Is venture capital about to get cut in half?

Welcome back to Cautious Optimism! Today is June 12th, 2024. In the newsletter this morning we have good news on inflation, the latest regarding startups and antitrust, more cash for AI model companies, and more. Off we go! — Alex

Trending Up: Sanctions on Russia … Oracle after earnings, OpenAI … bundling … space startups … gaming (more) … media synergy … Spotify’s prices (again) … the chance of AGI by 2027 … consumer trading volume … stocks …

Trending Down: Musk’s contra-OpenAI suit … Fisker … Twitter … custom GPTs (context) … inflation … the affordability of Chinese EVs in Europe … calm in the East China Sea … yields …

How about some non-AI news?

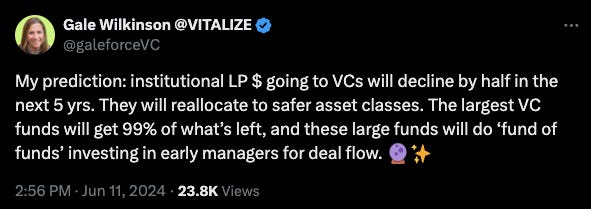

Bored of all the AI happenings? I understand. To help keep you sane, here’s VITALIZE’s Gale Wilkinson’s tweet on the near-term future of venture capital:

Not all investors agree, but the sentiment was reasonably well-received on the social media service. It’s not hard to grok why Wilkinson’s prediction could come true. With interest rates where they are, you can generate fat yields presently with all but no risk. That puts more pressure on higher-risk investments like venture to generate impressive IRR on the double. Or, put another way, it makes mediocre fund results more expensive to LPs.

Cautious Optimism: The counterargument is also not hard to sketch. Today, we have a venture capital industry that has taken its lumps after its party back in 2021 and is ready to back some super great companies at attractive prices that will scale for the next decade. LPs, however, seem to want to stuff venture full of cash when dealmaking is expensive and reduce their allocation when dealmaking is cheap.

Is antitrust good for startups?

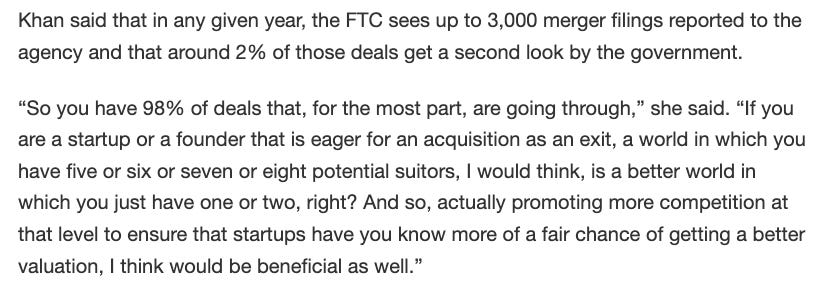

I’ve argued that startups should favor a strict antitrust regime from their government. Why? So that the largest tech companies can be murdered by upstart competitors instead of the market being forced to wait for them to commit suicide by enshittification. There’s another angle to the argument.

At TechCrunch’s recent event, the FTC’s Lina Khan had an interesting point regarding the M&A market that I want to flag:

Agreed.

Mistral, again

According to the Encyclopædia Britannica, the Mistral is a cold “wind in southern France that blows down from the north along the lower Rhône River valley toward the Mediterranean Sea.” It’s also the name of what could be the hottest startup in Europe. This week Mistral, which builds AI models with an open-source twist, raised €600 million. Sifted.eu reports that €468m of the total was equity funding, with the balance filled in with debt.