Welcome to Cautious Optimism, a newsletter on tech, business, and power. Modestly upbeat.

Today we’re looking at earnings from Rumble and Nu, how to break Alphabet into pieces, Reddit’s traffic wave, and a question regarding Waymo and Uber. To work! — Alex

📈 Trending Up: Humor … AI optimism … the number of GPT-4 equivalent models … Grok … AI training data suits …

📉 Trending Down: The U.S. economy … interest rates in New Zealand … Apple’s ability to play nice with developers … the Chinese steel industry (BG) … Chinese credit demand …

🤔 What Else?

Inflation cools further: The CPI “increased 0.2 percent on a seasonally adjusted basis, after declining 0.1 percent in June.” In the last year, “the all items index increased 2.9 percent before seasonal adjustment.”

Expect a fat rate cut in September.

It’s hard to compete with YouTube: Back in 2021, Rumble raised $100 million from Peter Thiel, JD Vance, and Colt Capital. The company went public in 2022 via a SPAC, and has done its best since then to build a conservative-aligned suite of Internet properties; these include a video hosting service, live streaming, and cloud offerings.

It’s going kinda poorly? Revenue fell 10% in Q2 compared to the year-ago period to $22.5 million. The company’s operating loss rose to $38.8 million in the second quarter, though its net loss did shrink a little.

Troublingly, Rumble’s operating cash burn for H1 2024 came to $55.6 million. At the same time the company’s “cash, cash equivalents, and marketable securities balance was $154.2 million” at the end of Q2, Rumble reported.

Perhaps Thiel will write another check.

Neobanking for fun, profit: Nubank’s Q2 earnings were bonkers good. Forget the market reaction. Just soak in 65% revenue growth, 48% gross profit growth, 28% net income growth, and 33% adjusted profit growth. Oh, and rising revenue per customer. Damn.

Shattering a technology titan

Recall that Google recently lost a court case, and was branded a monopolist by a federal court. Here’s US District Judge Amit Mehta own summation of his ruling:

The ruling was a big damn deal. Google will appeal.

Possible remedies are being discussed. According to Bloomberg, breaking up Google is “one of the options being considered by the Justice Department.” This is not a new concept for technology giants. Recall that Microsoft was deemed in breach of the same section of the Sherman Act back in the 90s. The judgment called for Microsoft to split its operating system business from its applications business.

Grinding down a longer saga into a few words: Microsoft did not have to split up but instead had to amend some of its business practices. Since then, Microsoft’s value has risen from around $350 billion (June 2000) to more than $3 trillion today.

What might a Google breakup look like? Bloomberg has the goods:

If the Justice Department pushes ahead with a breakup plan, the most likely units for divestment are the Android operating system and Google’s web browser Chrome, said the people. Officials are also looking at trying to force a possible sale of AdWords, the platform the company uses to sell text advertising, one of the people said.

Google sans Android and Chrome would be a different, smaller company. But as with Microsoft, we’re seeing the possibility of the breakup of a company that is both platform (operating system) and tools builder (apps). Put another way, splitting Android and Chrome off from Google’s search, advertising, video, and cloud businesses would somewhat fit with the historical precedent of the original Microsoft judgment.

The issue is that Google monetizes many of its properties through search. Chrome, for example, is a vehicle for search, and Android is a delivery mechanism for search, too. This yields a fascinating situation in which the parts of Google that might be shaved off would need to earn their bread from their erstwhile sister businesses. Perhaps as a sort of revenue-sharing deal? As Benedict Evans points out, that would be ironic.

I do not know the best way to atomize Google so that the search market would become more competitive. However, I can imagine required business practice changes—i.e., no more paying for search default status—having that effect.

Perhaps it would be more intelligent — and, let’s be honest, possible — to make Google play differently than try to disentangle its viscera and veins into several self-sustaining corporate bodies.

The Reddit Rush

Reddit’s userbase is growing at an insane clip this year. Thanks to Google’s search model changes, netizens are winding up on the social forum website at an accelerating clip. AdWeek reported SEMRush data indicating that between “August 2023 and April 2024, readership to the 20-year-old platform nearly tripled, rising from 132 million visitors to 346 million monthly visitors.”

Third-party data can be a bit wonky, so let’s see what Reddit had to say in its Q2 2024 earnings:

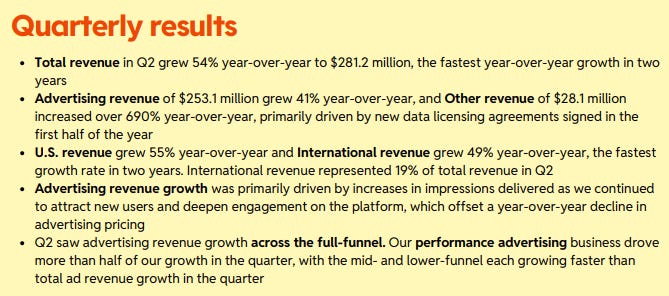

Hot damn. (Recall that Google has a deal with Reddit to use its data in its AI models; call it a corporate friendship of increasing harmony.)

Not all traffic is made equal. And for Reddit to take full advantage of its roaring influx, it needs to convert those fly-bys to registered, and active users. Investors are worried that it may fail to do so.

I am somewhat less concerned, given the following data from the company’s second-quarter investor letter:

Revenue growth outpaced DAUq growth, implying that Reddit is currently able to monetize usage. This is not merely thanks to AI-related data deals, though those revenues are helping the company grow, as you can see above. The 41% advertising revenue growth rate lags DAUq growth, but not by so large a margin as to be terrifying.

No, it seems that Reddit is enjoying a massive windfall from Google, and is making money off it twice — by selling ads against more folks, and pulling more value out of data generated by rising usage to boot.

If I bet on individual stocks — apart from my employee-era Crunchbase stock, I invest in index funds — Reddit would be an interesting wager to consider.

Waymo contra Uber

My friend Katie Roof wrote on Twitter today that she got ribbed for taking an Uber in San Francisco. Why would you do that when Waymo is around, the argument went. I also awoke to a text this morning from a friend who lives in my beloved City by the Bay stating that it’s great “having a robot drive you around and paying $10 less than Uber.”

My burning jealousy aside, there’s an interesting competition bubbling here. Waymo is contra-Uber’s trad business model in markets where it exists. At the same time, Uber is teaming up with Chinese EV giant BYD to bring BEVs to the world. BYD is investing bonkers sums into self-driving. And Uber intends to use BYD electric cars around the world, although a rollout of the partnership in the United States seems unlikely for now.

Uber and Waymo have also worked together, leading to an odd web of conflicting goals. Waymo wants to do self-driving for folks in more and more places; Uber needs to preserve its market share. When does the scrap get bloody?