Welcome to Cautious Optimism, a newsletter on tech, business, and power. Written just for you!

📈 Trending Up: YouTube’s ad load … Amazon wages … Alibaba’s AI progress … getting told what to do … direct air capture? … solar …

📉 Trending Down: Media literacy …building an Nvidia competitor … limits on UPI market share?

State of the Market as the Fed starts to ease

Shove over, Brat Summer, it’s Rate Cut Fall.

I admit that that phrase probably won’t coin, but thanks to the American central bank’s decision to cut a key overnight by 50 bips (0.50%) yesterday we are now in a new era.

Another 0.50% reduction is expected this year. The market is already moving thanks to the Fed, so let’s check in:

Stocks are set to rip higher at the open: In pre-market trading, the DJIA is set to rise 1.2%, the S&P500 some 1.7%, and the Nasdaq 100 a stonking 2.1%. In short, investors seem pretty happy with the Fed and its choice.

An ETF that tracks the Bessemer cloud index, keeping tabs on the sort of software companies that are used at comps for startup IPOs, is up 1.4% in pre-market trading.

All told, a pretty good package of trading this morning if you are into 1. the stock market going up and 2. especially shares of technology companies.

Some groups of tech stocks are doing even better than their peers. CNBC reports that shares of Nvidia, Arm, ASML, and others are sharply higher today. As I write to you, Nivida is up 3.1% in pre-market trading, Arm 4%, and ASML 5.1%. Investors think that looser financing conditions will keep chip demand hot. That’s not a bad bet, I reckon.

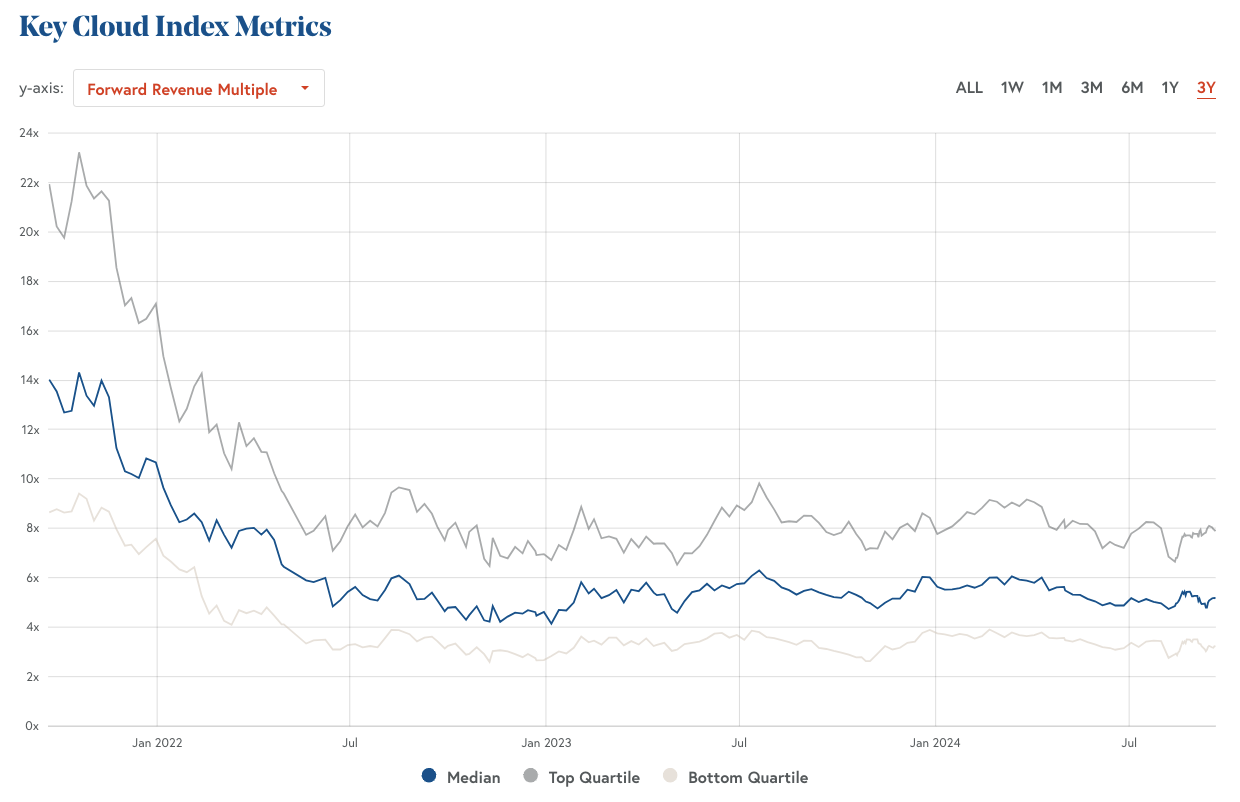

But despite the above, all is not well in technology-land. The following chart tracks the forward revenue multiple of the companies that comprise Bessemer’s index, which is formally known as the “The BVP Nasdaq Emerging Cloud Index.” That’s about as fun to say out loud as the “Formula 1 Qatar Airways Gran Premio del Made in Italy e dell'Emilia-Romagna 2023” grand prix.

Regardless, here’s the data:

The comedown from 2021’s valuation excesses is well known. Perhaps less clear has been the utter stagnation of technology valuations since, and how that flattening impacts startups. By that I mean the companies of the sort that startups aim to become — your Cloudflare’s, Monday.com’s, and Samsara’s — have seen their revenue multiples collapse and stay on the ground. That’s negatively compressed startup valuations, and made much exit activity frozen.

What I am most curious about in the next few weeks is whether or not we see any movement in the above chart. It’s well and good that Nvidia and Arm are seeing their worth bump higher. That means that LPs will have more money to allocate. But if we want to really get venture back into high-gear, we need exits. And exits will be far easier to come by if we the market deigns to award more market cap per dollar of software/cloud revenue.

As we sit here today, the Nasdaq 100 is at a flat 20,000 points, and here’s the Bessemer score sheet from its own index.

Like a hawk, we will keep an eye out. Today, the vibes are good because everyone loves a rate cut. We’ll know in a few weeks if, after the election, we should anticipate more IPOs or not. Here’s hoping.

I’m not sure about this JD Vance guy

Noah Smith is part of the reason why I wanted to go off on my own and write for myself. I watched his transition from Bloomberg Opinion columnist to ‘dude who has his own blog,’ and it looked like great fun. The difference between his publication, Noahpinion, and CO is that his is huge and makes lots of money.

Jokes aside, he just wrote the post I was cooking up. As I can’t improve on it, here’s the thrust of what I wanted to say in response to recent lies regarding Haitians in Ohio:

The United States is a nation of immigrants. Historically and currently. Singling out certain black non-citizens to agitate your pretty-damned-white electoral base is a shit thing to do. And Vance’s riff that people here in the country legally should get deported is simply disgusting.

I talk to business-y people about Trump from time to time. The gist I get from them is that they expect that the things that they want from Trump and his candidacy — inclusive of Vance — are the same things that he has promised and will actually do, and the things that they do not want from Trump are mere electoral ploys instead of similar promises that will see follow-through if he wins another term. (Tax cuts? Yes. New, higher tariffs and deportations? No.)

I wonder if they aren’t simply lying to themselves. When Team Trump say they want massive tariffs and day-one mass deportations perhaps they should be taken both seriously and literally. Their behavior provides scant cover to think much else.

"I wonder if they aren’t simply lying to themselves."

oh they are. or they know (consciously or subconsciously) that they won't be the first ones hurt by the destructive impact of Trump/Vance, so they're willing to take the gamble.