Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Bitcoin on the Nasdaq? … Internet regulation in the UK … phablets (BBG) … the price of gallium … Starlink competition … stablecoins in Africa … friendly fire … NFT trading volume …

📉 Trending Down: Trying to sort out Trump’s economic plans (FT) … freedom of the press … work weeks in Japan to bolster births … Yoon’s tenure …

November data from China reversed gains in Chinese stocks today, after Beijing reported that retail sales grew just 3% in the month. Analysts had expected a 4.6% gain against a 4.8% gain in October. China’s industrial production (5.4%) beat expectations (5.3%) in November, while real estate investment fell 10.4%.

The falling yield of Chinese government debt belies hopes for faster growth in China. Michael Pettis of the Carnegie Endowment points out that when the Chinese ten year yield dipped under the 2% mark, it was a new story. In the following few weeks, the figure has slipped to 1.72% and the nation’s thirty-year bonds are now under the 2% mark. Ouch.

Here at home, how the incoming presidential administration will work to slow the EV transition in the United States is becoming clearer. Reuters has the critical reporting here, but expect cuts to emissions standards, work to undermine California’s ability to lead on the matter sans Federal help, an end to consumer subsidies, and a change in the government’s own plan to buy more EVs over time. Going backwards. So hot right now.

And then there’s the leading technology story of the day, via Japan. SoftBank CEO Masayoshi Son “will announce a $100 billion investment in the U.S. over the next four years during a Monday visit to President-elect Donald Trump’s residence Mar-a-Lago.” The $100 billion figure should not shock — it’s the same amount that Masa targeted for his Vision Fund experiment, which managed to invest in both winners (DoorDash, Slack) and clunkers (WeWork, Paytm). And the move is a doubling of what Masa pledged during Trump 1.0.

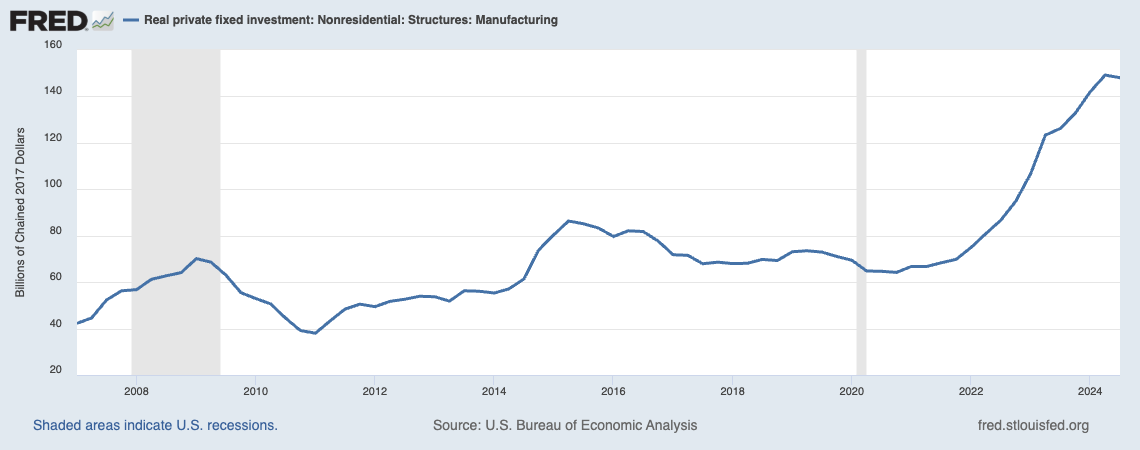

Masa likes to do deals. Trump and his incoming administration are expected by some to help foment dealmaking. And the United States is currently undergoing a boom in certain sectors that could make investment attractive. For example:

Don’t forget how much Trump loves a positive news story, credit for work he doesn’t execute personally, and people kissing his ass. Masa’s not stupid, and he probably wants some government help to make sure his investments go smoothly.

The AI Gap

While it’s fun to fawn over Nvidia’s growth rate and seemingly endless ability to grow its profitability, your spending is my income and thus someone is paying out the nose for the chip companies’ gear.

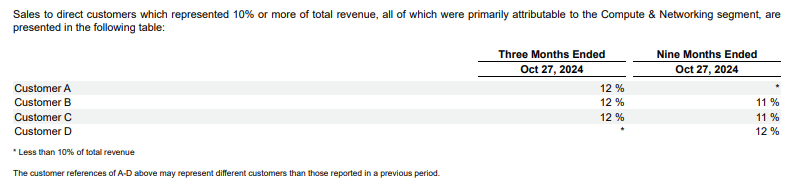

In fact, we know that a handful of Nvidia customers are spending so much that it has to break out their revenue for its own investors:

For reference, 12% of Nvidia’s most recent quarterly revenue works out to more than $4 billion. That rates to about $47 million per day from each of Nvidia’s largest customers in the last quarter. And we can now see somewhat clearly what impact that pace of purchase is having on some major cloud companies.

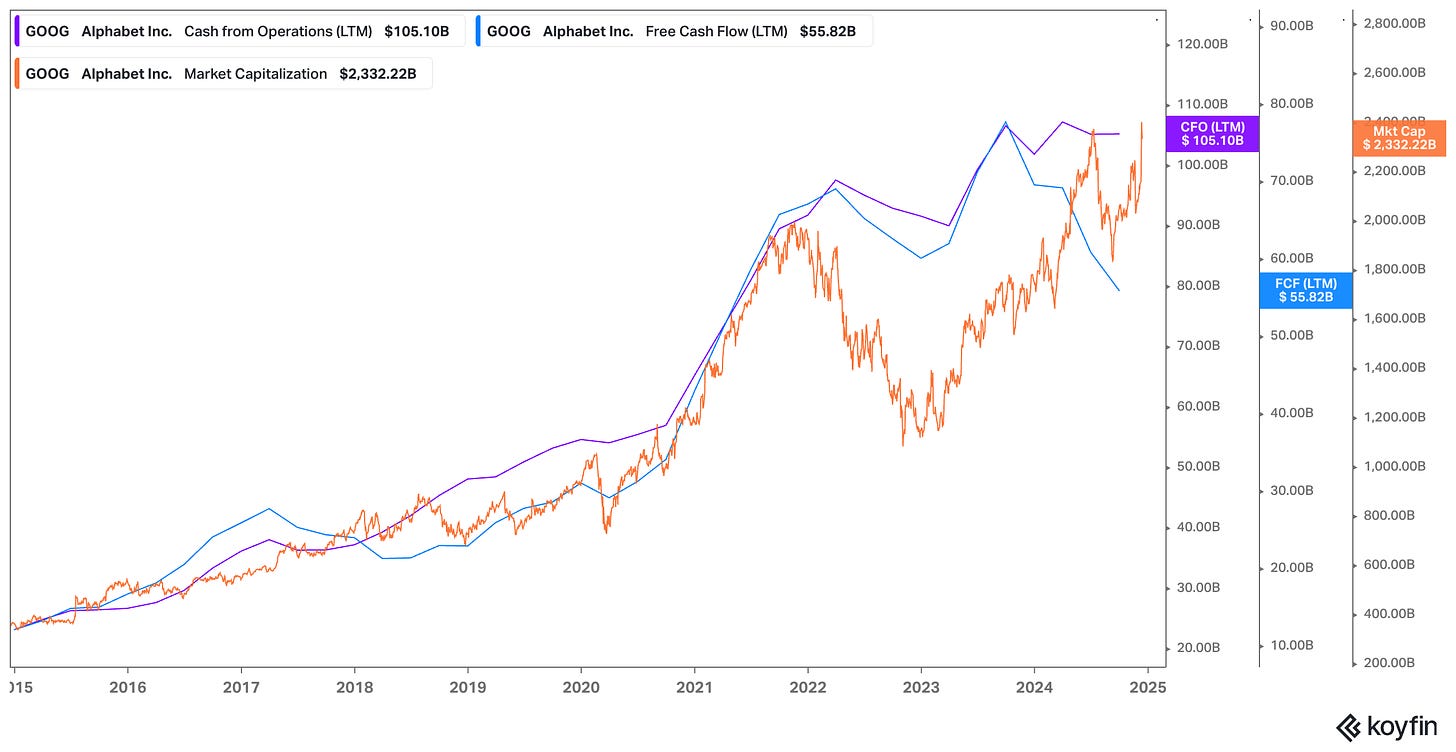

Koyfin, a financial data provider, dropped a host of interesting charts over the weekend comparing the valuation appreciation (rising share price) of the Mag7 to their trailing operating, and free cash flow totals. The charts show a widening gap between share price, operating cash flow results, and free cash flow totals.

I recreated the Alphabet chart in Koyfin this morning to help us see the point in the data:

The orange line is Alphabet’s market cap over time, which rose steeply during peak-ZIRP, lost ground, and has since rebounded. The purple line is the value of Alphabet’s last four quarters’ operating cash flow, while the blue line represents its trailing free cash flow.

As we know the equation for free cash flow:

Free cash flow = operating cash flow minus capital expenditures

We can see very clearly in Alphabet’s data that its rising capex is not only turning its trailing free cash flow growth negative, it’s driving a huge, new wedge between its ability to kick off cash that it can use for whatever it wants, and the reality of its required spend to stay competitive in the AI game. Put another way:

I admit to modest chartcrime (disparate axes for trailing cash flow metrics), but you catch my drift. If you observe the Koyfin thread you can see other examples of the same.

The deceleration in free cash flow amongst major cloud companies compared to their rising operating cash flow results is not a shock. I am not sitting here trying to tell you that buying a host of Nvidia chips is expensive.

What is notable is the scale of required spend. You might expect that investors now accustomed to the Mag7 spending big on buybacks and rising dividend yields to pout as the piggy bank that they might get paid from directly empties a little. But investors are not irked. Indeed, you could easily argue that the stock market is overvalued today and big tech at risk of a correction.

So, investors are not only content to see a rising percentage of Mag7 software cash flow spent on depreciating hardware, they are rewarding the companies in question for the work. That’s a nice and bullish public-market signal, and mark against the idea that you cannot innovate while public because investors won’t allow risk-taking.

And since I supsect that every public-market Alphabet is also a public-market Nvidia investor, they are getting paid twice today. Hold Nvidia and enjoy exposure to the hardware flavor of AI upside; hold Alphabet, Meta, Microsoft or Amazon, and enjoy exposure to the software flavor of AI upside!

My fellow index funders and I are eating.

The danger in the present moment is simply that investors are likely only content to endure implied lower rates of future direct investor return to fuel AI investment today if the current spend nets more free cash flow in the future. From that perspective, you could argue that even the largest cloud companies have more work to do to ‘earn back’ their preceding spend, not to mention what’s to come in calendar 2025.

Still, the vibes are good, and the AI gap is today an academic point more than a market-mover. But if AI revenue growth comes in under expectations, it could become something a bit more material.