SaaS is so fetch

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Programming note: Someone’s newborn decided that sleep was overrated last night, so today’s newsletter is slightly abbreviated. To come: A dive into Swiggy’s IPO filing, inclusive of its financial results and which venture firms will make out the best; and, favorites from the most recent YC demo day. — Alex

📈 Trending Up: Damage control … inflation in the United States … nine-figure fines … Starlink … Zap Energy … birth rates in South Korea? … the arsenal of democracy … VR affordability … software companies buying romance publishers? …

📉 Trending Down: Oversight of Big Tech AI investments (BG) … the ability to tweet about hacked documents, now that they impact the GOP …

Everyonesome peopleisare worried about OpenAI: The recent departure of OpenAI CTO Mira Murati underscores how much the company has transformed in the last year. Exponential View argues that OpenAI is “not falling apart,” and that “no one knows how to run this kind of business.”Fair, but the WSJ writes that “Current and former employees say OpenAI has rushed product announcements and safety testing, and lost its lead over rival AI developers [while] Altman has been largely detached from the day-to-day.”

Growing pains. The question is whether the new people that OpenAI is hiring can replace the people it is losing.

SaaS is so fetch

I made the above meme after reading this riff on SaaS from Sam Lessin, who argues that software is getting commoditized, and that net retention will have lower bounds than many tech folks thought. At this point, SaaS’s growth struggles and valuation woes are a regular point of converastion in tech, a far cry from a few years back when SaaS was the de facto ‘correct’ way to approach the market.

CO recently explored falling net retention rates at many software companies, arguing that their decline has helped foster to a growth deceleration that markets are still digesting. Software companies may simply not grow as fast as people thought they would.

Slower growth is part of the reason why software companies are struggling to go public, or choosing to go private. For investors with paper gains that they need to convert to cash, it’s a pain point. For founders working on startups that have lost their venture-backability it’s an existential issue.

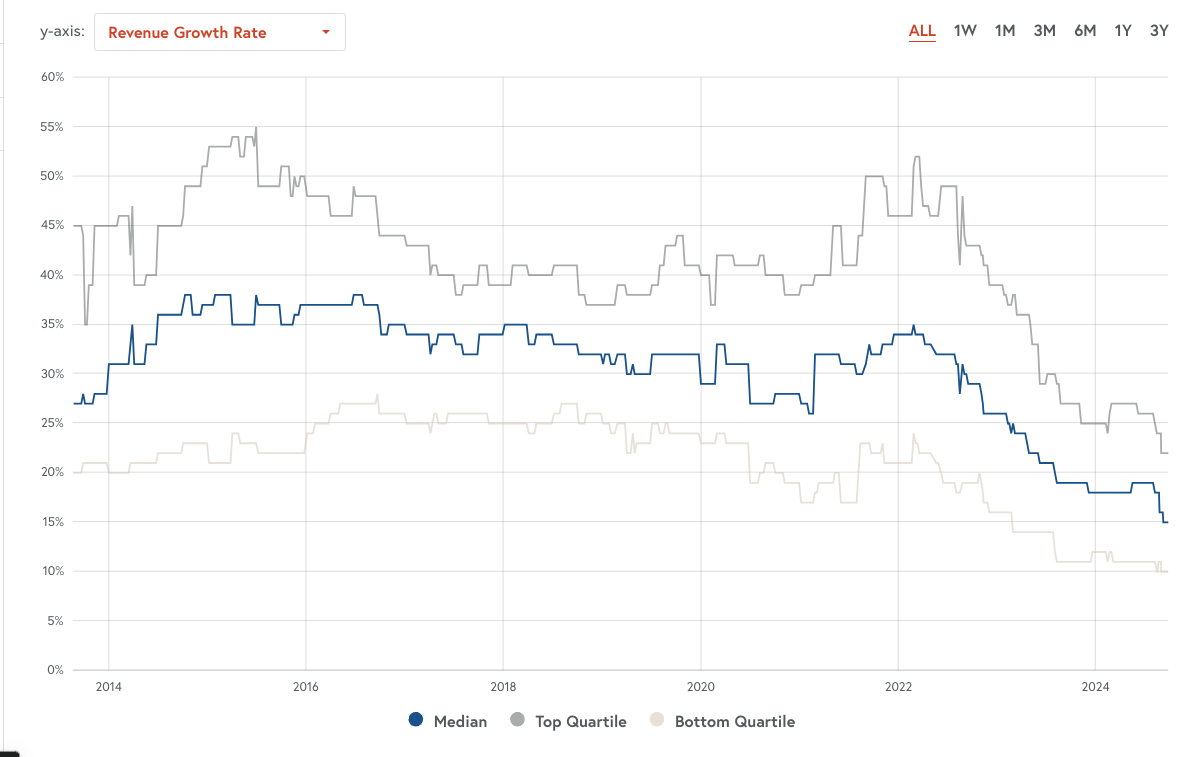

But growth deceleration at software companies is partially self-inflicted. Here’s a chart from Bessemer’s cloud index that shows how public cloud companies have seen their business shed points of growth since the onset of 2022:

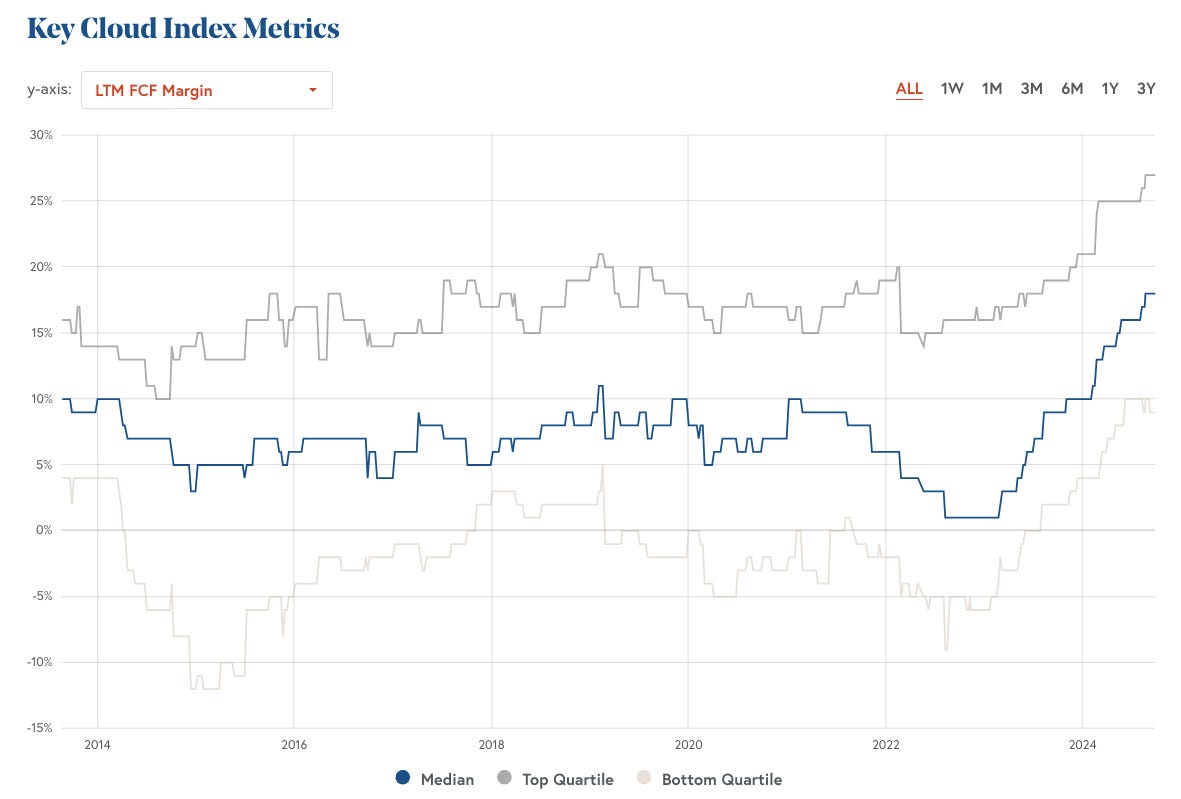

The companies in question traded growth for cash flow, as a separate Bessemer chart makes clear:

I am almost surprised that the advice given to startups after the bottom fell out of venture funding showed up so clearly amongst their public comps. Presuming that startups managed a similar trajectory to the above — which I am modestly confident in, given reports of cash-flow-breakeven, slow-growing unicorns that are stuck — we can say that upstart tech companies traded growth for lower cash burn so that they could stay alive.

Alive, and half-dead. Who wants to back a startup that is growing slowly at the cost of negative burn growth? Maybe some investors in early 2022, but I don’t think that venture investors today are so interested in buying into fixers uppers, when there are healthy, younger startups in the market looking for capital that don’t have a historical hangover on their cap tables to deal with.

The venture advice that startups burn less was not a mistake; at the time, capital was scarce and no company wants to run out of cash. But surviving is not the same thing as thriving, and VC backs the winners, not the mids. Perhaps that’s the way that we should consider zombie startups — not the undead per se, but simply mid micro-cap tech companies that are worth a 2-4x ARR to PE?