Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Feeling above the law … the United States … the solar races … being a miserable jackass … face computers … Broadcom, after earnings …

📉 Trending Down: The NYPD … the UK economy … Uber, Lyft market share in Waymo markets … spine … tech companies as cable companies … spine, redux …

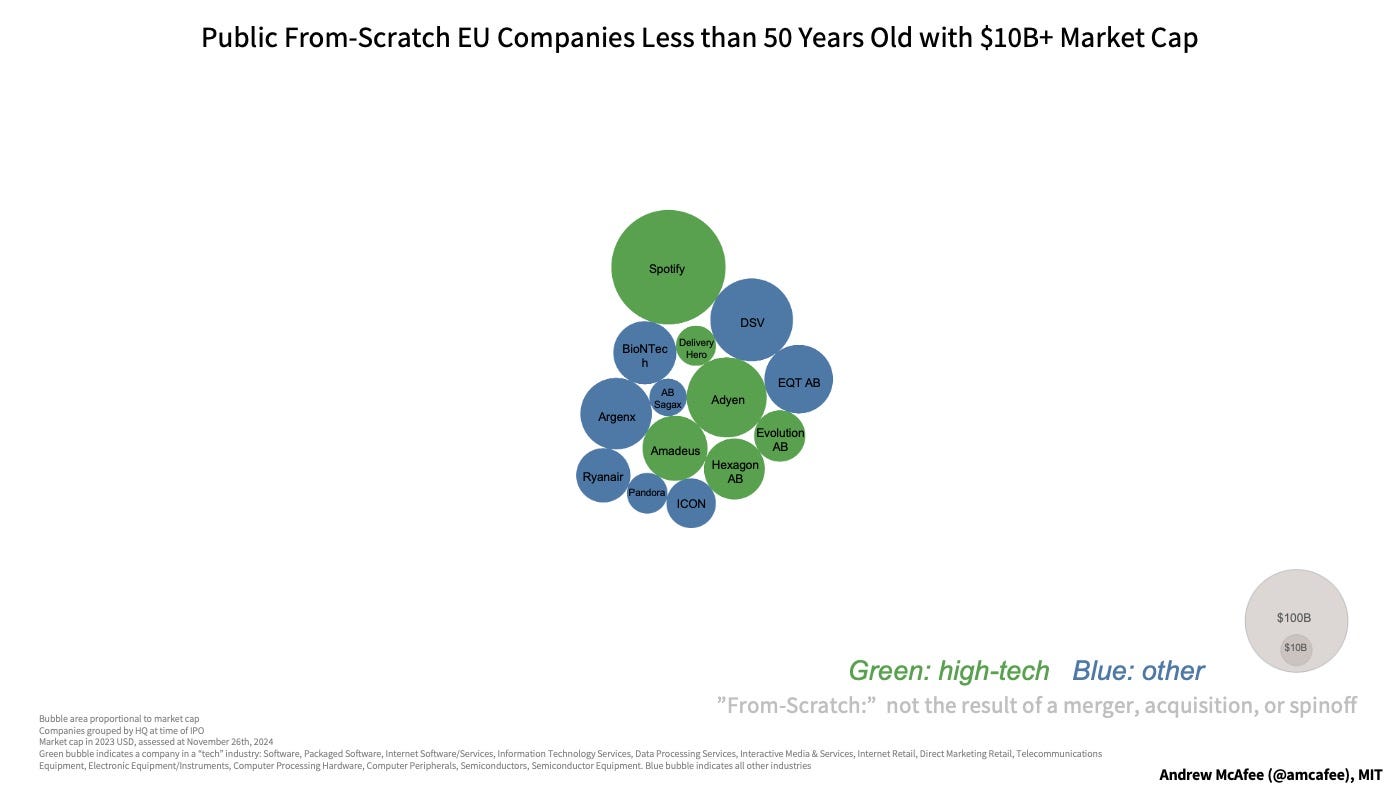

Remember the EU corporate market cap chart that kicked up a storm the other day? Here’s a zoomed-in version of the European side of the chart from the original author, Andrew McAfee:

Klarna is going to join the group when it lists if reporting on its expected target valuation bears out.

There are fourteen companies in the above plot. With Klarna, 15. I think a good goal for European founders is to try to race the number to 50 before the United States mints another trillion-dollar tech giant.

ServiceTitan soars

Shares of newly-public ServiceTitan shot higher yesterday, closing at $101.00 after listing at $71 per share, far above its initial and raised ranges. In terms of good IPO days, ServiceTitan had a corker.

There will be complaints about money left on the table. But as the trades-focused vertical software company raised much more than it appeared to anticipate while also stopping the timer on future dilution due to prior investment terms, how much do we really care?

Let’s look at the company’s multiples. CNBC calculates that ServiceTitan wrapped its first day as a public company worth $8.9 billion, a figure that Reuters reiterated. Against that figure, here’s what ServiceTitan told investors it pulled off in Q3: