Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: No shit … trade wars … chip tracking … music revenues, barely … foreign policy idiocy … thermodynamic computing? … who wants this … innovation under restriction …

📉 Trending Down: BigTech acquisitions? … Ethereum revenue … Starlink rollout? … house prices in China … being smart … press freedom in Turkey … press freedom in Serbia …

The most important business news this morning is anti-news, reporting that something that was supposed to happen may, in fact, not happen. The WSJ and others reported that the upcoming April 2nd tariff broadside from the White House could be smaller than anticipated. Here’s the Journal:

The White House is narrowing its approach to tariffs set to take effect on April 2, likely omitting a set of industry-specific tariffs while applying reciprocal levies on a targeted set of nations that account for the bulk of foreign trade with the U.S.

That incoming tariffs won’t be quite as punitive as expected masquerades as good news is evidence of how far domestic trade policy has fallen. But don’t take the current state of affairs as gospel — we are one tweet from a Danish education sub-minister or Canadian traffic warden away from trade tensions ramping right back up.

And there is, as yet, no plan. The WSJ went on to report that precisely which tariffs will get announced on the second of April, and what the finally reported plan will be “remains fluid.” That’s a polite way of saying that at present, there is no plan.

Ergo why this is good news. No plan and a smaller potential target are better than no plan and a larger target, at least when it comes to unnecessary and corrosive trade barriers.

The second most important piece of business reporting to start our week comes from Bloomberg’s Katie Roof:

There have been 11 startup sales of more than $1 billion announced so far this year, cumulatively worth $54.5 billion — a total that easily surpasses previous records for comparable quarterly totals, according to data compiled by CB Insights. By contrast, in the first quarter of last year, there were only two startup acquisitions of more than $1 billion, which together brought in just $3.2 billion.

Quite a lot of that $54.5 billion total came from just two deals — Wiz to Google for $32 billion, and Ampere selling to SoftBank or $6.5 billion, but the fact that we saw 11 unicorn exits in Q1 is very good news. Mix in the potential for CoreWeave to price Thursday and list Friday as is currently expected, and we’re enjoying a return to form of sorts for startup liquidity.

Of course, investors who were not part of the mega-exits are more crumb-looking than crumb-enjoying, but defrosting frozen exit markets is welcome news for all. Period.

Other critical morning items:

23andMe is heading into Chapter 11, which is about as surprising as discovering that cave diving and aquaphobia don’t mix. The DNA testing company’s most recent earnings showed falling revenues and trimmed losses, but 23andMe’s cash balance compared to its cash burn made it plain that sans salvation, the company was heading for the rubbish heap. So much for a company previously worth billions. 23andMe warned in its most recent quarterly SEC filing that there was “substantial doubt about the Company’s ability to continue as a going concern.” Yep.

The possible reduction in tariff pain next month caused the stock market to jump this morning.

Browser Use, of the recent Y Combinator graduates that I have earmarked to add to the TWiST500 this week dropped news that it has raised $17 million in a Seed round. The funds came from, TechCrunch writes, “Felicis’ Astasia Myers with participation from Paul Graham, A Capital, and Nexus Venture Partners.” Recall that Manus, a successive Chinese AI hit after DeepSeek, used Browser Use’s technology to great effect. Browser Use caught my eye because it wants to turn websites into hooks for agentic AI by turning visual elements into material more machine readable.

Recall that while it’s generally accepted that humanoid robots will find their niche in the real world as human life is designed for human-like forms, there’s little reason for AI agents to need to interface with the human-designed web, or computing for that matter; expect to see all digital information surfaces that allow for agentic interaction to have two different coats of paint — one for us meatsacks, and one for our eventual AI overlords.

Thoughts on the TechCrunch sale

When in doubt, navel-gaze.

Last week Yahoo sold TechCrunch to Regent, an investment firm that owns a host of publications including Foundry (Macworld, PCWorld, etc), the Federal Times, and a series of outlets targeting the armed forces, among other assets. The selling price was not disclosed, and as the selling and buying parties are both private entities, details are scarce.

I admit plainly that TechCrunch is, and will always be, home. I have had the great fortune of working for TechCrunch twice. The first time, I quit because I thought I was some mix of burned out and over it. As it turned out, I was just a few quarters from going to rehab. Go figure.

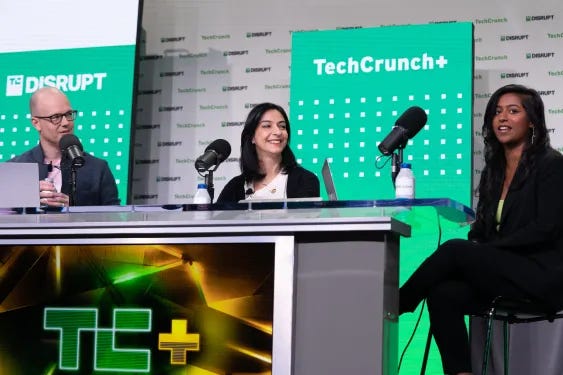

I got back to TechCrunch after spending a few years building Crunchbase News, thankful to squeeze myself into the only open seat at the time: reporting for the nascent TechCrunch+ subscription product.

There I stayed for nearly a half-decade, an interval that saw me eventually in charge that team. At this distance, I think it’s fine to say that we grew it to a seven-figure run rate that didn’t start with a one. But it didn’t get quite big enough or grow quickly enough to make it through an internal shakeup in early 2024. A bit adrift after TechCrunch+ was sunsetted internally, I said yes to Jason’s offer and wound up starting Cautious Optimism while joining the This Week in Startups team as a host and producer.

Why the boring rundown of my personal history when we’re discussing a news item that I was not party to? Because I think what partially held TechCrunch+ back from true success was its corporate parent, which makes the story useful by analogy. Again being politely vague to avoid ruffling feathers that aren’t my own, trying to build a new product inside a small piece of a far, far larger corporate behemoth is tough when internal rules prevent you from making reasonable choices. Nothing that happened was salacious. It was boring. We were forced to use Yahoo-owned tooling instead of payment technology that worked, to pick an example; we couldn’t pursue an even mildly aggressive geographical expansion strategy — that sort of thing.

I probably helped and hindered in equal measure. One of my personal failings is an inability to internally politic. Being prickly when you need help doesn’t.

TechCrunch+ might have worked out if it had had a less burdensome set of internal restrictions and more effective leadership from myself. It didn’t, TechCrunch wound up pivoting back to its roots as an advertising-and-events business, and now it’s been sold to a holding company that, I presume, wants to apply its own operating model to the publication. Here’s hoping that Connie and company get more freedom to maneuver than we might anticipate from such a sale. Or at least more than was afforded before.

The latest shuffling of TechCrunch kicked off a blizzard of complaint and commentary from former staffers. Others are making noise more privately, and we’ll respect their wish to not speak out loud. But the reason for the expressed pain is not simply angst at yet another sale of a venerable publication to private equity. Or at least not just that. No, TechCrunch was a special place for a long time. It was full of special people who worked incredibly hard and cared incredibly deeply about their work and subject. Many of those special people who work incredibly hard and care incredibly deeply are still there but are being reduced. I have yet to nail down the details, but it appears the full pre-sale staff won’t make it to the new owner. From a team already suffering from talent loss, even more names erased from the masthead is a shame.

Despite my yet-held belief that TechCrunch would have done well to sort out a recurring revenue product instead of leaning more heavily on more variable advertising revenues, there was a delight in the great green pages staying free. The Verge has a paywall now. The Information has built a fortress around its words. Try to read more than one Bloomberg story per year without getting shut out. The New York Times and the WSJ are more and more FT-like in their digital barriers. All while the set of reporting that is free gets smaller, and smaller. I wonder what TechCrunch’s new owner has in mind, frankly.

I almost wrote about TechCrunch’s latest adventure in corporate parentage over the weekend, but held back. I didn’t want to pop off. There are very good people there — including Connie whom I will always support — who are doing the hard work to try and keep the ship afloat even as the media waters get choppier and choppier.

Knowing TechCrunch, this is not its final chapter. I merely hope that it manages to retain swagger — panache? — even in the face of being sold, yet again, by one large pile of money to another.

In the meantime, I’ll be over here bleeding green.

Tomorrow: Notes on the StubHub filing, and the latest on CoreWeave’s upcoming IPO. And the impact of DeepSeek in resurrecting China’s venture capital pulse.

i thought this was a good discussion of the 'phase before this phase' of TC

https://www.theverge.com/23880330/matthew-panzarino-techcrunch-eic-digital-media-ai-google-disrupt-decoder

Good thoughts on TechCrunch, which was well-connected to the startup industry. Your thoughts on a recurring subscription product make great sense, given that The Information (ex-TC Natasha, etc.) has a very good product and seems to be heir-apparent to the Silicon Valley/Big Tech scene....