Why IPOs are over (for now)

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Friday. We made it. After yesterday’s selloff, domestic shares are about flat as I write to you. Around the world, the picture was mixed (up in China and India, down in Japan; mostly lower in Europe), but it seems that the world has realized that by pausing some of his recently-announced tariffs, others were left in place. Mix in another ratchet of US-China trade barriers, and we’re still looking at a very different — and worse — world for economic activity.

China did a funny: After the US put 145% tariffs on Chinese imports, and China responded with a 125% rate on American imports, the CCP Ministry of Commerce wrote that “Given that, at the current tariff level, U.S. exports to China are no longer commercially viable, China will not respond to any further tariff hikes by the U.S. on Chinese goods.”

In better news, the Producer’s Price Index fell 0.4% in March (0.1% core), with year-over-year ‘final demand’ PPI growth of 2.7% (context here). It’s nice to cap the week with a second tame inflation report. — Alex

📈 Trending Up: The length of human history … targeted executive revenge … JPMorgan … Blackrock AUM … consumer electronics costs … bribes … Microsoft still planning for the future … Deel’s staff …

Risk that US tech giants could face targeted duties in Europe, thanks to the ongoing trade war.

📉 Trending Down: The dollar … treasury holdings … Oh, god … spine … press freedom in Georgia … Apple’s historical GPU budget …

Fraud in startup-land, at least in the case of ecommerce startup Nate and its claimed use of AI that was really just offshore humans. (allegedly).

Why IPOs are over (for now)

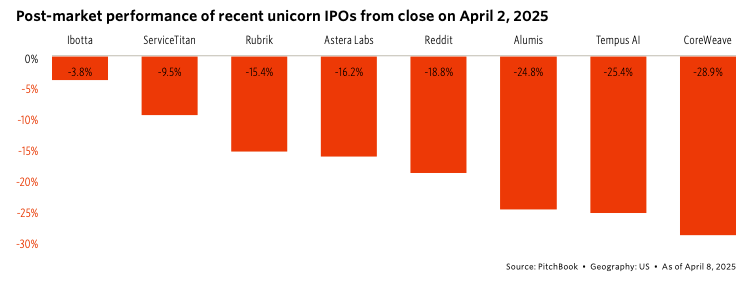

Reading PitchBook’s analyst note on tariffs and their impacts this morning, I was rocked by the following chart:

It’s hard to compare Chime’s potential IPO against, say, Reddit’s performance. Or what we’ve seen from Ibotta. All the same, wouldn’t the most recent cohort of IPOs be a useful metric at minimum? If yes, then the above is a flashing red light at the exit intersection.

Who wants to go public when the ground is melting underneath your feet?

State of Damage

After POTUS blinked and backed off some of his most extreme tariffs, markets rebounded. Many folks crowed that see, there was a plan all along. Market rallies are always welcome. But I wanted to run the math this morning to see where we truly stand:

Nasdaq Comp: -6% in the last month, -15% YTD

DJIA: -4.4% in the last month, -6.6% YTD

S&P500: -5.5% in the last month, -10.2% YTD

Coud index: -6.9% in the last month, -19% YTD

Semi index: -8.4% in the last month, -19.9% YTD

Bitcoin: +3.4% in the last month, -12.1% YTD

Our one day recovery-rally did not obviate prior damage. We’re still deeply in the red for the year, and even on a shorter time-frame we’re underwater.

The good news if you are under the age of, say, 50, is that your investing horizon is long enough that the declines mean you will enjoy better entry prices in your upcoming retirement and taxable equity buys. If you are over the age of 50, this is all pretty miserable.

AI competition is limiting safety investments

In early April, TechCrunch reported that Google was shipping its new models at a faster cadence than before, and that the speed appeared to be coming at the cost of at least safety reporting:

Google’s director and head of product for Gemini, Tulsee Doshi, told TechCrunch in an interview that the increasing cadence of the company’s model launches is part of a concerted effort to keep up with the rapidly evolving AI industry.

Keeping pace came at a cost, with TC writing that “Google has yet to publish safety reports for its latest models, including Gemini 2.5 Pro and Gemini 2.0 Flash, raising concerns that the company is prioritizing speed over transparency.”

At the time, it felt like one-off news item, so I put it somewhere in the back of my brain to sit and collect dust. Until today.

OpenAI has slashed the time and resources it spends on testing the safety of its powerful artificial intelligence models, raising concerns that its technology is being rushed out without sufficient safeguards.

Staff and third-party groups have recently been given just days to conduct “evaluations”, the term given to tests for assessing models’ risks and performance, on OpenAI’s latest large language models, compared to several months previously.

Call it a trend.

Let’s not be scolds. Companies respond to incentives, and given the extreme economic value of having a world-leading model, companies could be expected to find ways to get newly built tech to market more quickly over time; speed is money, so expect more speed.

Should we worry? I’m not. My view is that whatever ills we were afraid of enduring from AI tech — insidious cybersecurity issues, deepfakes, online content turning into machine-generated slop — are already here, and so demanding even more caution as we AI moves forward would only leave us with all the issues we can imagine, sans the gains that faster/smarter AI models will bring.

Sure, that’s a sunny perspective to take. But this blog is not named Permanent Pessimism, after all.

So, no, I’m not going to lose my cool over OpenAI and Google — and, soon, everyone else — limiting their safety work’s timeline before model releases. If it gets cut altogether, sure. But until then.

So long as any single AI company capable of building state-of-the-art frontier AI models decides that safety and alignment are not worthy goals, the rest of the market will have to choose whether they want to take on more risk to avoid being on the backfoot, or less risk at the cost of being behind the curve. We both know what companies are going to pick.

Closing: Apple is taking stick. Here’s the NYTimes writing about its recent product stumbles, and here’s The Information digging into its glacial pace of improvements to Siri.

My favorite bit from the two pieces comes from the Times’ note on Apple. Back in 2023 Apple had “about 50,000 GPUs that were more than five years old — far fewer than the hundreds of thousands of chips being bought at the time by A.I. leaders,” the paper of record writes. So, Apple CEO Tim Cook approved greater investment. But then:

Mr. Cook approved a plan to double the team’s chip budget, but Apple’s finance chief, Luca Maestri, reduced the increase to less than half that, the people said. Mr. Maestri encouraged the team to make the chips they had more efficient.

Dear god. That’s a fumble. Imagine being one of the most wealthy companies in the history of the world, and instead of using all that wealth to win the future, you try to, what, save a few bucks? Here’s a walking definition of penny smart, pound foolish.