It's power laws all the way down

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Robinhood’s revenue mix diversity … Indian venture capital … involution … water disputes … taxes in Egypt … Polish leadership of the presidency of the Council of the European Union … power availability in Puerto Rico …

Violence: People were killed in New Orleans, Las Vegas, Queens, Kankakee, and Montenegro as the year started. And that’s not counting deaths from wars in Ukraine, Gaza, and other places.

📉 Trending Down: Chinese government bond yields … optimism for economic growth in China … mortgage demand … chances that House Speaker Mike Johnson loses his gavel? …

Chart of the day

Fintech investor Sheel Monhot shared a FT visualization of PitchBook data detailing the number of active venture capitalists. It looks like this:

I don’t think that anyone is shocked that the number of active venture investors putting funds to work in the United States is in decline. With myriad unicorns suspected to be yet-hiding behind 2021-era paper valuations that are no longer valid, liquidity in its drought era, and software growth outside of AI failing to live up to past expectations, it’s tough out there.

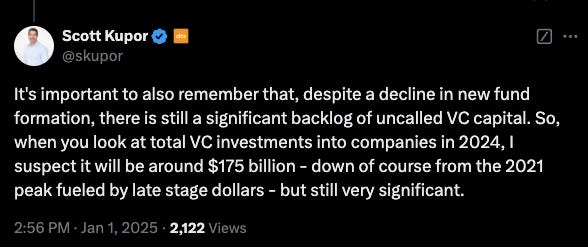

Scott Kupor of a16z and soon the second Trump administration, weighed in:

I wonder how much of the uncalled venture capital will get called, and what portion will not. We’re probably not done with venture firms pulling a Countdown, right?

Wealth inequality, venture edition

The same FT piece reports that American venture capitalists “raising their first fund” managed to secure just just $4 billion last year. We haven’t seen a number so low since 2015, and the pace at which new venture funds accrete capital domestically is far off its >$20 billion peak result set back in 2021.

As total venture investment by LPs slows in aggregate, not everyone is suffering. It’s not a new trend, but concentration of capital amongst the largest venture players is increasing. PitchBook data indicates, and the FT writes, that the majority of capital raised in 2024 by VCs raised by just nine firms.

Indeed, the same data source reported as 2024 came to an end that the “top 30 VC funds raised 75% of all venture capital in the US this year.” That’s a bit lopsided.

Power rules rule everything around me

In case you were curious, here’s the Big Name List from 2024, with percentage dollar share of U.S.-based venture capital fundraising calculated from the same denominator used by PitchBook in mid-December:

a16z: $7.2 billion, 11%

General Catalyst: $6.0 billion, 9%

Thrive Capital: $5.5 billion, 8.4%

Flagship Pioneering: $3.6 billion, 5.5%

TCV: $3.0 billion, 4.6%

ARCH Venture Partners: $3.0 billion, 4.6%

Norwest Venture Partners: $3.0 billion, 4.6%

Tiger Global Management: $2.2 billion, 3.4%

Kleiner Perkins: $2.0 billion, 3.1%

IVP: $1.6 billion, 2.4%

Venrock: $1.2 billion, 1.8%

The two names on that list that you might not recognize invest in biotech.

Adding together a decline in new investment for net-new managers, a falling total venture pool, and the ability of the largest funds to raise 2021-era capital, we’re seeing a concentration in venture investing that feels very old-school.

You used to have to hit Sand Hill Road to raise capital, because that’s where all the money was. Firm concentration was high back in the day. It’s back!

With crossover funding down to boot, the fact that a single venture firm raised about one in ten dollars last year means that a handful of firms — and, therefore, a handful of people — have huge influence over what sort of startups can raise, and can continue to raise. Oddly enough this means that prior incumbents like Kleiner are now something akin to first-tier-disruptors than market-setting behemoths.

Spitballing, it feels like when we consider a16z’s ability to drive the conversation in technology circles — techno-optimism, American Dynamism, etc — what we’re really referring to is the off-gassing of influence from enormous piles of cash. First capital, then word-based influence. (As a writer, I find this backward, but no one put me in charge.)

Is Musk bored of American politics?

Recall when Elon Musk turned his attention to a single funding bill in Congress, helping fuel a few days of legislative chaos? It was a whole thing. After that episode, Musk and his technology allies, with a new eye for political wrangling, got into an internal MAGA scrap over high-skill immigration and the importance of immigration, full-stop.