Venture investment cools in Q3, AI shines, exits disappoint (again)

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Amniotic cooling for data centers … WordPress drama … SEC enforcement? … TechCrunch, which got its redesign done … AI in India … the Anthropic-OpenAI rivalry …

📉 Trending Down: Amazon Prime’s usability … the US labor market … adults in the digital era …

The state of venture capital

PitchBook and Crunchbase dropped competing datasets this morning, showcasing their respective Q3 2024 venture capital data. You can read the full PitchBook notes here, and Crunchbase’s here.

This morning, we’re pulling out the most critical data points instead of trying to cover the entire set of information holistically. To work:

How much venture capital was invested in Q3 2024?

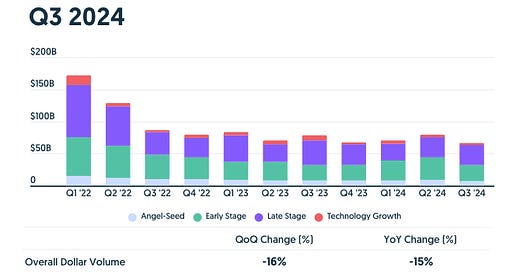

PitchBook reports $37.9 billion invested into startups based in the United States in the the third quarter. Crunchbase reports that the global figure was $66.5 billion in Q3 2024.

Disclosure: I worked for Crunchbase News back in the day, and I own shares in its parent company from my time working at the company.

The US figure was the first quarter-on-quarter decline in venture capital investment in “a year,” PitchBook analysts Kyle Stanford and Nalin Patel write. Driving the dip in total deal value? A smaller number of “outsized rounds,” the pair said.

The global figure was also not terribly exciting, with Crunchbase’s Gené Teare reporting that the number was down 16% compared to Q2 2024, and 15% from the $78 billion that the company tallied for Q3 2023 global venture capital dealmaking.

Which startups raised the most?

AI startups, shockingly. Globally, Crunchbase writes that AI startups raised $19 billion, which works out to just over a quarter of all venture capital investment in the third quarter (28%).

Separately, PitchBook told Bloomberg that the concentration in the United States was even steeper, with AI startups raising 27% of total US venture deal count in the first three quarters of 2024, and 36% of the total dollars.

That’s a lot less than half, but you do have to feel for founders who are not building AI-focused upstart tech companies. Being out of favor is never fun.

Briefly, what can we learn about Europe, Asia and Latin America?

Europe: Pitchbook reports that deal count and deal value were down a little, with “encouraging signsheading into the end of 2024, with monetary policy loosening and inflation rates normalising.”

Asia: We’ve written extensively about the decline of Chinese venture capital, so it’s not a huge shock that startups in Asia raised just $17.9 billion in Q3 2024 per PitchBook, the “lowest figure since Q1 2017.”

Latin America: What is $1 billion worth in venture investment for a region that has roughly twice the population of the United States? Not much. It seems that after a pretty big run in 2021, Latin America is once again all but a forgotten area for venture dealmaking.

How bad were exits in Q3 2024?

Terrible. Crunchbase reports that, globally, “early-stage funding is trending up by around 10%, and late-stage funding is down around 20%” so far this year. That’s good news for early-stage founders, sure, but doesn’t indicate that the late-stage venture market is doing well.

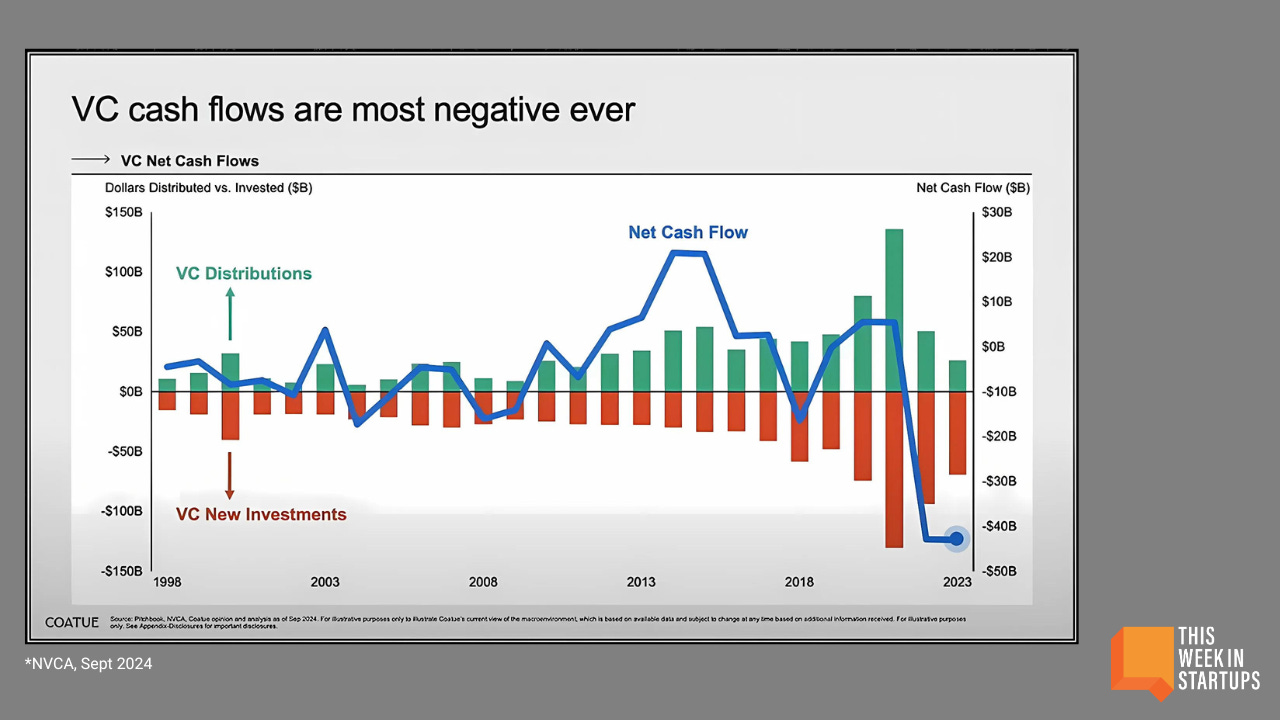

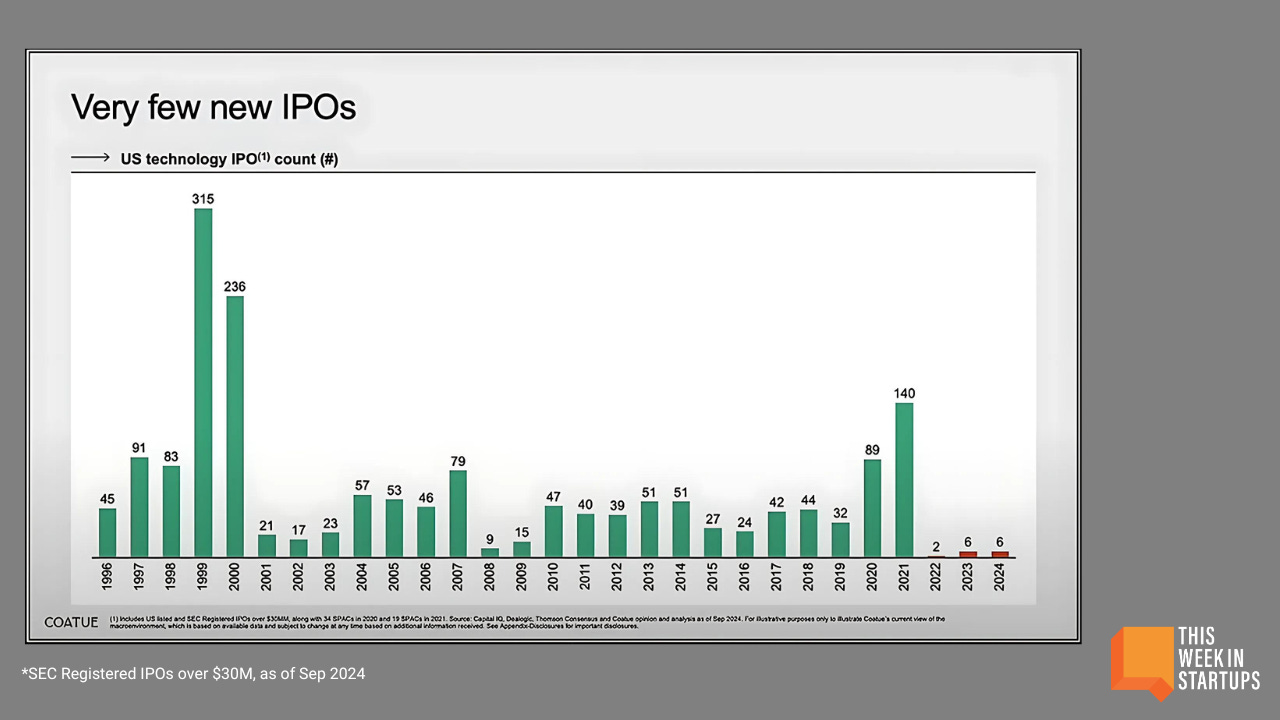

And the why there is a terrible exit environment. Exits in the United State are slow — IPOs are picking up, but remain muted, and M&A is restricted by fear of government intervention. But there is a little good news. PitchBook reports that European exit value is up in the first nine months of 2024 compared to all of 2023. Growth! In this economy!

And with rates coming down around the world, there’s reason to believe that we could be on the cusp of a modest rebound in exit intensity. That would de-sweat a huge number of venture brows, I reckon.

In Asia, the Ola Electric IPO provided a huge boost to exit numbers. Amazing how a big IPO can make everything seem better?

That doesn’t sound so bad, why are people so worried about exits?

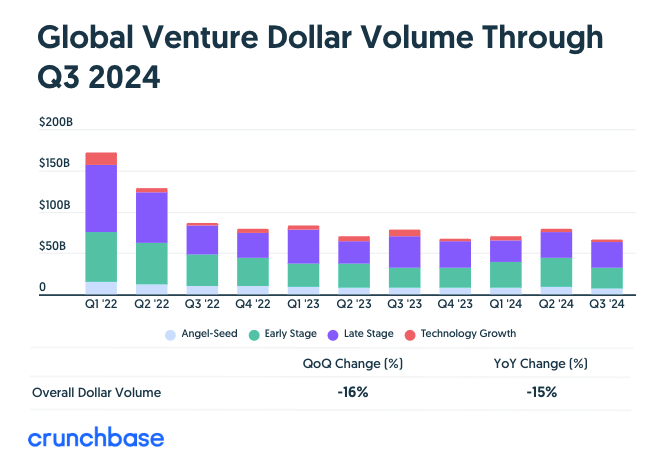

Because venture capitalist have raised so, so much more money than they have returned to their own backers.

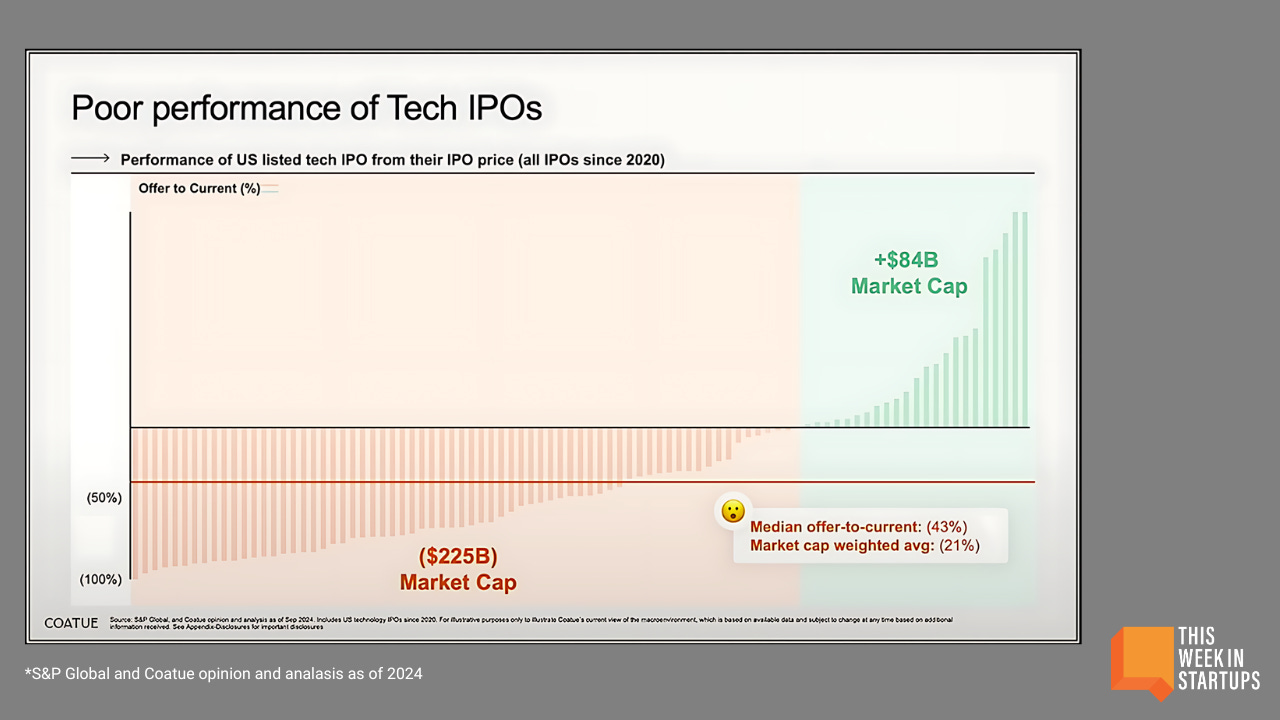

Here’s a chart that we pulled from the All-In Summit yesterday on This Week in Startups. Coatue’s Thomas Laffont presentation had some bangers:

That’s really bad, and is largely due to the following collapse:

Why are U.S.-listed technology IPOs now at their slowest pace ever, including the dot-com crash and the global financial crisis? Maybe because, as Laffont pointed out, the companies that did go public did not perform well:

So much for the ‘leaving money on the table’ argument. Most tech IPOs in the United States were actually priced at a fat premium to their longer-term value. That’s a win for founders, not a loss.

Still, if you were a public-market investor, and had seen most recent tech IPOs suck air, would you be hungry for more?

Closing today, StandardAero just raised a bunch of money in an IPO. As it turns out, the company is working with Boom, the startup building supersonic passenger jets. We’ll take a quick look at it tomorrow. And I have an interview with Crunchbase’s Chief Product Officer in the can that we need to chat about. Talk tomorrow! — Alex