The second era of fintech

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Datacenters in Mexico … Gamefile … climate change … China-India economic ties … going outside, thanks to apps … crypto consolidation … tariffs … NATO defense spending …

Vibe shifts: How quickly the market went from counting on several 2025 rate cuts to the chance that rates actually go up this year.

📉 Trending Down: Working at Meta … free speech … newspapers? … free enterprise …

Wow: China Weighs Sale of TikTok US to Musk as a Possible Option

Wow: EU reassesses tech probes into Apple, Google and Meta

Everything is coming up fintech?

Bloomberg reports that revenue growth at Plaid ticked back up >25% last year. That’s a return to form for the private fintech unicorn. Klarna is prepping for an IPO and is innovating on product and cost cutting. UK neobanks are healthy and growing. Runway put up big numbers last year. And I am once again seeing more rounds from fintech startups in Africa.

Seems that we are, in fact, entering into a more fecund fintech era. About time. Poor fintech went from hero to zero in what felt like record time. You can largely track why from the following chart:

The value of a dollar of fintech revenue, as measured by tracking the trailing price/sales ratio of Block and PayPal, fell dramatically from mid-2021 (peak ZIRP) through 2022 into the basement in 2023 and 2024. Where revenue multiples for certain leading fintech players have stayed.

You might feel that 2-3x trailing revenue for Block and PayPal is a bargain. I could also make that argument. But the market has valued them thus, and therefore put a lid on the value of fintech revenue for many fintech startups that might have wanted to exit.

It’s a hell of a lot easier to raise capital or list when you get $15 worth of equity value for every dollar of trailing revenue you have, than $2 or $3.

It’s bullish to see positive vibes from fintech startups. The market just needs a modest reflation of public-market revenue multiples, and I suspect we’d see a wave of fintech exits.

Chart of the Day

Via Boldstart’s Ed Sim:

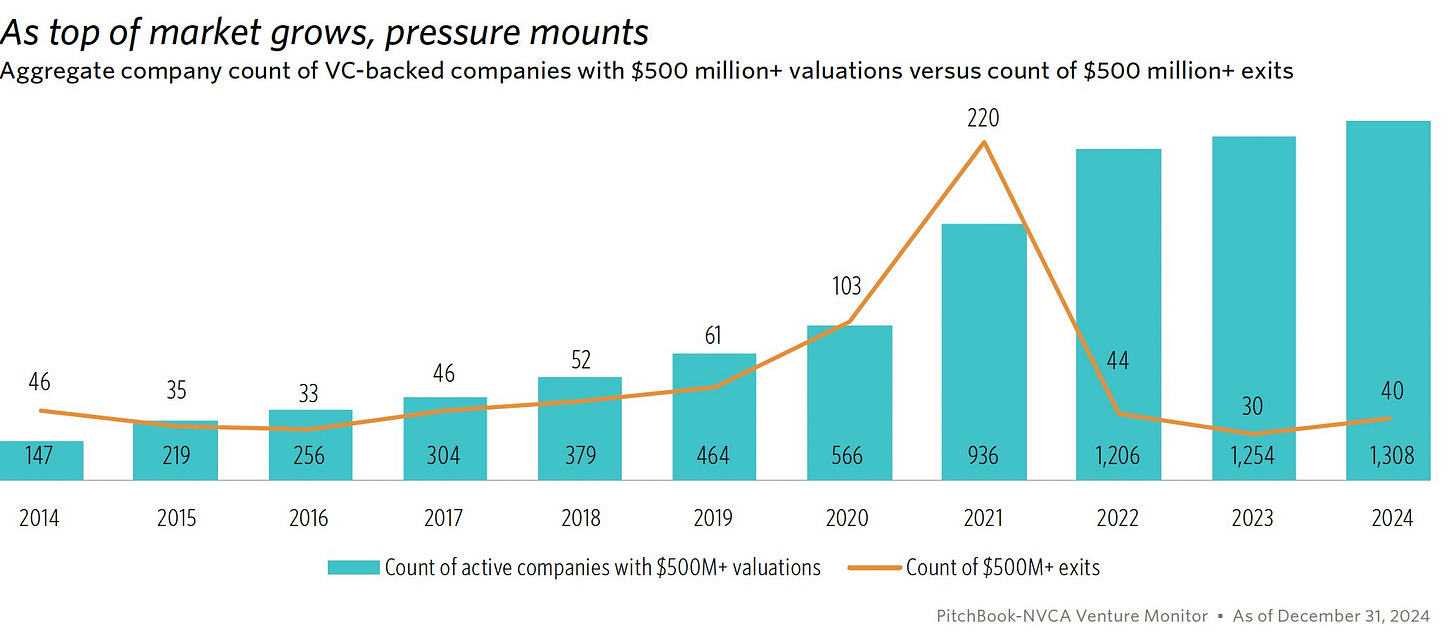

This is PitchBook/NVCA data showing how many startups in the market have a half-billion dollar valuation or greater. And how many similarly-sized exits there have been. As you can see, the two numbers moved in sync until 2022, when exits collapsed but the number of active half-unicorns in the market kept growing.

That tension is the liquidity crisis. That tension is the reason why tech folks hammered so hard on Lina Kahn. That tension is probably also why we’re seeing venture funds contract, partners leave, and the like. Solving the gap between dollars in and dollars out is the 2025 venture mandate.

From the interview circuit

I recently yammered with the CEOs of Profound (SEO for the AI search era) and Resistant.AI (fraud detection and AML AI). Those are here.

I also taped chats with the CEOs of Weaviate (vector databases) and Sila (improved battery tech) and have another on the books with a space startup that will come out along with the other two on Friday. (If schedules hold!).

The takeaway? AI search is already big enough to constitute a material challenger to link-based search, even if Google owns a big chunk of the new market. AI will help crack down on both document and transaction fraud, even as the same tools are making the bad guys more sophisticated. 2025 is going to bring some under-the-hood improvements to AI that will help it keep improving. And battery density improvements could quickly scale, opening new use-cases for battery-powered machines.

I love chatting with founders and getting hyped about how they are attacking pretty big challenges. And the interviews I’ve done this week were just what I needed to inject a huge dose of optimism into my veins. There’s so much cool stuff coming. I cannot wait.

Coming up:

A look into the Blaize SPAC deal

More on the UK’s AI push

An update on SaaS multiples