US trade policy towards Chinese imports?

I doubt it. I’m still trying to sort out the latest. POTUS pulled back on “reciprocal“ tariffs, but ratcheted up barriers with China. Until news came on Friday that certain consumer electronics would be made exempt from tariffs. Just kidding. It turns out that Chinese electronics exports to the United States are still privy to a 20% tariff and that number might go up, too?

Is the strategy here to be as confusing as possible? If so, it’s a dogshit strategy from the perspective of business confidence.

Still, the Trump tariffs are reshuffling global commerce. Apple is pushing hard to move capacity to nations privy to the 90 day tariff reduction. That means India, Vietnam, and other nations are seeing a major American tech company try to stuff business inside their borders to prevent seeing its profit margin consumed by taxes. China, Nikkei Asia reports, isn’t making that easy.

Our weekly economic calendar can be found here.

I presume that all the above will be out of date by tomorrow morning. But as we track the changing outline of global commerce, I pine for the era in which tariffs were not something I had to track weekly, let alone hourly. To work! — Alex

📈 Trending Up: The underpinnings of capitalism? … earnings at Goldman … smartphone sales in Q1 … unintended consequences … excellent summaries … corruption … Chinese exports … Russia’s invasion of Ukraine and constituent damage thereof …

📉 Trending Down: UK venture flows … African venture flows … the dollar … Japan’s population … Russia’s population … blaming the bad guys … helping your case …

The Antitrust Test

Back in 2020, 48 states and the FTC sued Meta, arguing that the company enjoys “monopoly power in the personal social networking market in the United States,” and that the massive concern “illegally maintains that monopoly power by deploying a buy-or-bury strategy that thwarts competition and harms both users and advertisers.”

The Trump 1.0 suit is heading to trial today.

Stakes are high. The government wants Meta to divest purchased properties like Instagram and WhatsApp. Meta, in contrast, wants the government to piss off and let it keep printing money.

With the EU considering taxing digital advertising revenue generated by American tech shops inside its borders over the current Trump tariff push, Meta is not having a great year.

Is it fair for the government to relitigate historical purchases? The state thinks that Meta wasn’t entirely forthcoming during those episodes, undercutting the “but you already said yes” defense regarding the past-tense corporate M&A.

Surprised that Trump 2.0’s FTC is keeping the case going? Don’t be. Lina Khan’s replacement at the FTC Andrew Ferguson kept Khan’s M&A guidelines in place when he took over the gig. (I’ve argued for months now that Ferguson is not simply a placeholder for corporate kindness at the FTC.)

This morning in an interview with Fox Business — natch — Ferguson said that Meta is “certainly” a monopoly. Meta shares fell after the remark, but remain higher in pre-market trading.

No matter how stringent Ferguson’s views are on the antitrust beat, there’s a chance that Meta founder Mark Zuckerberg has made enough propitiations to POTUS that Trump yanks the entire case.

The FTC has been remote from the Presidency historically to ensure independence and limit corruption. Those barriers are now lower than they were. And Zuck has been spending a lot to kiss Federal ass.

Washington is so worried that Trump could intervene to help his new buddy that the concerns made Politico. Ferguson said he doesn’t expect Trump to step in, but he’d obey “lawful orders.”

Recall that tech folks backed Trump in part to limit government oversight of their business practices, including — especially? — their ability to buy smaller competitors and absorb them into their existing empires. The startup angle here is simple: Many venture investors consider it more important to allow the largest tech companies to buy smaller rivals to keep money circulating in private-market circles. There’s real merit to the argument. CO has long held the view that antitrust action net creates more space for startups to maneuver, but regardless, many people bet that Trump would not pursue cases similar to the suit against Meta.

And here we are. Let’s see what the day brings.

Tech gets a breather

Net-positive news regarding tariffs over the weekend gave global shares a boost, another clear indication that investors consider trade barriers to be business anathema. Anticipation that tariffs will be lower than expected mean higher equity prices.

Shares rose in Asia, especially in Hong Kong

Shares also rose in Europe

And are set to rise in the United States

Apple is rallying. After picking up 4% during Friday trading, the American consumer technology giant is up a massive 6% today in pre-market trading. That Apple can probably keep making lots of money in the near-term is good news for everyone, and especially Cupertino.

Nvidia is also enjoying a rally, as are crypto prices in recent days. Bitcoin is back above $80,000, for example.

Looking around the market, we’re back to it being very unlikely that the Fed cuts rates in May. The good news is that investors are currently pricing in a 62% chance of a 25 bips cut in June, and a nearly 12% chance that the Fed could cut twice as much in June.

Lower rates mean that safe investments pay less. That makes riskier, more expensive, and more growth-oriented investments more attractive. Which is great for tech companies of all sizes. Recall that we got our last truly nuts technology boom when rates were effectively zero.

Overall, things are calmer than they were last week as we kick off a new seven-day cycle. How about a few days of calm to regain our bearings? That would be lovely.

But don’t relax. A lot of CEOs think we’re heading for a recession. Here’s hoping they are wrong, but, still, maybe float a little extra cash for the next quarter or two.

Consumer AI demand is still growing like hell

Wrapping up with a little good news, consumer demand for modern AI tooling is robust and growing. Recently, OpenAI’s Sam Altman admitted that his company’s userbase had something akin to doubled in the last few weeks.

Given that we’re aware of ChatGPT having reached 500 million users, that would imply around a billion users. However, Altman narrowed the numerical point by saying that around “10% of the world uses [its] systems, now a lot.” Forbes, who reported the exchange, points out that that implies a “number closer to 800 million users.”

Hot damn.

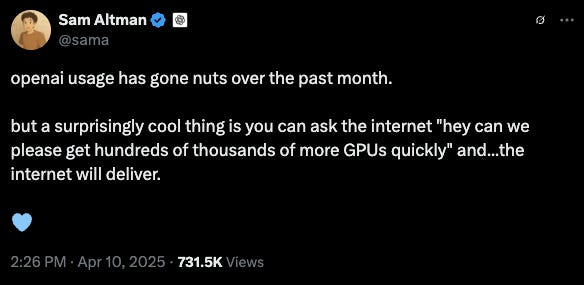

We knew this news already, of course. Recall that when OpenAI’s image generator went viral, Altman had to limit usage and said that his GPUs were melting. Later, the CEO asked the internet if anyone had spare GPUs he could use, so long as they came in blocks of 100,000 at a time. Well:

Back when genAI was new and there was more hype than usage, folks wondered if the new technology would have staying power. I think that we can put that question firmly to bed, and instead ponder a more important query: After software development, what’s the next enterprise AI use case that will go vertical?

Place your bets!

You Seem to follow the market closely. What companies do you invest in?