Tempus goes public as corporate leaders struggle with AI deployments

Welcome back to Cautious Optimism! It’s June 14th, 2024. Today we’re chatting IPOs, enterprise AI, why founders can raise this summer, and news from around the world! — Alex

Trending Up: Adobe’s stock … Musk’s compensation at Tesla, officially … LP interest in huge secondary-focused funds … AI detection startups … chances of a Newsmax IPO … here’s the deck … cheaper rockets … flooding … the costs of flooding … theocracy …

Trending Down: Windows Recall … crypto venture capital fund size … Oracle’s advertising dreams … Musk’s ability to stay out of court … German corporate solvency … water availability in China … Mexico … the United States … LP financial health …

Tempus AI Goes Public

Yesterday evening, Tempus AI priced its IPO at $37 per share, the top end of its proposed range. Renaissance Capital reports that its “fully diluted market” cap is more than $6 billion ahead of its first trade. Tempus raised a gross $411 million in the transaction.

Cautious Optimism: Tempus had a big AI story and a lot of sticky red ink. Is it a $6 billion valuation a win? As a fundraising event and a way to cash out its prior backers, yes. But according to Crunchbase data the company raised its $200 million Series G at an $8.1 billion post-money valuation back in 2020, and PitchBook writes that its worth stretched to just over $10 billion in 2022. That means that we’re witnessing the feared ‘down IPO.’

It’s not hard to argue that seeing a company leave about 40% of its prior worth on the floor is a loss. What I think matters more is that a company that “primarily derive[s]” its revenues from its non-AI work today (S-1 page 125) just landed a roughly 10x run rate multiple despite -44% net margins in its most recent quarter. Surely that’s good news for other private tech shops that want to list and can say “AI” out loud?

Doubly so when we consider the following:

Is AI whiffing in the enterprise?

The Register has a story out this week entitled “Payoff from AI projects is 'dismal', biz leaders complain.” The piece is based on a LucidWorks survey of “business leaders across North America, EMEA, and the APAC region who are actively pursuing generative AI initiatives,” which you can access here.

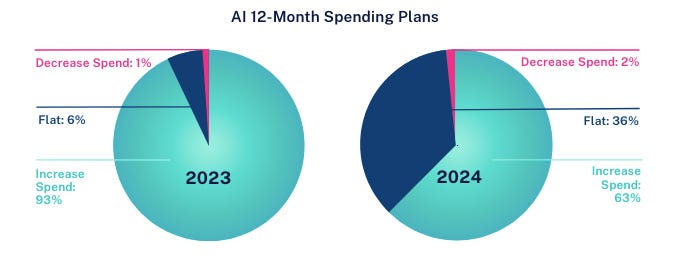

I have a slightly more positive take, having looked at the data. Despite the fact that “42% of companies have yet to see a significant benefit from their generative AI initiatives,” and “only 25% of planned generative AI investments have been fully implemented so far,” the LucidWorks dataset also finds that the money is set to continue flowing:

It’s not precisely bullish that the number of companies busy deploying AI that plan to boost spending this year went from nearly all to under two-thirds in a year. But with the share of companies looking to lower their spend stuck in the super-low single digits, one-third of respondents looking to hold investment steady and 63% still planning more investment, it’s hard to say that AI is hosed in the enterprise.

Despite the fact that lots of early genAI deployments are struggling:

My read? All companies want to do more with less, and are willing to keep spending on AI in hopes of unlocking savings. Put another way, companies are keeping their wallets open in case AI really can reduce their human capital costs.

That or they are just plain scared:

Organizations are experiencing a significant learning curve in launching initiatives and companies are twice as likely as they were last year to feel they are falling behind their peers. More than 85% of business leaders feel they’re behind or only on par with their competition.

Where is AI having an impact? According to its union, The New York Times is looking to slash its art team thanks to AI, news that comes after Klarna made similar noises.

And to close out, yes, you can raise this summer!

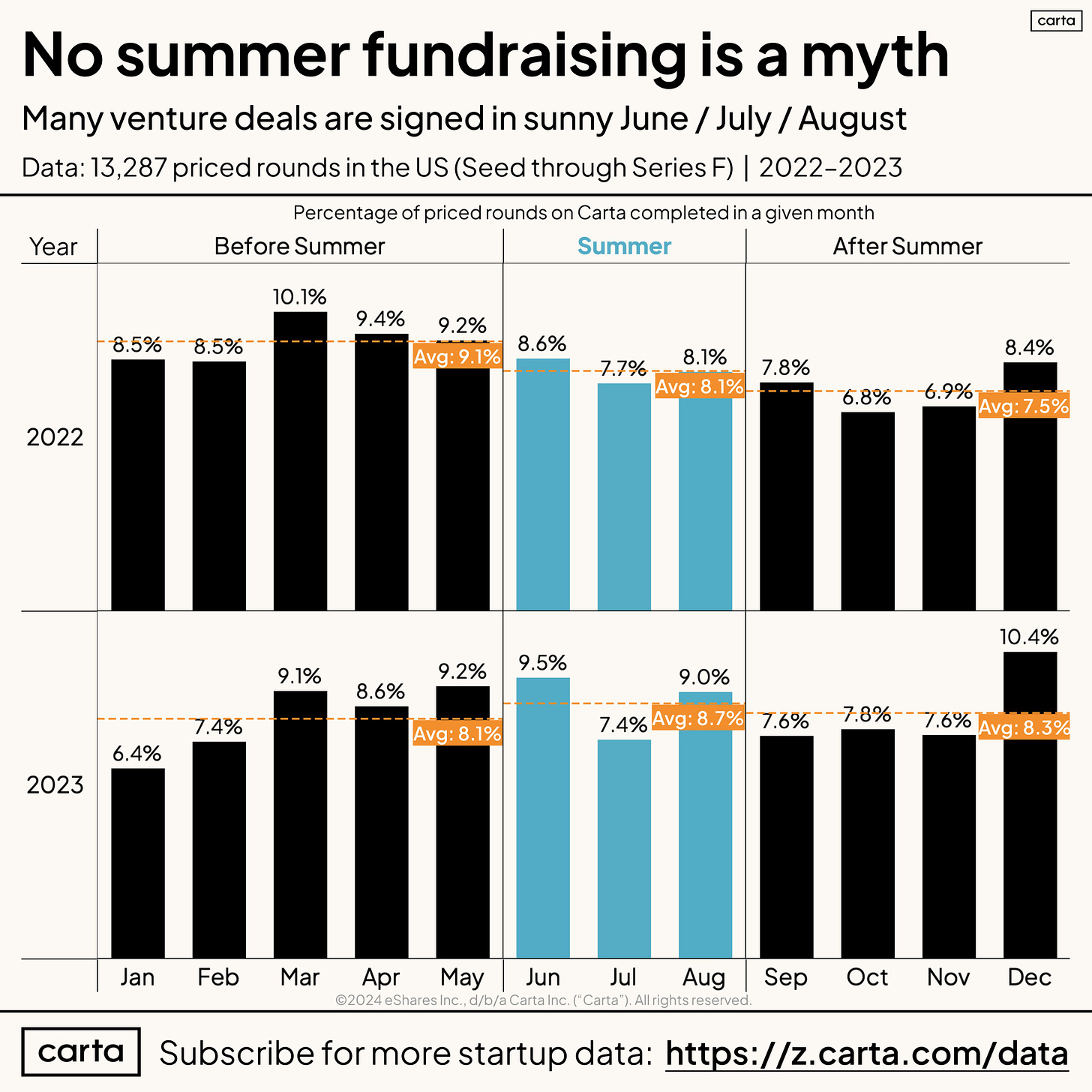

Startup founders looking to raise new funds do not need to wait until after the Summer season comes to a close. That’s the lesson from Carta’s Peter Walker, who tweeted the following set of charts:

2023 data indicate that it was better to raise in June last year than any month apart from December. And that two of the three Summer months were better than September through November. So much for conventional wisdom.

Speaking of which, Cautious Optimism will dig into the SaaS pricing model revolution tomorrow morning. So, make sure that you’re email is in the system so that I can send it to you: