Welcome to Cautious Optimism, a newsletter on tech, business, and power. Written just for you!

Today we’re looking at a slew of financial updates, then meditating briefly on Sam Altman’s latest post on superintelligence. To work!

📈 Trending Up: Tropical Cyclone Nine … protectionism … regional code storage … vertical AI? … HarmonyOS … Chinese stimulus … Drama in Wordpress-land …

📉 Trending Down: AI as paid add-on? … fintech bundling … huge early-stage rounds … closed social networks … China …

Scale quadruples, Smartsheet sells, Raspberry Pi rises

Data labeling giant Scale AI has seen its revenues “nearly” quadruple to “almost $400 million in the first half of the year,” The Information reports. Questions remain regarding Scale’s gross margins and revenue mix, but it’s impossible to deny that the unicorn is kicking ass.

And it’s looking somewhat inexpensive. Scale’s last round saw it raise $1 billion at a $12.8 billion pre-money valuation, or a $13.8 billion post-money price. With Scale on an ~$800 million run rate today, the company is trading at around 17.3x its current revenue pace. Mix in, say, 50% growth in the back half of 2024 and the company’s run rate multiple falls to 12.8x, give or take.

For a company growing as quickly as Scale is, that’s cheap. So, I presume that the company’s people-powered, AI-serving tools — reinforcement learning from human feedback, or RHLF, and human-in-the-loop data labeling — don’t have the sort of margins that SaaS concerns generally target.

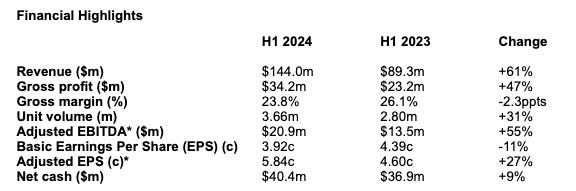

Raspberry Pi is also having a heck of a year. The company just dropped its H1 2024 results, including:

Apart from some gross margin degradation, that’s a pretty darn solid set of results. They beat expectations, too, underscoring that it is possible to take hardware companies public. That’s good news for Tiny!

And then there’s Smartsheet, which is going private. The transaction allows us to answer an interesting question:

How much software company does $8.4 billion buy you these days?

The answer is one heck of a lot. The deal, an all-cash transaction, is being executed at a premium of 41% “to the volume weighted average closing price” of Smartsheet over the last 90 days. Notably the premium offered all but evaporates compared to what Smartsheet was worth yesterday — shares of the software company are up 6% today, all that was left between its ambient market valuation and its proposed exit price at the time the deal was unleashed publicly.

Thankfully for you and I, Smartsheet dropped earnings earlier this month, giving us a very recent look at its financial performance. That means we can try to sort out of the PE giants circling the company are getting a deal or not.

Smartsheet is a software business with mostly recurring revenues, and a far-smaller services arm.

Here’s its quarterly results for both sources of top line, inclusive of growth rates as calculated by the company: