Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Apple’s at-home hardware (BG) … ServiceNow, in the UK … S&P 500 all-time highs … Xiaohongshu (FT) … Indian IPOs … power availability in Florida …

📉 Trending Down: The Chinese real estate market … the WordPress ecosystem … retiring early in China … AI-based election meddling? …

Monday morning read: Data center tech is exploding but adoption won’t be easy for startups, by Rebecca Szkutak

📅 Economic Calendar: Chinese and South Korean, imports, exports on Monday … UK unemployment, German wholesale prices, French and Spanish inflation, Indian exports and imports on Tuesday … UK, Italian inflation, Japanese imports and exports Wednesday … EU inflation, U.S. jobless claims, retail sales, Japanese inflation … Chinese house prices, GDP, industrial production Thursday … U.K. retail sales, U.S. building permits Friday

💱 Earnings: Bank of America, Goldman Sachs, Citigroup, Ericsson, United Airlines Tuesday … ASML Wednesday … TSMC, Netflix, Morgan Stanley, Blackstone, Nokia, VinFast Auto, American Airlines Thursday … Procter & Gamble, AmEx, Ally Friday

Distribution Dire Straits

Over on TWiST, Jason and I are working on themes — the larger undercurrents that help explain what’s going on in venture-and-startup-land today. One of them is Distribution Dire Straits, or the multi-year crisis venture capitalists face regarding turning their investments into cash returns.

VCs, as you know, first count paper wins (TVPI), and, later, cash returns (DPI) when their bets become liquid via a sale, merger, or IPO. With venture fund timelines around a decade, lag can build up in the VC system. You can wind up with a huge amount of previously invested capital looking for exits during a time, for example, when exits are scarce.

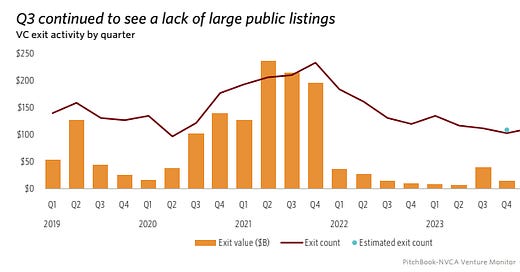

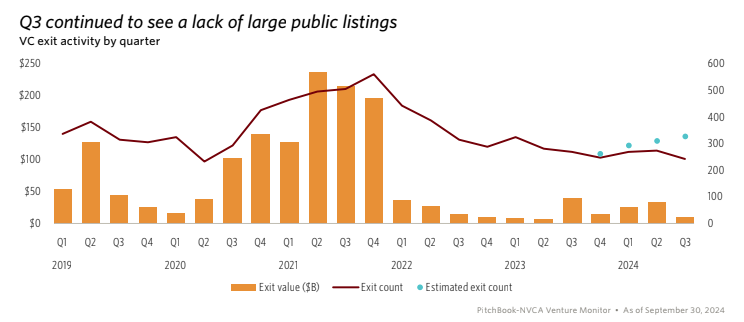

That’s where we’ve been for years now, after VCs raised and invested more capital than ever back in 2021. Here’s the current state of affairs, via the PitchBook-NVCA Q3 2024 US venture report:

Interestingly, 2024 should close with more total exit value from U.S. startups than we saw in 2023. A year-end result that roughly matches what we saw in 2022 is also not out of the question. But even with those gains, 2024 domestic venture-backed exit volume would add up to roughly 10% of the dollar volume seen in 2021.

Small gains or not, a 90% reduction in exit value is terminal for venture economics.

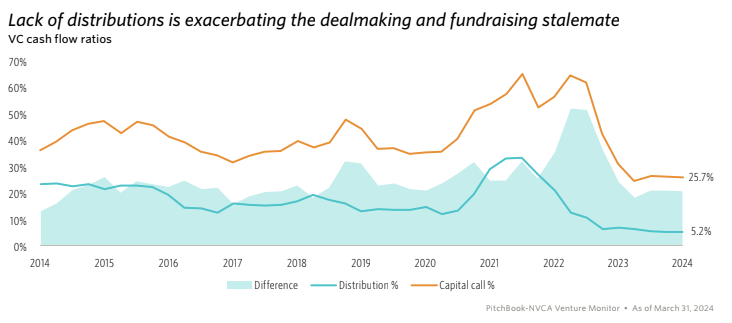

Another way to look at the situation, again via the fine folks over at the PitchBook-NVCA crew, is the gap between the amount of capital that VCs are calling versus returning. Observe how the gap between calls and returns has persisted, leading to a decline in capital calls as exits failed to manifest:

Put another way, the faster that VCs can recycle capital to backers, the faster they cut checks. And the slower exits occur, the less new capital that is invested.

If you wanted to argue that Lina Khan’s time atop the FTC has limited venture investment, here you go. I would add in, however, that the above charts do not explicitly detail the quality of prior investments; this is not all the FTC’s fault, in other words. While it would would be convenient to blame the post-2021 liquidity dearth on Khan’s shoulders, I doubt that she is even more than half to blame. (Chamath: “The companies suck.”)

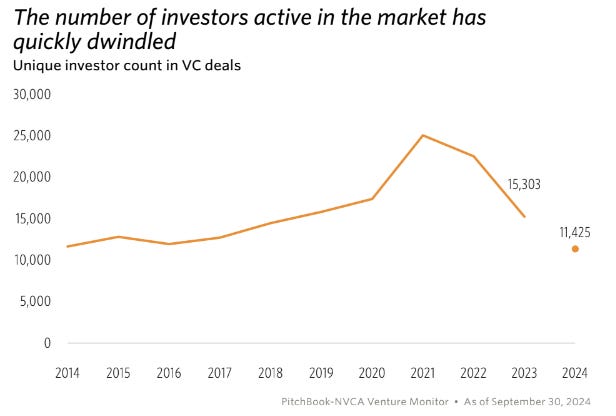

Moving along, the distribution dire straits theme doesn’t merely impact active venture investors. The resulting slower investment pace is decimating the number of active funds. One more chart from the report:

The chart peaked at 25,133 in 2021 before falling to 22,563 in 2022, according to the underlying spreadsheets that made the above graphic. The 2024 figure will rise as the year wraps, but I doubt that we’ll see an explosion in year-end dealmaking.

If you were curious, a decline from 25,133 active funds in the United States during 2021 and just 11,425 so far this year is a roughly 55% decline. That will moderate to perhaps less than 50%, but it’s still down by half.

A few IPOs would not go amiss today, would they?

Table Space could go public

Speaking of IPOs, over in India Table Space is prepping for an IPO, TechCrunch reports. The publication writes that the shared space renter “operates more than 60 centers across six urban Indian cities” and is worth about $550 million today.

Entrackr reports that the company’s revenue grew to Rs 678.5 crore ($80.7 million) in its fiscal 2023, up from Rs 344 crore in its fiscal 2022 ($40.9 million). And the company is very lightly profitable against those numbers, turning in about Rs 45 crore ($5.3 million) in profit for both its last fiscal years.

A huge company? No. A neat IPO, probably. If the United States is going to get its IPO cadence back, we’re going to need more Table Space-sized listing here at home. No more waiting for $1 billion in revenues, please.