Welcome to the stablecoin boom

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: GOP support for more H-1B visas? … climate risks (FT) … signs of life in Japanese industrial production? … Go Army, beat Navy … tensions in the West Philippine Sea … high-skill chip immigration … Musk-AfD …

Chart of the day: Data center power demand in Atlanta (WSJ)

On one hand, using so much land and power and water when Atlanta needs more housing is a near-term crunch. On the other, housing a fleet of digital super-brains near your city is a good way to stay involved to the next era of technology. Atlanta is already at the center of payment processing, and features the world’s busiest airport

Apollo reckons that we’ll need “to add the equivalent of three NYCs to the power grid by 2030” to meet data center power demand.

📉 Trending Down: South Korean industrial production … Boeing’s stock after a 737 crash in South Korea … the population of Vietnam … European economic growth, sadly …

Speaking of datacenters

Who is making bank of the AI boom? It’s not just Nvidia. Certain companies that provide gear to datacenters are also having the time of their lives.

No company better embodies the trend than Astera Labs, a smaller IPO I covered for TechCrunch earlier this year. After listing at $36 per share in March, Astera is now worth around $140 per share. It’s not hard to see why: The company’s revenue grew 47% in the third quarter compared to the second, expanding over 200% compared to the year-ago period.

And during the company’s earnings call, its CEO struck a very bullish tone:

Looking into Q4, we expect our revenue momentum to continue, largely driven by the Aries PCIe and Taurus Ethernet product lines. The Scorpio Fabric Switches is continuing to ship in preproduction volumes. The criticality of connectivity in modern AI clusters continues to grow with trillion parameter model sizes, multistep reasoning models and faster, more complex AI accelerators. These developments present a tremendous opportunity for Astera Labs' intelligent connectivity platform to enhance AI server performance and productivity with our differentiated hardware and software solutions.

But Astera is not the only company enjoying data center (AI, really) tailwinds. Bloomberg reports that Japanese tech company Ibiden is racing to expand its capacity. Calling Ibiden “the dominant supplier of chip package substrates used in [Nvidia’s] cutting-edge semiconductors,” the company’s stock has appreciated in recent trading sessions.

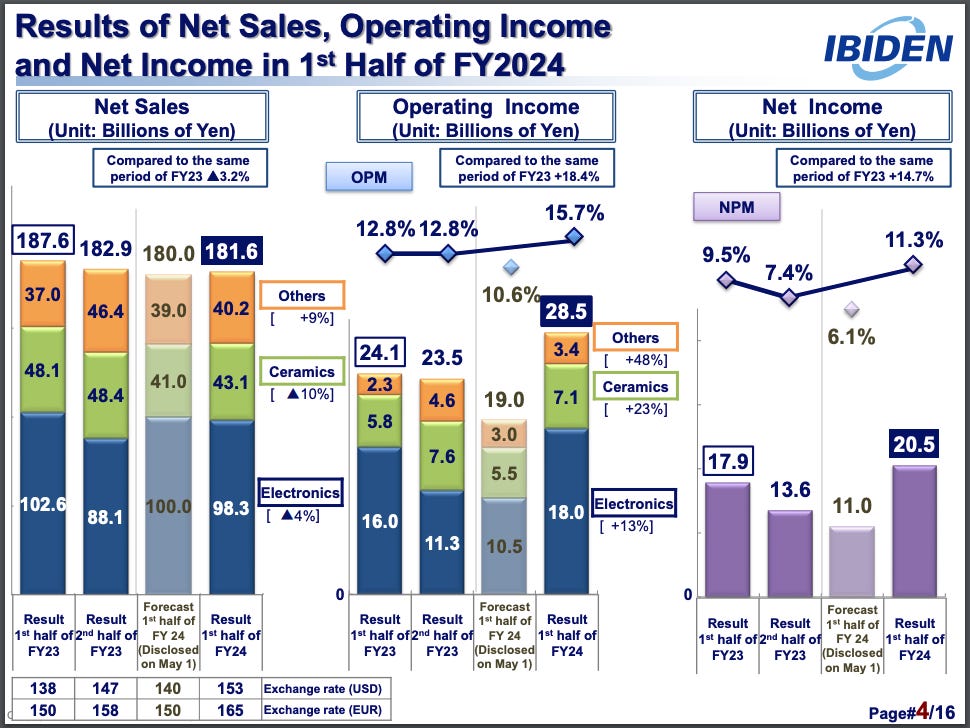

But a quick look at Ibiden’s financial results from the preceding quarter are less than impressive:

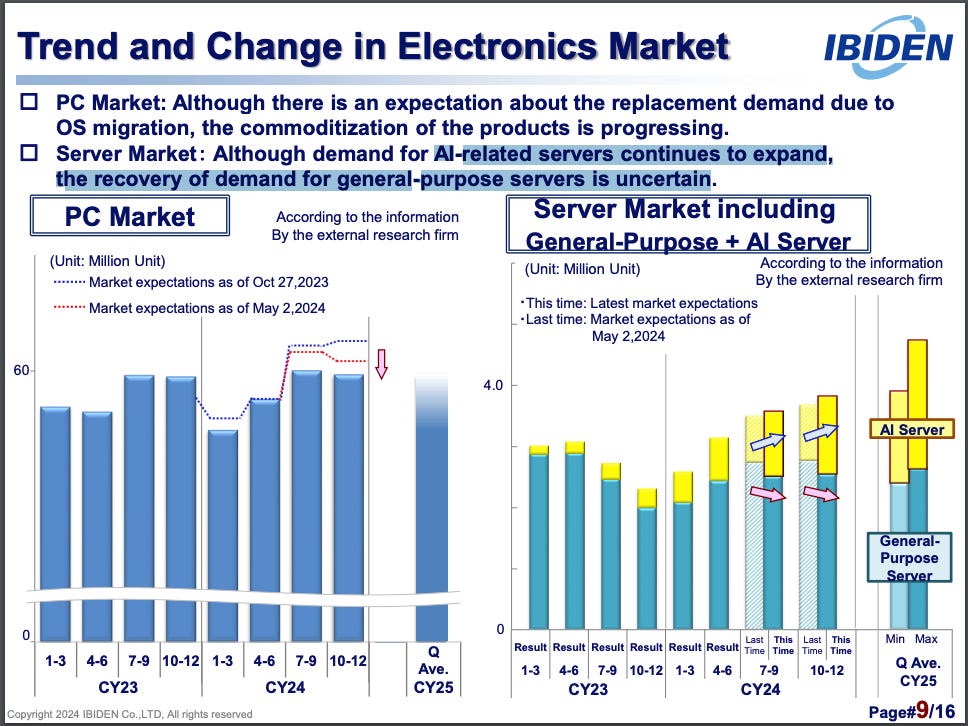

So, what’s going on? A revenue mix-shift. Ibiden reports later in the same deck that demand for “AI-related servers continues to expand, the recovery of demand for general-purpose servers is uncertain.” Observe the chart on the right:

That’s a rapid, sharp shift.

I am actively looking into the startups that are best-positioned to win a chunk of present and future data center spend apart from GPUs and similar. Hit reply if you know one.

Welcome to the stablecoin boom

Tether is in trouble in Europe due to the Markets in Crypto-Assets Regulation, which took effect today. Markets are still sorting out what Tether’s failure to meet standards and its delisting from European exchanges means, but at a minimum it opens the door to other, more regulation-friendly stablecoins to snag market share.

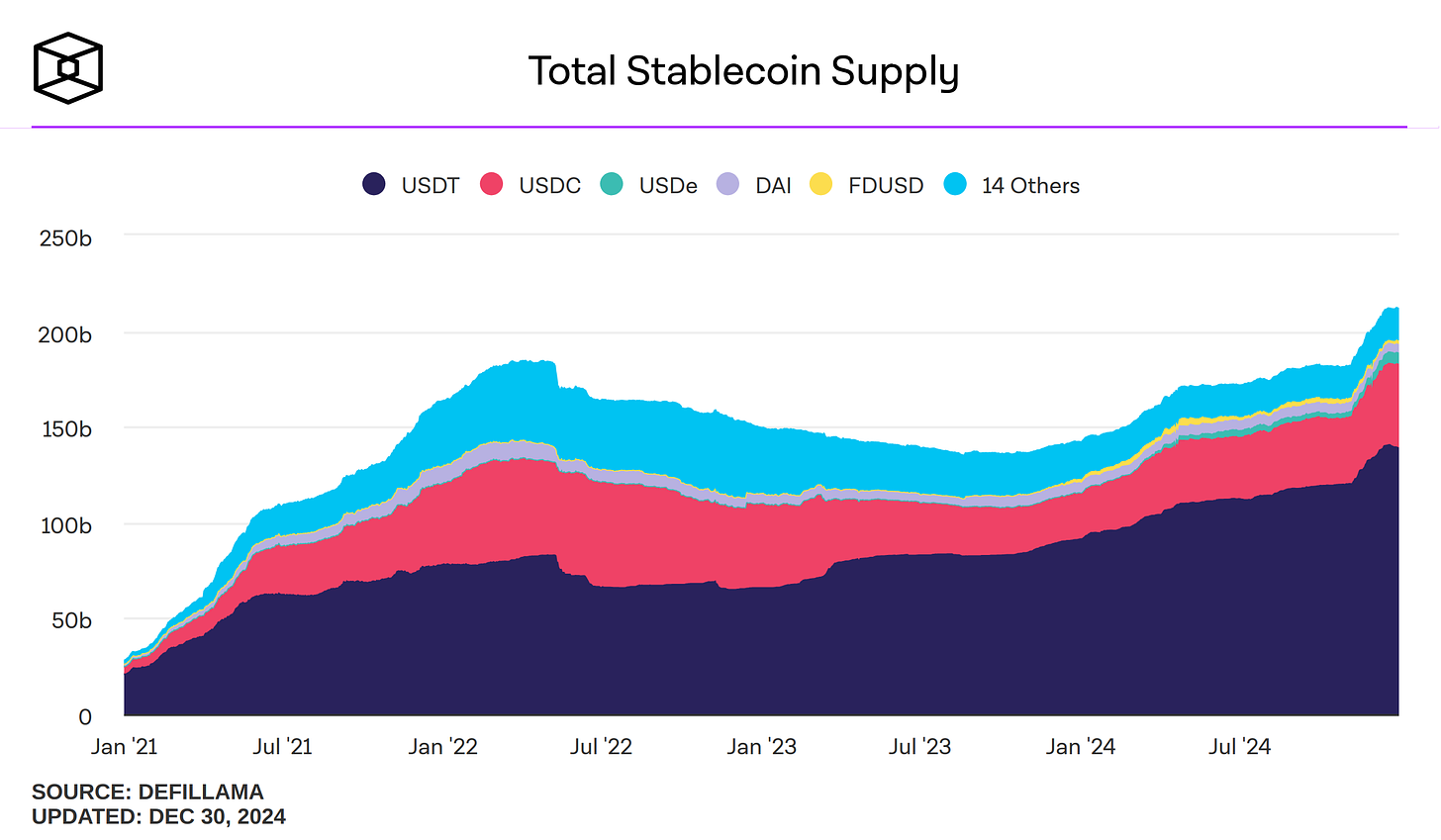

And there are a lot of takers. Here in the United States we’re familiar with Tether, a USD-pegged stablecoin with a controversial history, aversion to market-normal transparency, and huge market share. And we know Circle, the company behind USDC, which has tens of billions of dollars worth of circulating supply of its rival USD-pegged stable.

Recall that stablecoins are digital tokens designed to trade at price-parity to a particular fiat currency; if you own a USD or EUR-pegged stablecoin worth one unit of that currency, you can spend it online as if it was the currency in question.

Circle and Tether are cleaning up. Circle is expected to go public next year, while Tether reported net profits of more than $5 billion in the first half of 2024.

How do stablecoin companies make money? Simple. If you want to buy, say, Alex’s Excellent USD-Pegged Stablecoin, you give me a dollar and I give you a token. I then take that dollar and invest in low-risk bonds and other financial instruments that feature coupon rates and maturity dates, and collect a nice, fat stream of investment income while you get a digital dollar.

Sitting on mountains of cash was not very lucrative during ZIRP. It’s far more lucrative today, and the outlook is even better today than it was a few months back, when more rate cuts were expected in 2025.

The potential profitability of the stablecoin business crossed with all-time high demand means that there’s a lot of money to be made:

And companies including banks are racing to take part. Bloomberg reports:

Banks in the US are expected to join in on the rush once legislation that could pave the way for them to issue stablecoins is enacted. In Europe, with the recent clarity brought on by the Markets in Crypto-Assets Regulation (MICA), and the decision by Tether to discontinue its EURt stablecoin, that has presented an opening for competitors wishing to enable customers to make payments or hold fiat-like alternatives.

There are a few startups in the mix, too. Stably offers Stablecoin-as-a-Service or SCaaS as it puts it. And there are smaller stablecoin providers like JPYC (Yen stables) and Paxos, which has its own stablecoins and helps powers PayPal’s own.

The Information reports that stablecoin startups are hoovering up fresh capital.

PayPal’s stablecoin’s growth — or lack thereof — may indicate that earning market share in the industry won’t be easy. Its stablecoin (PYUSD) has attracted just $539.39 million worth of circulating tokens, though the figure did peak sharply in August and September to more than $1 billion for a moment.

Tether and USDC are not going to be easy to disrupt from a consumer perspective. But if banks wanted to build, what shall we call it, a private stablecoin network to allow for quick international payment settlement? I doubt that any of the more consumer-facing products in the market today could challenge it.

No matter who winds up “winning” — existing tech companies in the space, upstart tech companies looking for early market share, or incumbents building bespoke technology for their own operations — 2025 is going to be the year we see the first stablecoin IPO, and probably a number of eight and nine-figure rounds invested in the space.

Buckle up, crypto has a use case.