Webtoon goes public, and the IPO scale question

Welcome back to Cautious Optimism! It’s Thursday, June 27th, 2024. Today we’re looking at a recent IPO, riffing on some new startup growth data, and chatting through market-clearing exit heft. Tomorrow I’m planning a look at Scale AI’s latest revenue numbers. Let’s have some fun! — Alex

Webtoon lists

Last night, Webtoon priced its IPO at $21 per share, the top end of its $18 to $21 per share price range. With 15 million shares sold, the company raised $315 million in gross proceeds, not counting underwriting expenses and a 2.25 million greenshoe option.

Need a refresher on Webtoon? CO has you covered.

Blackrock indicated it wanted $50 million of the company at its IPO price, while majority owner Naver has a concurrent private placement worth $50 million. Webtoon is worth just under $2.7 billion at $21 per share. The company will begin trading later today.

The question we need to answer is whether or not that price is cheap, middling, or expensive. The more pricey the Webtoon IPO seems at its final listing price, the better the vibes are for tech debuts. Here’s the math:

With $326.8 million in Q1 2024 revenue, the company is valued at just over 2x its current run rate. That’s low.

With $1.28 billion in 2023 revenue, the company is valued today at just 2.1x its last-year’s revenue. That’s not much better.

Webtoon’s IPO price, while at the top of its range, does not afford it an attractive revenue multiple.

Why? After all, Webtoon flipped from net losses in Q1 2023 to a small Q1 2024 net profit. Even more, Webtoon was in the black on an adjusted EBITDA basis last year, indicating that its profitability ramp has been long underway. (The company’s operations were also cash-flow positive last year and in the first quarter of 2024.)

The answer is that Webtoon grew by just 5% in the first quarter compared to the year-ago period, and as we discussed when digging into its numbers, the company’s user base appears to be struggling to expand further.

As a growth company, Webtoon is a non-starter. As a profit machine, it’s nascent. That means it sits between the two possible public-market valuation peaks (growth on one side, profitability on the other, and the trough of blah in the middle). As such, it did not garner an IPO price tag worth writing home about in revenue multiple terms. The company’s IPO was successful, however, seeing Webtoon raise a pile of capital and flip from private-market status to public-company standing.

After short hits, what the Webtoon IPO can tell us about the IPO size debate.

Short Hits

Trending Up: EU datacenters in space … French startups … AI translations … Sheets speed … building atop Salesforce … SpaceX, thanks to a new contract to crash the ISS …

Trending Down: Shein, Temu in the United States … AI adoption in old-school industries … flow of Chinese talent to India (FT) … flow of tourists between India, China … Blue Origin

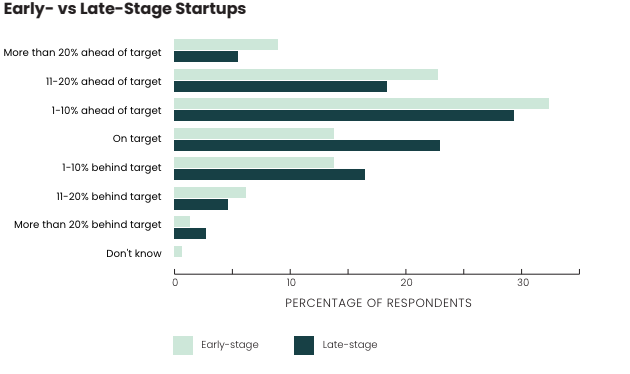

Good news? CO reader Chris Ulbrich sent in a survey of 254s startup execs with “responsibility for their company’s marketing.” The good news is that 59% percent of those surveyed said that their companies are ahead of their revenue targets for this year. Here’s the data breakdown:

Watch this space: OpenAI’s move to close API access to Chinese users of its genAI technology is providing a boon to China-based companies that sell competing products. Bloomberg reports that Chinese AI companies are offering discounts and helping customers move from OpenAI to domestic tech. Which AI market would you bet on? The world’s, or China’s?

How big do you have to be?

Back in the days of yore, a company going public needed to have $100 million in trailing revenues and several quarters of accelerating profitability. Those norms changed, in part thanks to the SaaS model, with many tech companies going public without the profit component. Public market investors were content to float unprofitable software concerns thanks to their built-in revenue growth (net revenue retention) and high gross margins. They seemed like sure bets.

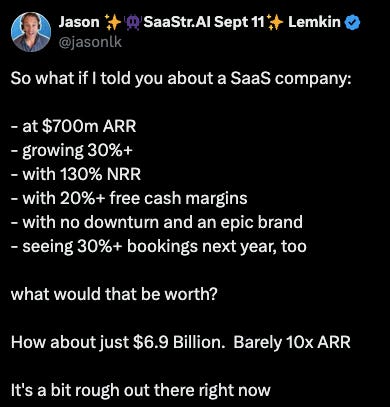

Today, the market for software companies has lost some of its prior steam. Thanks to slowing net retention and SaaS growth, many software companies are trading for very low revenue multiples compared to recent norms. Case in point, SaaS-guru Jason Lemkin discussing GitLab earlier this week:

YCharts pegs GitLab’s current price/sales multiple at 12.17x today, thanks partly to the company’s share price rising since Lemkin tweeted his math. That’s better than 10x, but it is a mere shadow of the more than 80x price/sales multiple that GitLab had back when it became a publicly public company in late 2021.

I bring up the GitLab numbers in light of the Webtoon IPO because both companies are pretty big. Webtoon is larger in revenue terms and growing more slowly, but thanks to a recent debate amongst startup and venture players discussing when a company can and should go public, size itself is back in the debate.

The old $100 million figure is passé, and tech companies are frequently not listing until they are far larger. Brad Gerstner of Altimeter made the point recently that Salesforce went public at a valuation of $850 million. It’s done well. Here’s Gerstner on a possible, hoped-for return of smaller IPOs:

I hope one of the things that we bring back to the IPO market is that companies don’t feel like they have to wait until they get to $100 million or $200 million or $500 million of revenue in order to go public.”

Why do tech companies feel like they need so much money to list? Atreides Management CIO Gavin Baker explains that this is the common wisdom amongst some venture capitalists: