Welcome back to Cautious Optimism. Today is June 3rd, 2024. Below we have lots of chips news, a fintech update, a few notes on unexpected impacts of really good change, and more. To work! — Alex

Trending Up: Chips (AMD) … chips (Nvidia) … Spotify prices (good) … yet more local datacenter buildout … Raspberry PiPO … representation of women at the highest level of Mexican politics … flooding in Europe (Italy, Germany) … indie media in India …

Trending Down: The increasingly desiccated corpse of FTX … prudishness on X … Verta’s independence … my California yearning, as I report this morning from the Liquidity Summit … stock market technical anti-fragility … the ability of OPEC to make inflation worse … the Tories … economic stability in Nigeria …

A special shoutout to Paul Sawers for using the phrase “in fairly rude health” when referring to Spotify in his piece (linked above).

Startup of the Day: ten ten

My fascination with French startups is long-held. Given that, by conventional Silicon Valley logic, France should be a hellscape of limited innovation, sclerotic state-own enterprises, and bureaucrats throttling founders for the mere idea of building something new, it’s notable that it’s not.

Despite the anti-regulatory bent of most American investors and founders and the view that Europeans like to vacation more than work, France is churning out not only massive AI companies busy attracting global talent, but also consumer hits.

The inimitable Anna Heim recently covered a startup called ten ten that I do not understand — it’s a walkie-talkie app for zoomers? — but my lack of comprehension is not important. What does matter is this:

Ten ten’s sudden rise is particularly noticeable in France, where it has been downloaded 1 million times. Including on Android, where it became available a few weeks ago, the app saw 6 million downloads since its launch, according to data shared by market intelligence firm Sensor Tower with TechCrunch on Friday.

So much for Europe being a backwater. Even if they do have better worker rights and vacation policies.

Hey, the neobank(s) are thriving:

Higher interest rates are making a misery out of software investing. With rates high in critical tech markets like the United States, the value of many software companies is under pressure. As a result, tech valuations are taking a whacking, and the IPO window, which seemed open for a hot second, is now busy trying to close.

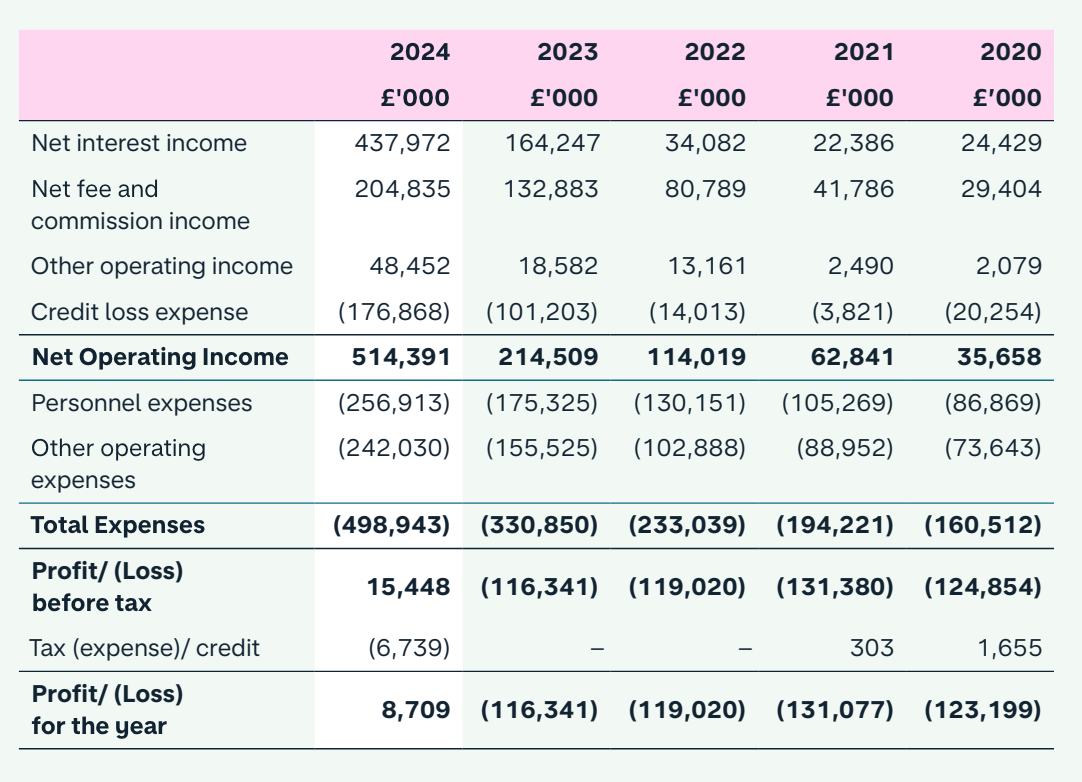

But! Not all tech shops are suffering from the current interest rate regime. Monzo, for example. The UK neobank had a simply excellent last year. In its last fiscal year, Monzo saw its revenues rise from £355.6 million to £880.0 million. Also its profit before tax rose from -£116.3 million to £15.4 million.

The company reported other salubrious metrics, including greatly expanded customer deposits and more subscribers. Good for Monzo. But what really smacked me when reading its annual report was the following:

Hot damn that net interest income is spicy. I tell you, high interest rates have been Bad News for software companies, but for fintech shops that had to butter their own bread during ZIRP, today is a feast.

Unexpected Anti-Benefits:

Running low on time here at the venue, so to be super brief:

Something that I have learned during my life working and bopping around is that every coin has two sides. Good things are never unalloyed good, and bad things are never entirely bad. Of course, there are exceptions, but the point tends to hold.

Enter two unconnected scenarios that are stuck in my head.

First, The Economist makes an interesting point in its coverage of falling global fertility rates, viz the United States:

“Instead, the bulk of the decline in the fertility rate in rich countries is among younger, poorer women who are delaying when they start to have children, and who therefore have fewer overall. More than half the drop in America’s total fertility rate since 1990 is caused by a collapse in births among women under 19. That is partly because more of them are going to college.”

Teenage pregnancy? All but conquered. More women in higher education? Hell yeah. The impact of those important victories on the future of Social Security? Yet to be sorted out.

And, second, the world has worked to cut sulfur dioxide pollution caused by shipping. Sounds good, as sulfur dioxide is a contributor to acid rain. But, the bad news, as New Scientist put it a few days ago, is not small:

“A sharp drop in sulphur dioxide emissions from ships since 2020 may warm the planet more than expected this decade, although researchers disagree on the magnitude of this change in temperature.”

Unexpected anti-benefits, sadly.

Ok gotta run, more to come. You are lovely and brilliant and deserve either a nap or a sugary treat today. Get on it! — Alex