I, for one, am opposed to monarchy

In tech news: We can add Chime to our hoped-for 2025 IPO list.

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Stocks, after yesterday’s mess … good news from unexpected places … rip and replace … the wrong people making choices for women … negative results of sports betting … Apple-China relations … domestic spine … giving people money to have kids …

📉 Trending Down: Global love for Chinese ships … Micron Technology, after earnings … real estate stocks after the Fed meeting … AI control … the price of AI coding tools? … smart watches … Chinese military modernization … Vietnamese territorial boundaries …

Chime filed to go public. We’re talking about that right after we discuss:

They want a king

Yesterday it became clear that when it comes to setting Republican policy, there’s a putative leader (Trump), a putative assistant (Vance), a real leader (Musk), and a real assistant (anonymous Twitter accounts).

To catch up the non-politically focused amongst us, there’s a continuing resolutions (CR) before Congress. CRs are tools the government uses to keep the lights on when there isn’t the will to pass a “political agreement on full-year funding, often due to divided party control in government,” as the Bipartisan Policy Center puts it.

Skipping much Congressional arcana, current House Speaker Johnson (R-La) regularly has to depend on Democratic votes to keep the government open. This is because the Republican majority in the House is small, and GOP members of the house often have conflicting goals (sharp spending cuts versus, say, more defense outlays).

Back in September, Speaker Johnson had to lean on Democratic votes to keep the government funded. As he did in March. So, it’s not a huge shock that he had to negotiate with Democrats regarding the current continuing resolution before the House. Until yesterday, it appeared that Congress was going to pull off another one of its unpopular balancing acts — Speaker Johnson cobbling together a CR that can pass, his party voting against the bill because they know it will pass, and Democrats getting some of their own goals met in the process.

Compromise, in other words. Compromise, however, is now even less popular today than it was in D.C. previously.

Enter Musk, who took extant grumpiness amongst GOP House members that they were unable to unilaterally get their way, and turbocharged it through incredibly animated tweeting. He posted his way through it, as they say.

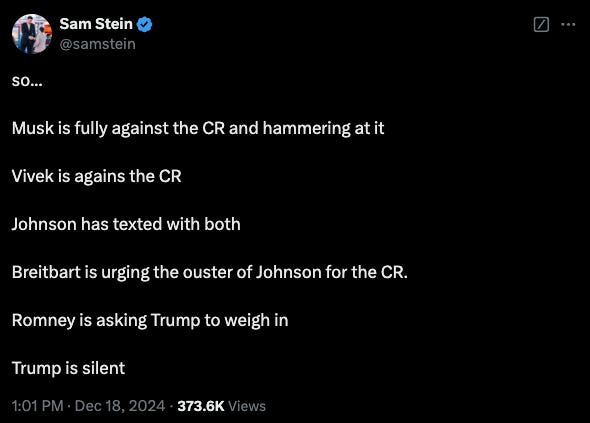

Yesterday as of about 1 PM, this was the state of play:

Musk tweets against the proposed compromise bill included issuing veiled primary threats, and using some of his quasi-governmental channels to publish alternative facts. The effort worked. A swell of GOP members in the House began to more loudly oppose the CR — undercutting GOP House leadership in the process — thanks to Musk making it clear that they would be more likely to face primary rivals if they voted for the CR.

Musk later took a victory lap after it was clear which way the wind was blowing:

Trump and Vance eventually came around and made a statement against the CR. But their comment was late, and I would argue irrelevant by that point. Musk had changed the House calculus, and now we’re heading towards a government shutdown, per current tea-leaf reading.

Now the incoming President wants a debt-ceiling boost in whatever bill eventually goes through, but how that would pass the House is not clear. At least not without Democratic votes, which would require compromise. And then we’re right back to where we were.

The only way that I can see the House mess sorting itself out sans a lengthy shutdown — leading to eventual compromise, as always — is if Musk can single-handedly bully the entire GOP caucus in the House and Senate into doing precisely what he wants, when he tells them to. What counts as useless spending is the purview of the same man who is effectively Speaker of the House, and is running circles around the man he helped elect to the White House. All while not being an elected official or even real government employee.

And lots of people are pretty ok with the situation.

That many Silicon Valley folks are in themselves in favor of Musk’s efforts and tactics is revelatory, but not shocking. Who could have expected that the people who called those less wealthy than themselves NPCs, and foment about concentrating control inside large corporations to founders and their financial backers — themselves, in other words — don’t think much of our system of distributed authority and built-in checks and balances to any single nexus of power?

No, what they want is a singular executive, unencumbered by ears or empathy, to execute their will without delay or dispute. They want an owner-CEO to run the country, to use business phrasing. In politics we have a word for that role: King.

Normally here I’d caveat that we’re speaking directionally not definitively, but, hey. And Musk is retweeting stuff like this:

Cool.

Since I finished this little riff this morning, two things happened that are worth our attention:

Chime is going public!

Bloomberg reports that American fintech unicorn Chime has filed privately to go public. The same piece indicates that 2025 is the preferred timeline for a Chime debut.

We can add Chime to our hoped-for 2025 IPO list. Companies like Circle and Turo have been on the docket for so long it feels like they have moved in. Databricks, too. Today, there’s market optimism that stocks will stay hot next year, and with animal spirits barking, IPOs will return in force.

Having heard a similar tale for many Decembers now, I am skeptical if hopeful. There’s a lot of really fascinating information currently tucked-up inside startups and unicorns. I want to see it. I want to nosh on the income statements and see how companies performed coming out of COVID, in the post-ZIRP reset and since.

Chime, in particular, is a wrapped package I cannot wait to unbox. After its rise to a valuation of around $25 billion, news from the company seemed to slow. Often that happens when a company hits turbulence and pulls back into itself to get its operations in order. Is that the case with Chime? I don’t know, but quarterly data in its eventual S-1 will fill us in.

Until the public filing drops, we’re stuck with what we had before: Partial data. Forbes reported that Chime was on a roughly $1.5 billion run rate back in May, up from $1.3 billion worth of 2023 revenue, itself a gain of 30% from the preceding year. Forbes also reports that Chime lost $200 million last year, but was profitable to in the first quarter of this year.

So, $1.5 billion run rate in may and operational results that are trending towards the black, though we’ll want to make sure when the filing drops that we’re all in agreement regarding what profit is.

All told, the numbers make it clear that Chime has reached enormous scale, is still growing nicely, and can self-fund. Mix in the fact that it had $900 million in cash earlier this year, and Chime appears very steady indeed. Well done to the Chime team.

What might Chime be worth when it does list? Nubank might be a good comp for it, given that Nubank is also a neobank that earns its living banking individuals. In its most recent quarter, Nubank generated $2.94 billion worth of revenue (+38% YoY, +56% in FX neutral terms), and GAAP net income of $553.4 million.

It’s worth about 6.5x trailing revenues, Ycharts reports. If we presume that Chime will earn the same revenue multiple, at $1.5 billion worth of annualized revenue, it would sport a value of about $9.75 billion. That’s a pretty penny, and damn near a decacorn result, but still far less than Chime was once valued. (That’s not a knock against Chime, look at Nubank’s P/S ratio from its early trading days to understand where sentiment for fintech equity once was.)

But if Chime was to wait until it could defend a $25 billion valuation, it might have to wait to list until my children are in Middle School. And my oldest daughter is two. So, a listing in what many hope will be warm IPO waters makes sense. Get out when the getting is as good as you think it might be for a while yet.

Here’s hoping that Chime winds up not being an outlier, but instead one of a herd of unicorns racing for the IPO window en masse.