Why Applovin is the best-performing tech stock of the year

Amazon chips, Toast, Airbnb, Pinterest earnings

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Small-ball startup M&A … Flipboard (?) … stimulus in China … tariffs, prices … bitcoin ETFs … tensions in the South China Sea … lower interest rates …

Amazon-Anthropic: Amazon might be good for another few billion dollars, but if AI model giant Anthropic wants the cash, it may need to use the ecommerce giant’s Trainium chips on AWS. For an Nvidia shop, that’s a tough pill to swallow.

Amazon really wants other companies to use its chips. The company crowed in its last earnings report that that it kicked off a “strategic collaboration with Databricks [to] leverage AWS Trainium chips as the preferred AI chip to help customers improve price-performance” when building genAI apps. Expect more o this.

📉 Trending Down: Parenting … growth at Rivian … housing affordability … growth at Ola Electric …

Why Applovin is the best-performing tech stock of the year

While we noted Adyen earnings and a few other companies yesterday, it’s worth pausing and taking a look at Applovin today after the company soared from ~$169 per share earlier this week to $249 per share this morning. It saw a gain of more than 40% yesterday.

Why? Here are the numbers:

The 2021-era IPO reported Q3 revenue growth of 39%.

Even better, the company’s $1.20 billion worth of revenue led to net income of $434 million—a figure that was up 300% compared to the year-ago period.

Applovin also turned in a 60% adjusted EBITDA margin

It also boosted operating cash flow by 177% on a year-over-year basis in the third quarter.

But it gets even better. CNBC wrote (while this publication was parsing Trumponomics, alas):

For the fourth quarter, AppLovin sees revenue of $1.24 billion to $1.26 billion, representing growth of about 31% at the middle of the range. Analysts were expecting about $1.18 billion.

So what’s going on at Applovin that has seen its shares rise by just under 519% this year? Advertising.

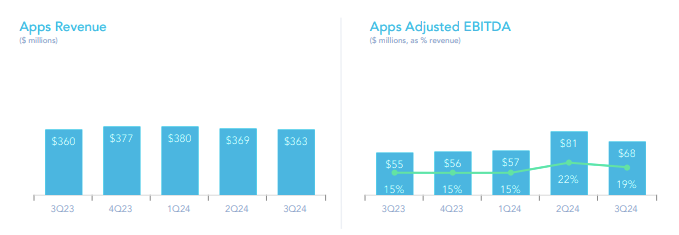

Applovin was best known as a company that helped apps monetize. However, that business is flat-to-middling:

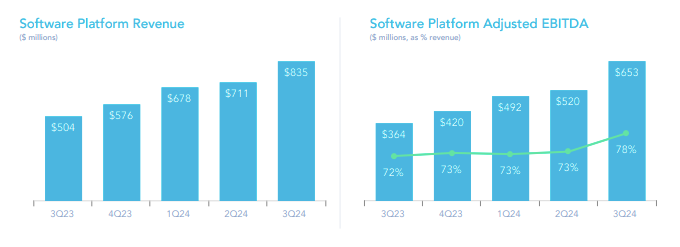

In contrast, the company’s advertising business is exploding (Applovin intends to “rename [its] ‘Software’ Platform and associated revenue to ‘Advertising’ [from here on out] to better align with the nature of this business.”):

What’s driving that growth? In part, AXON, a machine-learning model that helps “target app-install ads to the users most likely to download those apps,” per AdExchanger. And it’s apparently getting smarter and better. Here’s Applovin in its earnings letter:

Our AXON models continue to improve through self-learning and, more importantly this quarter, from technology enhancements by our engineering team. As we continue to improve our models our advertising partners are able to successfully spend at a greater scale. We're proud to be a catalyst to reinvigorating growth in our industry.

Teaching AXON is no small task. During its earnings call, Applovin called Google a “great partner for [it] on the cloud side.” What does that mean? Applovin has secured all the compute it needs through Google, the company stated. How much compute is that? Here’s Applovin CEO Adam Foroughi:

We've got one of the largest GPU deployments in the world at this point, and we like to invest ahead of our needs so that we can continue to build more complicated models that'll help the business scale. So when we make these investments, we're investing in infrastructure that is quarters ahead of where we are today in terms of consumption.

A GPU-led effort to build a technology that is crushing the market? You might expect Applovin to get more points for its ML prowess than it does in tech conversations and press. But the market? Already there.

Applovin has a silly name, but its business results are anything but.

What you need to know from yesterday’s tech earnings rush

Airbnb is off 6.5% pre-market. The company just beat revenue expectations $3.73 billion compared to an expected $3.72 billion), but missed earnings per share by a penny. The company’s mere 10% revenue growth in the preceding quarter and in-line guidance for the fourth quarter did not excite investors.

Toast is up 14.5% pre-market. ARR growth of 28% ($1.6 billion), GPV growth of 24% ($41.7B), 28% location growth (127,000), GAAP net income and rising adjusted profitability were popular. Why is Toast up so much today? The company beat trailing expectations and boosted its full-year guidance from “non-GAAP subscription services and financial technology solutions gross profit in the range of $1,340 million to $1,360 million” after Q2 to “$1,395 million to $1,405 million” after Q3.

Toast now expects 32%-33% growth in 2024.

Cloudflare is off 7.6% pre-market. The tech company beat trailing expectations, reporting revenue growth of 28% ($430.1 million), free cash flow worth $45.3 million, and better earnings per share than the street expected. However, its anticipated Q4 revenue of “ $451.0 to $452.0 million” came in under analyst estimates.

Pinterest is off 12.8% pre-market. As with Cloudflare, Pinterest beat trailing expectations but stumbled on forward guidance. Revenue of $898M beat expectations of $896 million, but the company’s midpoint revenue guidance — $1.135 billion by CNBC calculation — was under street expectations of $1.143 billion.

"Applovin has a silly name, but it’s business results are anything but."

its