Investors grade Tesla's self-driving event, and why you shouldn't compare OpenAI to Google

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Nvidia competition … Corweave’s credit access … the ‘agent economy’? … Monzo’s valuation … open-source video generation … Operation Gigawatt …

📉 Trending Down: Human moderation … wholesale inflation … shut-down nuclear reactors … press freedom … power availability in Florida …

The market wasn’t jazzed by Tesla’s robotaxi event

The old joke that the market can stay irrational longer than you can stay solvent is precisely why I would not — if I traded individual stocks — short Tesla. '

I have never quite understood the scale of valuation premium that Tesla enjoys over its more conventional rivals. It always seemed too great to be fully explained by even the most optimistic fans of the company, its products, and its vision.

Let me explain in numbers (data via Yahoo Finance this morning):

Telsa:

Market cap: $762.53 billion

Trailing PE: 67.05

Price/Sales: 8.74

GM:

Market cap: $53.60 billion

Trailing PE: 5.36

Price/Sales: 0.33

Ford:

Market cap: $42.46 billion

Trailing PE: 11.12

Price/Sales: 0.24

Why the gap? The market has been willing to award Tesla a sky-high valuation relative to its automotive peers on the belief that the company is different; that it will grow more quickly, make more money, and become — in time — so monstrously profitable that its current price point will become cheap compared to future cash flows.

Optimism, in other words. No sin there, but it gets harder to be sufficiently optimistic to support the above-denoted valuation premiums if the product promises themselves stutter.

That appears to be the case with Tesla’s robotaxi event that it held last night. Recall that CO took a brief look at the number of commercially-available self-driving cars earlier this week. It’s not that large a number today, though we do appear to finally be at the starting point of an upward-bending curve.

Tesla is not about to change our projections. Instead, the company promised:

Unsupervised Full Self Driving (FSD, the Tesla brand name for its autonomous technologies) in California and Texas next year.

Cybercab at a $30,000 price point, available in production “before 2027.”

A robovan, which admittedly looked cool, but is a version of similar tech that is already being deployed in China.

Waymo is already running a robotaxi business in California and parts of Texas. Cruise is inching back to market. And Tesla is going to get there in a while.

There is material value in full self-driving in the two largest constituent economies of the United States. But did Tesla investors expect less than FSD in the Lone Star State or the Golden State by next year?

In other words, did investors get anything more than what they had pre-purchased by owning Tesla stock before the delayed robotaxi event? The answer appears to be no. Here’s Mr. Market:

Don’t call me a hater. Call the stock market a hater. (Really, I don’t care who gets there first, I just want self-driving cars in the Northeast.)

OpenAI and Google, a reminder

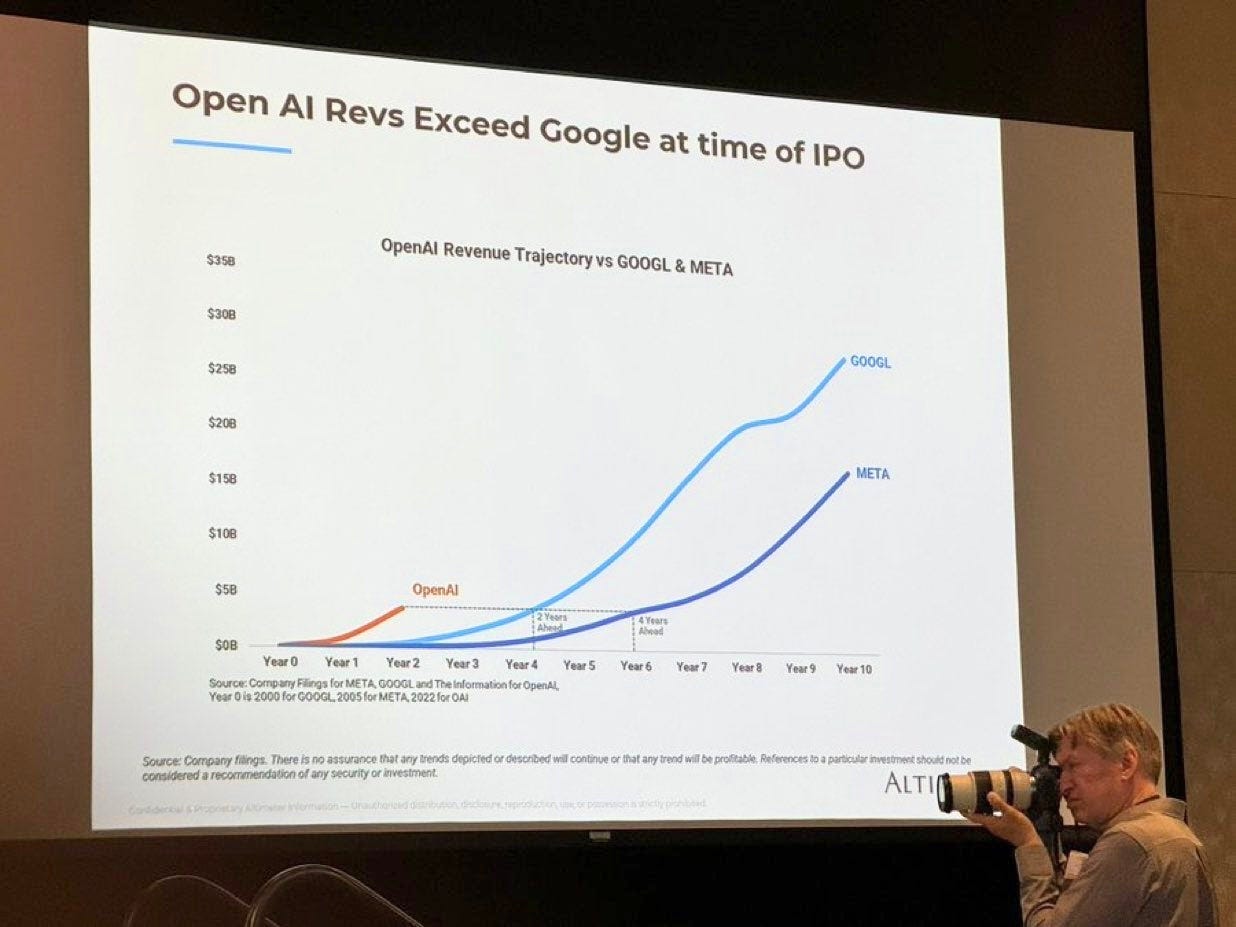

There’s a chart running around Twitter that is worth a moment of our time:

We’ve covered the OpenAI round in some detail lately, so we won’t belabor it here. But the chart makes a very specific point: OpenAI is growing faster than some of the most valuable companies in the history of the world.

This is true. It’s also true that OpenAI started to build its revenue base when the Internet was far larger:

Google, founded in 1998, had an Internet population of around 180 million to sell to, according to OurWorldInData

Meta, founded in 2004, when the Internet population was around 912 million people.

The chart, however, is not built around founding years but rather the year in which they achieved real commercial beginnings. Hence, 2000 for Google — the company’s 1999 revenue was de minimus — and 2005 for Meta, the year after it was founded.

By 2022, the “year zero” for OpenAI in the above and the year in which ChatGPT arrived, the Internet population was a lot. OurWorldInData caps out at 4.70 billion people in 2020. But the answer is a lot more than 20 years before. So, OpenAI managed to grow revenue more quickly, on a slightly massaged timeline, thanks in part to structural progress in the underlying protocol it uses to attract, and serve customers.

But that’s not really why I think that the OpenAI v. Google/Meta argument is a bit specious. All respect to Brad Gerstner from Altimeter who I am told is the original poster of the chart, but here’s how Google’s life began:

If we read the above starting in 2020 — the year the chart treats as Google’s first — we can see that it had just started to really focus on commercial results and that it had a single unprofitable year before starting to kick off material profits. It also grew more than 4x in 2021, and about 4x in 2022. Then it grew by nearly 3x the next year. While making more money.

Meta went public later than Google did, compared to its incorporation date. So its data is a bit less temporally tied to what it did in its very early monetization days. Still, by the time it did list in mid-2012, the company was, like Google, shitting gold:

And that is inclusive of share-based compensation expenses.

Even Amazon, famous for its quick growth and early unprofitability, was losing less money per quarter at the time of its IPO than your average late-stage unicorn today probably burns per month:

All this is to say that yes, OpenAI is growing super fast and that’s impressive as all heck. The company really did manage the leap from company valued on the strength of its technical prowess and product-lead over rivals to company valued on the strength of its technical prowess, product-lead over rivals, and mind-shattering revenue growth.

If OpenAI had failed to make that jump, we certainly wouldn’t see the company securing a valuation north of $150 billion.

But perhaps comparisons to the current crop of tech megacorps is an error. They grew faster than we can nearly recall today, and did so while — mostly — bathing in black ink.

Not so, OpenAI.

I think below the Google's financial statement chart, what you meant was 2000, 2001 and 2002 not 2020, 2021 and 2022. Kindly check this if I am miss-reading your intention.

Alex,

I think a J Curve Comparison looking at Money in and Money out would show that OpenAIs "losses" are best thought of as investing in future cash flow. It does seem likely that their path to $100 bn in revenue will cost somewhere around $30 bn. That's a J Curve that will probably build the first company valued in the $3-10 trillion range somewhere around 2030 if growth is still there.

The ability of AI to "seep" into all work will make it far more prevasive than search and advertising.