Meet the fintech startup that Wells Fargo is accidentally subsidizing

Welcome back to Cautious Optimism! It’s June 17th, 2024. Today we’re talking AI’s impact on the written word, Bilt’s amazing startup journey, the IPO market, and looking at the week ahead! — Alex

Trending Up: Black-owned chatbots … the box office … writing for industry pros … San Francisco … privacy-focused acquisitions … nine-figure social media exits … AI search in Japan … privacy-focused tech companies … China’s nuclear arsenal … the American heat dome … schools shuttering due to heat in the United States and Greece and India …

Trending Down: Censorship … Will Lewis … my former employer Yahoo’s relationship with The Trade Desk … Oyo’s valuation … adblock on YouTube … Jared Kusher’s play in the Amazon aggregator market … the Chinese economy … home prices near the ocean …

Monday Morning Annoyances

AI-powered search engine Perplexity recently got into hot water for borrowing pieces from media outlets. The company responded that it is still working on the feature in question and that it intends to hammer out deals with media companies to share revenue. (The concept of asking for forgiveness instead of permission is not a get-out-theft-free card, I add, for no particular reason.)

Don’t worry about the company. It’s going to be fine. Recall that in April Perplexity announced a chunk of new capital and deals with Deutsche Telekom and SoftBank. The latter agreement is now bearing fruit for the company, with TechCrunch reporting this morning that the startup is “now using the deal to expand its user base, and data touchpoints, in SoftBank’s home market.”

Good on Perplexity. May you make lots of money to pay for the data you are collecting and serving to your users.

But while Perplexity and other AI companies are showered with capital and access, we’re seeing the market for creative work decline thanks to AI-powered tools. This as the media world is itself seeing inbound traffic from technology platforms fall. Mix in a perilous climate for the work of journalism, and it’s bleak out there for people who get paid to write.

Best that we fire up another $100 billion for AI companies, I think. That should fix it.

Upcoming : U.S. economic data on Tuesday (retail sales, industrial production, business inventories), Juneteenth on Wednesday, Accenture earnings, initial jobless claims and housing starts on Thursday, flash PMIs for domestic services and manufacturing on Friday …

The fintech Robin Hood

The fintech sector has been in the news lately thanks to Synapse. The banking-as-a-service company that provided a software layer between an actual bank and other fintechs recently entered bankruptcy. There has been chaos in the wake of its failure (its partner bank is now in trouble as well):

For instance, Synapse customer teen banking startup Copper had to abruptly discontinue its banking deposit accounts and debit cards on May 13 as a result of Synapse’s difficulties. […] Funds at crypto app Juno were also impacted by Synapse’s collapse, CNBC reported. […] Meanwhile, Mainvest, a fintech lender to restaurant businesses, is actually shutting down as a result of the mess at Synapse.

But not all fintech companies are struggling. Indeed, Bilt is making a killing thanks to a deal it struck with Wells Fargo. Bilt offers a credit card that allows users to pay their rent and earn points in the process. Something that you mostly cannot do, I learned during my long stint as a renter.

The company reached a $3.1 billion valuation after raising $200 million earlier this year. How did it manage that in 2024 when venture capital is thin on the ground for non-AI companies, and fintech itself has been out of fashion?

It turns out that the company is living large operating intelligently thanks to its partner bank Wells Fargo getting hosed picking up the tab. The Journal has the key numbers:

But Wells is losing as much as $10 million every month on [its Bilt] program as savvy customers flock to the card, according to current and former employees. Executives made internal projections on key revenue drivers, such as the likelihood that cardholders would carry balances, that turned out to be inaccurate.

Put another way, Wells Fargo is funding Bilt to the tune of $10 million per month, which I would guess is why the startup’s model works. The two companies are working to retool their deal, which was set to last until 2029.

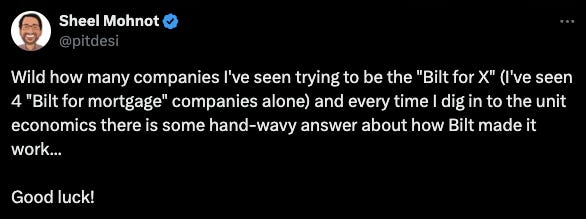

Sadly, while this is all pretty awesome for Bilt in the near term, other startups that want to ape its model should not expect to land a similar deal. Here’s BTV VC’s Sheel Mohnot — a noted fintech investor Taco Bell enjoyer — responding to the Bilt news viz other upstart tech companies that see it as a North Star:

Given Wells Fargo’s history of breaking the law, stealing from customers, opening fake accounts, and poor internal controls, I feel precisely zero percent bad that they are getting hammered. Still, for all the wannabe-Bilts that were built, I doubt that they will be similarly lucrative.

IPO Watch

Briefly as we head out, Tempus AI’s stock is comfortably above its IPO price of $37. It closed Friday just over $40, and is adding more this morning as the newsletter goes to print. Also, Webtoon’s IPO (more here) is now on the books for June 27th. Mark your calendars.

Cautious Optimism: Writing this little newsletter for you is a literal joy. I love doing it. It’s also a work in progress. So, if you peruse it more than once a week — whether you are a paid subscriber or not — hit respond and let me know what you want to see more of. Also, if there are topics you want me to dig into, well, I am here to serve. — Alex