PE-backed Solera is going public, which is cool apart from its insane debt costs

Welcome back to Cautious Optimism! It’s Monday, July 1st, 2024. Welcome to Q3. That Earnings are coming up, along with Q2 venture capital data. I’m stoked. — Alex

Trending Up: Plaid … fintech M&A … South Korean semiconductor production … Chewy … space whoopsies … rare earth metals as geopolitical footballs … extreme weather in India … hurricanes … racism in Italy, the UK … AI scams …

Trending Down: Getting around EU rules with a paywall … the Chevron deference … consumer spending in China (NYT) … support for gay rights, concerningly …

Illustrative Datapoint: “The tech-heavy Nasdaq Composite climbed 18.1% in the first six months of the year as the [AI] craze excited investors” — CNBC

Term of The Moment: K-shaped recovery. Supporting data.

Economic Calendar:

USA: Job openings and auto sales Tuesday, ADP employment and initial jobless claims Wednesday, unemployment and wages Friday

EU: Core flash inflation estimate and unemployment Tuesday, industrial import prices Thursday, retail trade Friday

Solera is going public

After selling to Vista Equity Partners back in 2016, Solera is going public. Reporting indicates (BG) that the company could seek to raise as much as $1 billion at a valuation stretching as high as $13 billion in its debut.

If you are in a hurry: Solera is a massive software company that deals with motor vehicle data. That data is used to sell software products that deal with vehicle insurance claims, data-rich apps for vehicle repair shops, dealership software, and vehicle fleet management services. However, despite growing operating profitability, Solera’s debts are crushing; the company wants to raise capital to lower those costs. That’s likely why Vista is willing to take it public in a market that many tech companies are eschewing due to the low valuation multiples many public tech companies sport.

Turning back the clock, Vista had to raise its offer to $55.85 per share to buy Solera, giving the deal a $6.5 billion price tag at the time. What did Vista buy? Solera's last earnings report covered the last calendar quarter of 2015 before being sold. They included:

Revenue: $308.0 million, +9.0% YoY

Net income: $53.0 million, up from $4.4 million YoY, artificially boosted due to an income tax benefit

Adjusted EBITDA: $121.11 million, +4.6% YoY

Long-term debt: $3.13 billion, up from $2.48 billion YoY

That’s a run rate of around $1.25 billion, GAAP net income, strong adjusted EBITDA as a percentage of revenue, and quite a lot of debt. How has the company done since?

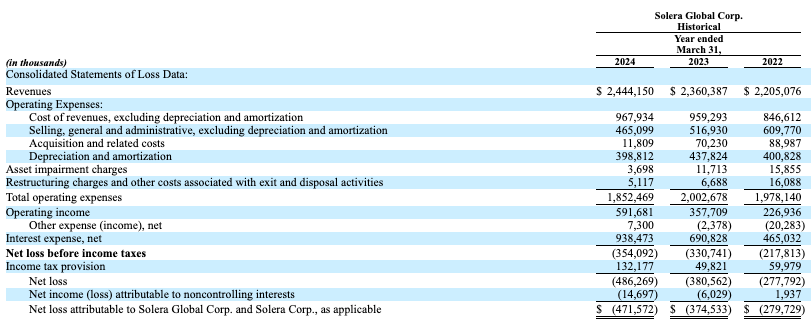

Here’s the income statement from its S-1:

Solera’s revenue growth was just 3.6% in the last year. Inside that number, revenues from its Vehicle Claims segment grew 7.0%, Vehicle Solutions +7.8%, Vehicle Repair +4.1%, and Fleet Solutions -6.5%. Something that Solera can flex in its roadshow is the fact that most of its revenue (90% in its most recent fiscal year) was recurring. This includes “subscription and re-occurring transaction revenue,” mind.

So we have a software company that is (as we can see in the above table) slowly growing its revenues, reducing its operating cost basis quickly, and expanding its operating income. What’s not to like? Debt. It’s a big problem.

Part of the issue is that Solera has been super-acquisitive during its life. The company reports “50 completed acquisitions and over $8 billion of capital deployed on acquisitions since 2006” in its IPO filing. Having a lot of debt can be bad or not. It depends on the size of the underlying company servicing the debt and how costly the debt is.

Solera reported $8.1 billion in net long-term debt in its IPO filing.

Sadly, the cost of servicing that massive debt load has risen sharply. How did that happen? Gisting down a lot of accounting speak, here’s how Solera’s debt costs shot higher (emphasis added):

On June 4, 2021 […] we refinanced $4.6 billion of our existing indebtedness. The impact of refinancing fees and a conversion from fixed rate indebtedness to variable rate indebtedness impacts the comparability of our results for the periods presented. […]

The proceeds of this refinanced indebtedness were used primarily to retire our legacy debt (including fixed rate notes) and preferred stock as well as Omnitracs debt in connection with that acquisition.

What happens if you refinance a huge chunk of debt during a period of low interest rates, and then rates are raised incredibly quickly? It gets expensive. Quickly.

Here’s what happened to Solera in its fiscal 2023 (emphasis added):

[I]nterest expense increased by $225.8 million, or 48.6%, to $690.8 million. The increase was primarily attributable to (i) the interest cost associated with the $3.1 billion net increase in additional indebtedness incurred in connection with the Refinancing Transactions, the $83.4 million related party loan added on November 18, 2021 and the $400.0 million Spireon Borrowings and (ii) an increase in interest rates applicable to our variable rate indebtedness that increased our interest expense by $162.6 million.

And in its fiscal 2024 (emphasis added):

[I]nterest expense increased by $247.6 million, or 35.8%, to $938.5 million. The increase in interest expense was driven primarily by an increase in the average interest rate that increased our interest expense by $216.1 million.

Spending more than $900 million on interest expenses in a year when your company’s total revenues are under $2.5 billion is bonkers.

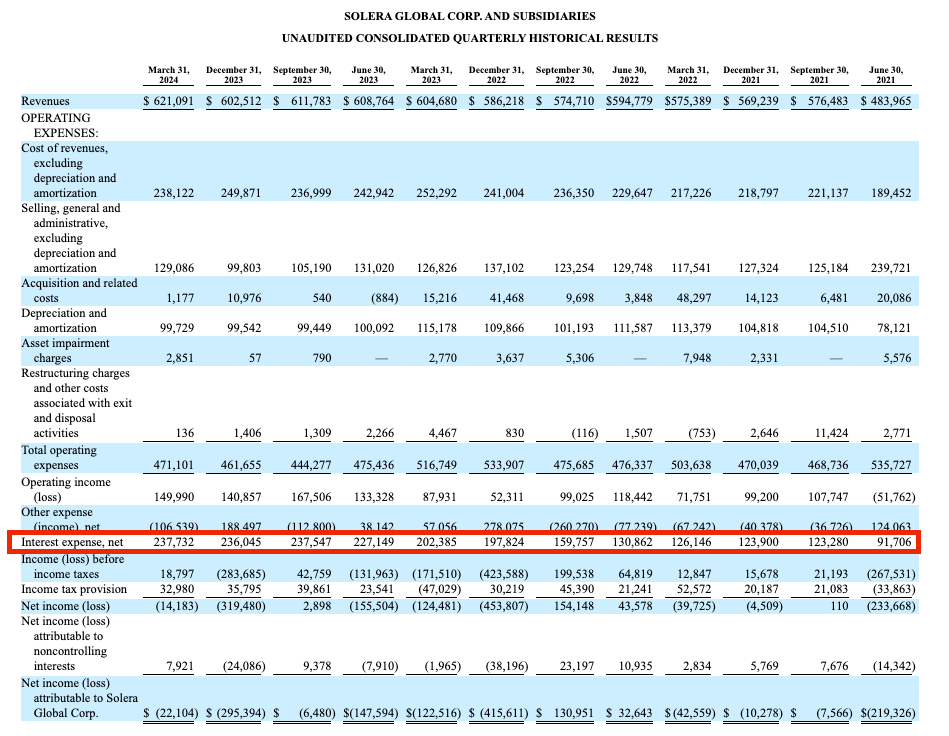

Here’s the quarterly breakdown of the company’s interest expenses (red box, added), showing how quickly things got out of hand:

Yowza.

Solera is shooting for a 4-5x revenue multiple, given its $10 billion to $13 billion target IPO price range. Using the company’s final quarterly report, it had a run rate of $1.23 billion. At $6.5 billion in sale value, it was worth about 5.2x. So, Vista is likely about to take the company back out at a lower multiple than it paid. Of course, we presume that its backers have already eaten their fill from the company and are about to get a markup when it lists. Never cry for PE.

Still, I doubt that Vista was hoping to take the company back at a lower multiple than it paid; such are the risks of holding an asset through a bubble and then taking it out when it bursts.

I wonder how many other PE-owned software companies are in similar straits, with revenue growth far outstripped by the rising costs of their debts.