Rockets go up, learning Mandarin, and the good news for SaaS

Also: Sheryl, meet bus. Bus, meet Sheryl.

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Zoox … a ceasefire in Gaza? … tech parties for Trump … Lenovo-Infinidat … VC interest in crypto … POTUS interest in crypto … Olivia Trusty … losing weight, on the cheap …

📉 Trending Down: Fire batteries … banker income in China … freedom of speech … Snap … EU-X relations … US population growth prospects … French population prospects …

China’s population fell for the third year in a row, the AP reports. “China’s population stood at 1.408 billion at the end of 2024, a decline of 1.39 million from the previous year,” the group writes.

Those declines come after declines of 1.48 million in 2023 and around 600,000 in 2022.

They’re giddy

The Times has a great piece up detailing Zuck’s pitch to the incoming Trump administration on its corporate changes, because nothing says ‘well functioning nation’ than business leaders feeling the need to butter the next President to avoid him trying to jail their CEO.

Apart from Zuck giving immigration superhater Stephen Miller’s plans his nod, the well-known tech leader also found a great place to file the blame for his company’s previously held positions:

Mr. Zuckerberg blamed his former chief operating officer, Sheryl Sandberg, for an inclusivity initiative at Facebook that encouraged employees’ self-expression in the workplace, according to one of the people with knowledge of the meeting. He said new guidelines and a series of layoffs amounted to a reset and that more changes were coming.

Earlier this month, Mr. Zuckerberg’s political lieutenants previewed the changes to Mr. Miller in a private briefing. And on Jan. 10, Mr. Zuckerberg made them official: Meta would abolish its D.E.I. policy.

Sheryl, meet bus. Bus, meet Sheryl.

Rockets Go Up

CO missed the launch of Blue Origin’s New Glenn rocket because the launch kept getting delayed and let’s be honest sleep matters.

No matter, the launch finally happened and it was gorgeous. New Glenn is a heavy launch (20,000-50,000 kilogram payloads) vehicle and it made it to orbit on its first attempt. Booster collection failed, but for the SpaceX rival, it was a good day. (SpaceX itself caught Starship’s booster after a launch this week, but also suffered a pretty spectacular RUD. Such is space work.)

Here’s the launch video, via Bloomberg’s YouTube channel:

The Duolingo Trade

Back in 2021, language teaching service Duolingo went public at $102 per share. (Notes here from the IPO with The Information’s venerable Natasha Mascarenhas.) The company closed out 2024 worth more than $320 per share, making it a very successful IPO in terms of post-debut value creation.

Not every 2021-era public-market listing has such a brilliant track record

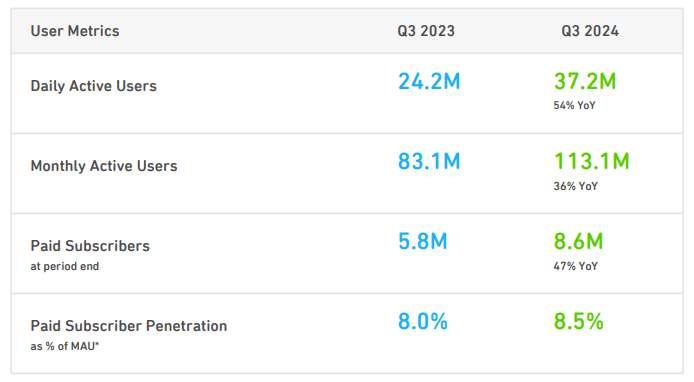

And you don’t have to look too far to see why investors are fans of the service. Here’s its Q3 2024 (the most recent data we have) detail of its usage statistics:

Greater DAU growth than MAU growth implies growing addiction — politely — to the Duolingo product. That perspective is underscored by not only a pretty insane pace of growth in paid subscribers, but also a better yield of paid users as a portion of its free userbase.

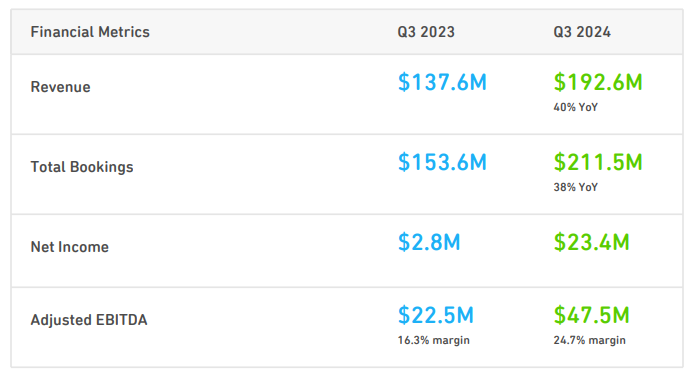

As a result of all that usage growth, Duolingo had some financial results worth yelling about last year:

That pace of revenue growth post-IPO is stellar; and while the net income gains are juicier than an overripe peach, adding 8%+ to your adjusted EBITDA margin is clear evidence of operating leverage in action. You love to see it.

Then, TikTok’s ban became Pretty Damn Real, and its users started flocking to Xiaohongshu, a Chinese Instagram rival. Given that it’s a Chinese app, a lot of it is in Mandarin. The deluge of Americans to Xiaohongshu therefore led to a bunch of those same folks deciding that it’s high-time that they learned a little mandarin.

Here’s Duolingo:

Shares of Duolingo have similarly risen in the last few trading sessions, with the company seeing its value fall to as little as $306 per share before rising to $341.80 at the end of trading yesterday. The company gained nearly 7% just yesterday as investors digested the idea that TikTok’s ban could boost the American edtech company.

While it’s neat that Duolingo is enjoying this particular usage bump — and as we noted above, as the company is getting better at converting free users, presumably it’s seeing a revenue bump as well — I wonder if a more connected world will lead to:

Work by regular folks to learn more languages as they interact with digital tools made outside their national boundaries

Work by AI companies to ensure that all languages are machine-chewable into other dialects so that everyone online can yammer with their friends, no matter their location or mother tongue.

Anyway, good on Duolingo for being its usual, weird self.

I Do Not Like The Poll That Doesn’t Like Me

This thread between Paul Graham and Elon Musk is notable for showing real dissension amongst the tech-elite.

Closing number: 8x

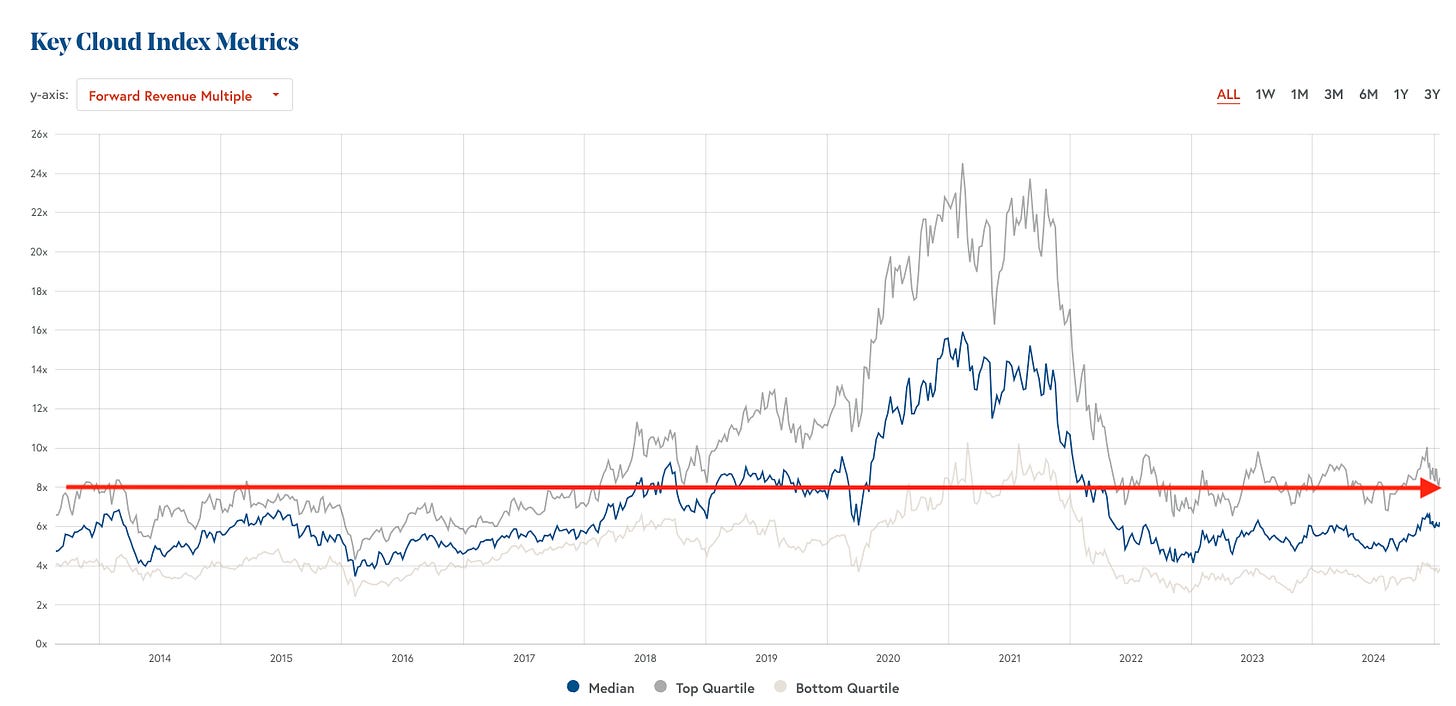

I keep tabs on public-market SaaS revenue multiples. They tell us how easy — or hard — it is for startups to generate value. How the comps do, so too does the private-market valuation.

But instead of seeing a reflation of SaaS revenue multiples, we’re seeing a flat line at around the 8x forward revenue for the top quartile of public cloud companies. Observe Bessemer Cloud Index data, with a little CO graphics editing work on top:

There are three eras in that chart. Pre-2020, 2020-2021, and 2022+. The current era is actually more fertile ground for generating SaaS market cap than the pre-boom era. It may not feel like it, but times are Pretty Good by historical standards for upper-quartile cloud shops.

We’re heading into inauguration-land. That will color next week. CO also has some notes brewing on TechCrunch’s layoffs, which are a big bummer. — Alex