The Series A Crunch Is No Joke

Welcome back to Cautious Optimism! It’s June 20th, 2024. CO was off yesterday due to a childcare crisis. Days off will occur as infrequently as possible, but family first — always. Let’s talk about the Series A crunch and Chinese venture capital! — Alex

Trending Up: Our (safe, future) AI overlords … supercomputer buildout … geolocated datacenters … encryption … AI search … Chinese auto exports … the chance of war in the West Philippine Sea … corporate venture capital …

Trending Down: Trump’s social media company … cybersecurity … AI search … the Chinese real estate market … domestic economic balance …

Did you know? The cost of eating in the United States is far less than in other developed nations. (H/T economist Jeremy Horpedahl)

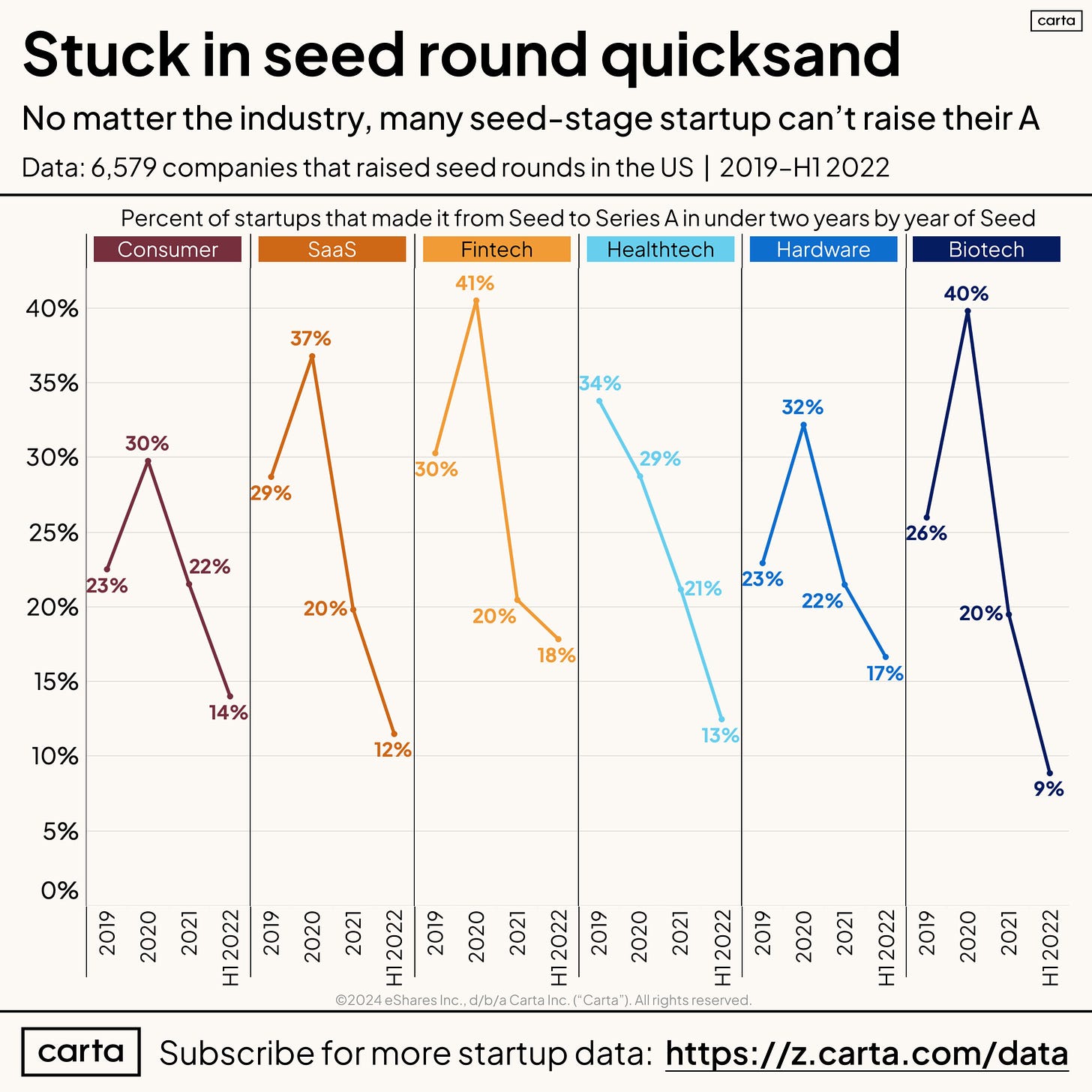

The Series A Crunch Is No Joke

A venture stage “crunch” occurs when startups at one level of financing and development struggle as a group to reach the next level of financing, and, therefore, development.

Historically, the most common crunch discussed occurs at the Series A level, when startups that have raised Seed capital have a bear of a time securing their first lettered round. Recall that Seed-stage startups tend to be very nascent, revenue modest, and sharply unprofitable. They also tend to have quick growth.

The old rule of thumb was that startups growing in the triple-digits (year-over-year percentage) with $1 million worth of annual recurring revenue (ARR) or more could raise a Series A. Those days are long gone.

The bar is going up partly due to it being possible to raise multiple Seed rounds — Jason and I talked about this here on TWiST — and partially due to changing economic conditions making venture investors more conservative than before.

Here’s investor and AMEX denizen Trace Cohen on his portfolio:

Responses to this tweet brought up a litany of questions. With just the above information, folks argued, you can’t really say the companies in question deserve a Series A. What sort of net dollar retention are they sporting? Their customer value compared to their cost to acquire those customers? Their burn rate? Their burn multiple?

Those questions are all valid and are worth considering in any venture market — heady, moderate, or parsimonious. But what’s worth remembering is those concerns go away during boom times. Venture investors are willing to buy into the bull case for startups. In today’s stingy revenue multiple climate, private-market investors are taking a lot more into account than just quick growth and trailing revenue scale.

The argument used to go like this (back in, say, 2021):

Here’s a software startup doing $5 million in ARR today, growing at 300%. That’s $15 million worth of ARR next year. It’s not hard to chart a path for this company to $100 million worth of revenue; therefore, it will go public; and we should buy as much of it today as we can to reap the max reward later.

Now the argument looks like this:

Here’s a software company doing $5 million in ARR today, growing at 300%. Software growth rates have slowed, and capital availability has lessened. Therefore, this company’s growth will rapidly cool. And as many public software companies are earning sub-5x ARR multiples, and IPOs are rarer than pigs in tuxedos, the eventual return here is far from guaranteed. Therefore, we will limit our investment choices to only a few companies and offer them less capital at higher prices.

We’re discussing venture vibes here, but we can move from emotions to data if you want. SaaStr investor Jason Lemkin once told me the venture capital market is just the NASDAQ on steroids. He meant the higher the public market values of tech companies go, the more return private-market investors think they can make. More NASDAQ equals more venture capital investment.

If you want to go one step further, given how poorly growth-oriented stocks perform during periods of more expensive capital, the venture capital market is just the inverse of prevailing interest rates. When they are low, venture is high, and when they are high, venture is low.

Regardless of how far back you want to trace the line, venture vibes for non-AI companies are in the toilet. Enter Peter Walker from Carta with the data:

The dataset here ends in H1 2022 because you can’t expect Seed-stage startups to instantly raise their A. So we have to go back a bit to see older cohorts and how they have matured—or not.