Inside WeRide's IPO filing, and the latest fintech shutdowns

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Modestly upbeat.

This morning the Producer Price Index (PPI) rose by 0.1%, less than the 0.2% that was expected. CPI data drops tomorrow. Stocks liked the news.

The rundown

📈 Trending Up: China’s ability to produce current-gen-level AI chips …Southeast Asian venture … EV charging speed … meal kits? … Japanese stocks … credit card delinquency …

📉 Trending Down: Bets on Trump saying “crypto” … Fed meddling … Olympic anti-doping legitimacy … creator earnings after the Apple Taxman Cometh … dockworker contentment …

🤔 What Else?

Shutdown Season: Tally is dead. After $172 million in known raised capital and a valuation that stretched to $855 million, it’s over. If you need a refresher, Tally originally set out to help people repay high-interest credit card debt with lower-cost loans. Its offering was the ∆ between credit card rates and its own, and its ~NIM was the ∆ between the Fed rate and its own lending vig, I suppose. I wonder if rising interest rates generally made its model tricky to cough up gross profit. Along with what appears to be declining consumer credit quality. (See above.)

A pivot to B2B this year failed to shake up the company’s chances at life, and it failed to secure more capital. Its investors said no thanks and the plug was pulled.

A bummer for fintech, the founders, and the staff who are now sitting on shares and options worth zero.

Shutdown Season, Part 2: Score is dead. Originally designed as a “pop-up app,” in TechCrunch’s words, its builders let it run on longer than initially planned. This shutdown is less painful than Tally’s, for obvious reasons, but is worth adding to our running roster all the same.

Chip labor: The FT has a great piece out looking at the mismatch between demand for highly-skilled semiconductor “engineers and technicians.” About 1,500 engineers join the domestic chip manufacturing game. We’re going to multiply that number by about 50. Sounds like a wages issue!

I tuned into the Trump-Elon chat, which was slightly interesting. In the section I heard live Musk tried to find a way to convince the former President that climate change is, in fact, something that matters. And that nuclear power is good. Trump argued that sea levels will rise by “one-eighth of an inch over the next 400 years,” which is comedically false. And that nuclear power was, in fact, very dangerous unlike, in his view, fossil fuels.

After a few rounds of that I gave up. Turboscribe has a good transcript here.

Say hello to the WeRide IPO!

While domestic companies tuck their tails and hide behind private-market investors, a Chinese company is keeping the IPO calendar alight. Meet WeRide, which builds self-driving tech that it applies to cars, vans, and industrial vehicles.

As a startup, WeRide was a brilliant fundraiser. During its life as a private company, WeRide raised $1.1 billion, according to Crunchbase data, at a valuation that crested at $5.1 billion.

What did all that investment buy? Quite a lot, it turns out. WeRide claims in its F-1 filing that it is the “only company that offers commercialized L2-L4 full range autonomous driving solutions for cities.” The L2-L4 point is a huge deal. Level 2 self-driving vehicles require constant driver engagement. Level 3 self-driving cars are more self-directed but may demand that that the human present take over.

Level 4 is where things get good. As JD Power puts it, a Level 4 system will “not require you to take over driving” while using it. Put another way, WeRide claims that it has built a self-driving system that is, in fact, self-driving — at least at the upper end of its capabilities.

Governments agree with its progress, with WeRide claiming “autonomous driving permits” in four countries—the UAE, China, the United States, and Singapore—and “trial and commercial operations” in three 30 [updated to correct the number] cities across seven nations. That’s quite good, really, and speaks to the progress that self-driving tech has managed while tucked out of the spotlight.

Most importantly to your humble chronicler, WeRide claims to be the “first company in the world to offer paid L4 robotaxi services to the public,” giving it the “longest operation[al] track record.” I don’t like to drive; good on you, WeRide.

Capital in, technological progress out. Now we need to understand how good — or not — of a business WeRide is.

WeRide’s uneven results

Disregarding the usual corporate chaos that comes with a Chinese company listing in the United States — WeRide Inc. is a Cayman-domiciled holding company that owns subsidiaries that operate in China; historical VIEs; intra-corporate eliminations and cash transfers, etc — it’s not too hard to get a grip on how well WeRide is performing in 2024:

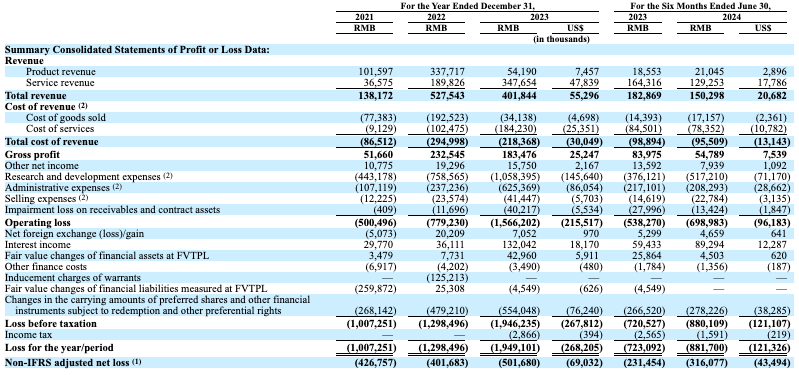

The answer? Not incredibly well. Despite all that it has accomplished on the technical side, the company’s top line fell from 2022 to 2023 (-23.8%) to just $55.3 million. In the first half of 2024, revenue fell a further 17.8% to just $20.7 million.

Against that H1 2024 revenue result, revenue costs ran $13.1 million, leaving so little gross profit that the company racked up a $96.2 million operating loss in the six-month period. Operating losses at WeRide grew by nearly 30% from H1 2023 to H1 2024. (WeRide’s $40.2 million worth of share-based comp in the first two quarters of the year did not help.)

So, WeRide is shrinking and losing more money as it does so. Not a great business, right? Eh, I actually kinda love it. Let me tell you why.