Meet the nine companies with genAI revenues of nine-figures or greater

You already know all of them!

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Modestly upbeat.

📈 Trending Up: Tragedies of the Commons … progress towards supersonic commercial flight … censorship in India … South China Sea tensions … Meituan revenue …

📉 Trending Down: Relationship between interest rates and (certain) capex … venture investment in China (still) … the simple view that more money = fewer kids … Apple’s Books, News teams … cybersecurity … Brave’s employee base …

⏰ Quick hits:

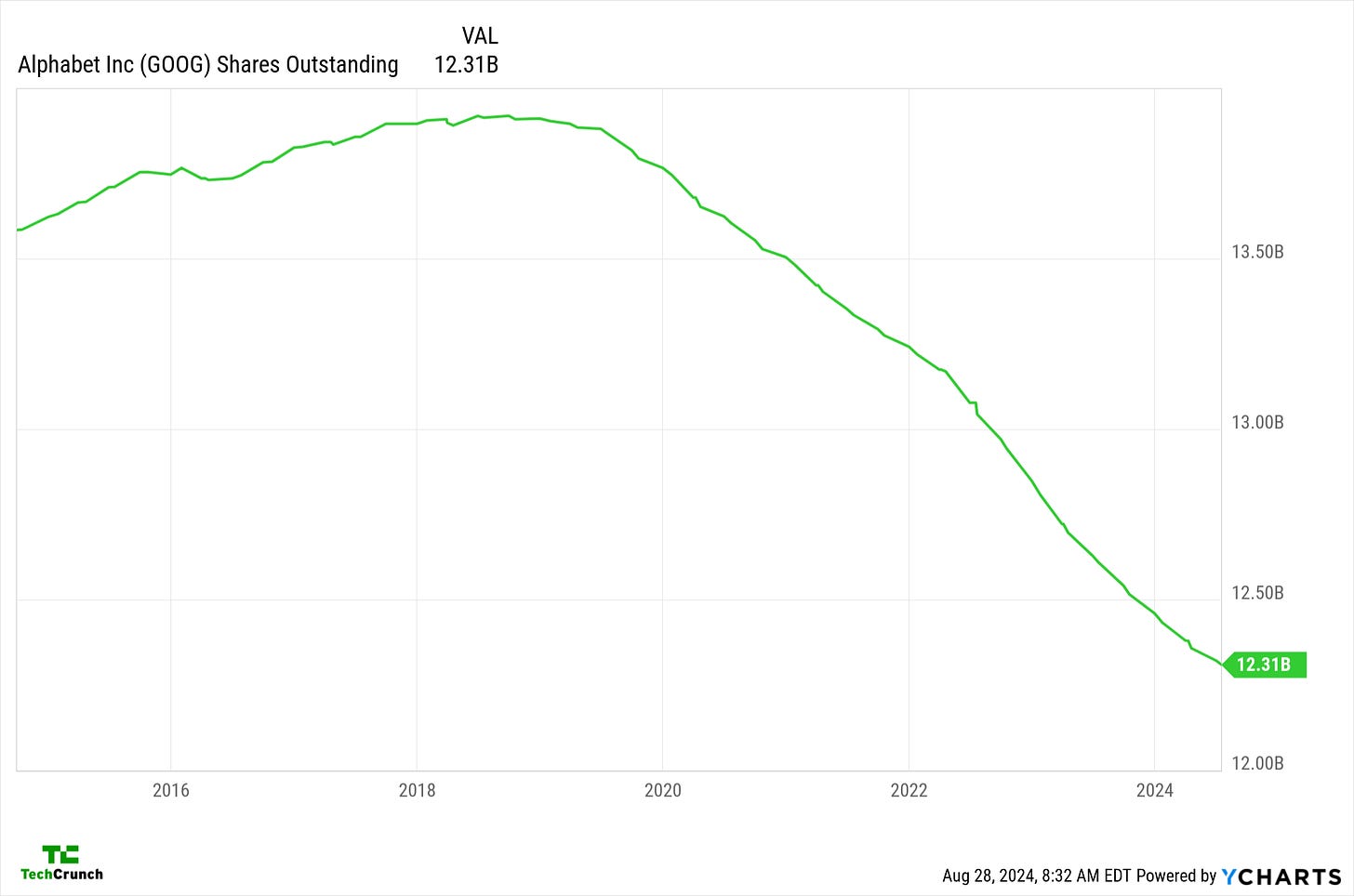

What about Google? After our look at corporate dilution yesterday, a beloved reader asked what about Alphabet? Let’s find out!

Alphabet had $5.9B worth of share-based comp (SBC) in Q2 2024, up a hair from $5.8B in the year-ago quarter.

In the same quarter, Alphabet spent $15.7B on share repurchases ($15.0B in the year-ago quarter.)

As a result of spending more on buybacks than it spent on SBC, Alphabet’s share count is falling like a rock:

Paying your employees a modest fraction of your revenue in stock and using excess cash flow to reduce your overall float is perfectly fine. Put another way, the largest tech companies kick off so much cash that they can pay their staff however they want.

Earnings today: NVIDIA, Salesforce, CrowdStrike, HP, Veeva, NetApp, Li Auto, Pure Storage, Okta, Nutanix, Chewy, and Affirm

Box shares are up nearly 6% in pre-market trading this morning. The company’s most recent earnings report included a host of enticing profitability metrics. And very slow revenue growth.

Box’s problem is that it’s trying to grow during a slow period for SaaS expansion generally, and because “one third of Box’s revenue is generated outside of the U.S., of which approximately 60% is in Japanese Yen,” as the company put it. The Yen’s weakness is dragging Box’s dollar-based growth down. Talk about a headwind. (Ironically, the expectation of impending Fed rate cuts has boosted the Yen, allowing Box to add $2 million to its full fiscal year revenue projections. Great work, JPow!)

Klarna is (almost) profitable: European fintech giant Klarna’s latest report (H1 2024) indicates that the unicorn grew 27% in the first two quarters of 2024 compared to the same period in 2023 (kr13.27b from kr10.48b). Gross profit rose 22%, operating expenses flat, and tiny operating and net losses paired with positive adjusted income.

Klarna will go public in the next few quarters. How can it find another few points of growth?

If you run-rate Klarna’s H1 revenue ($1.263B) and apply Affirm’s trailing price/sales ratio, you get $11.9 billion. Do with that number what you will.

Who is making real money in AI? About nine companies

A friend of the newsletter sent in a recent Sapphire Ventures market report digging into the state of software investing, venture as a whole, and AI in particular. (You can read along here if you want; I recommend at least perusing the entire entry.)

Inside it are familiar themes — rapidly expanding capex at hyperscalers, AI megarounds, and the feeling that some hype is boiling off the market — including AI-derived revenue.

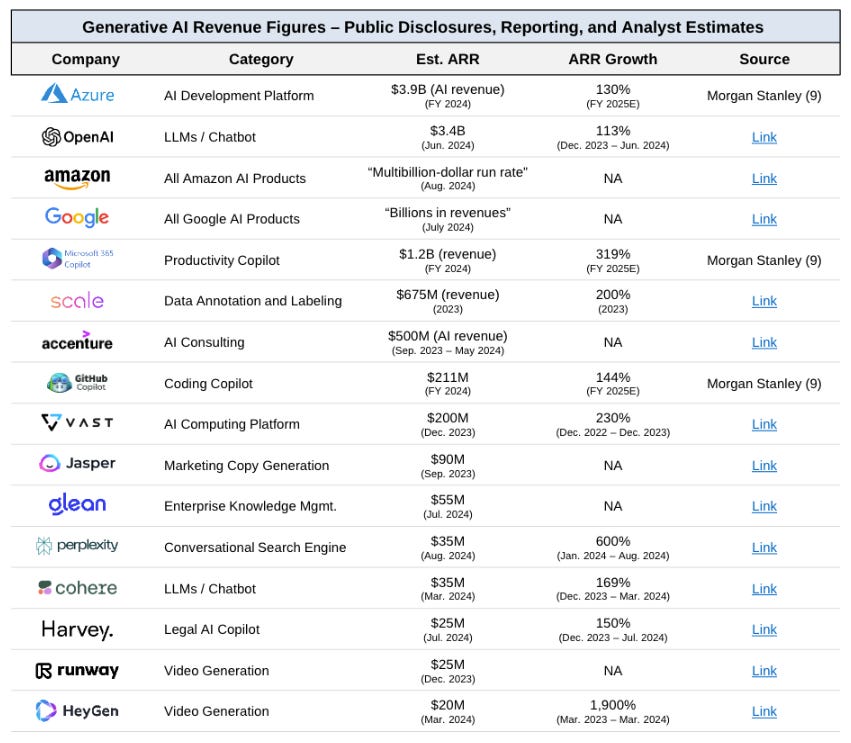

Here’s the critical table:

What stood out to CO in the above is there are only nine companies by Sapphire’s reckoning known to be pulling $100 million or more worth of generative AI revenue on an annual basis.

The list is very top-heavy, with five of the nine slots held by big tech companies and their products: Azure (Microsoft), Amazon, Google, Microsoft 365 Copilot (Microsoft), and GitHub Copilot (Microsoft).

OpenAI takes another slot. It’s all but owned by Microsoft. Accenture genAI revenue comes from consulting, so it almost doesn’t count for our purposes. Scale AI, meanwhile, has been backed by Amazon, AMD, Meta, and Nvidia. The last name from our $100M+ genAI revenue cohort is Vast, which Nvidia and Dell back.

Big tech companies, big tech products, and big tech vassals are the big winners thus far in genAI revenue. Are we shocked, given the concentration of stakes that we see above that the largest cloud concerns are spending heavily? They already have a huge lead; why not double down on building more capacity?