Why Nvidia's stock is down

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Modestly upbeat.

📈 Trending Up: Data centers in China’s East … VCs going bargain hunting …

📉 Trending Down: OpenAI’s accelerator? … Hong Kong …

🙃 Whoops: An intrepid CO reader wrote in, arguing that our discussion of genAI startups with $100 million or greater revenues was light a few names. Invisible.co said publicly that it expects to reach “$100M ARR by EOY,” for example. And Midjourney was reportedly set to crack the $200 million revenue mark last year.

That’s better! Frankly, the threshold I set was too high; $50 million would have been a much better benchmark to track. Then we could have said hey, HuggingFace is somewhere around $30 million to $50 million in revenue today, and is therefore worth of praise and not exclusion.

🙃 Whoops II: The Verge has a great piece on OpenSea’s rise during the NFT boom and later descent as that wave subsided. Yesterday, OpenSea announced that it had “received a Wells notice from the SEC threatening to sue [the company] because they believe NFTs on our platform are securities.”

I can see both sides of this. In the ‘wtf is the SEC doing’ camp, the idea that an individual selling digital pointers to URLs constitutes securities trading seems risible at first blush.

However, when we consider that NFTs are often generated and sold in sets by companies hoping to make money, purchased by investors with hopes of making money, and traded on platforms that facilitate price discovery, at least some NFT projects do feel pretty damn Howey.

Wall Street shrugs at Nvidia’s latest

Nvidia turned in a quarter for the ages yesterday, and was met with further share price declines. After falling 2.1% during regular trading yesterday, Nvidia’s stock is down another 3.6% in pre-market trading this morning.

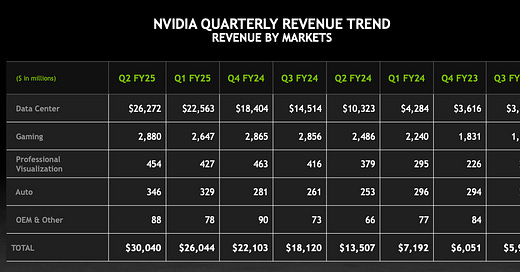

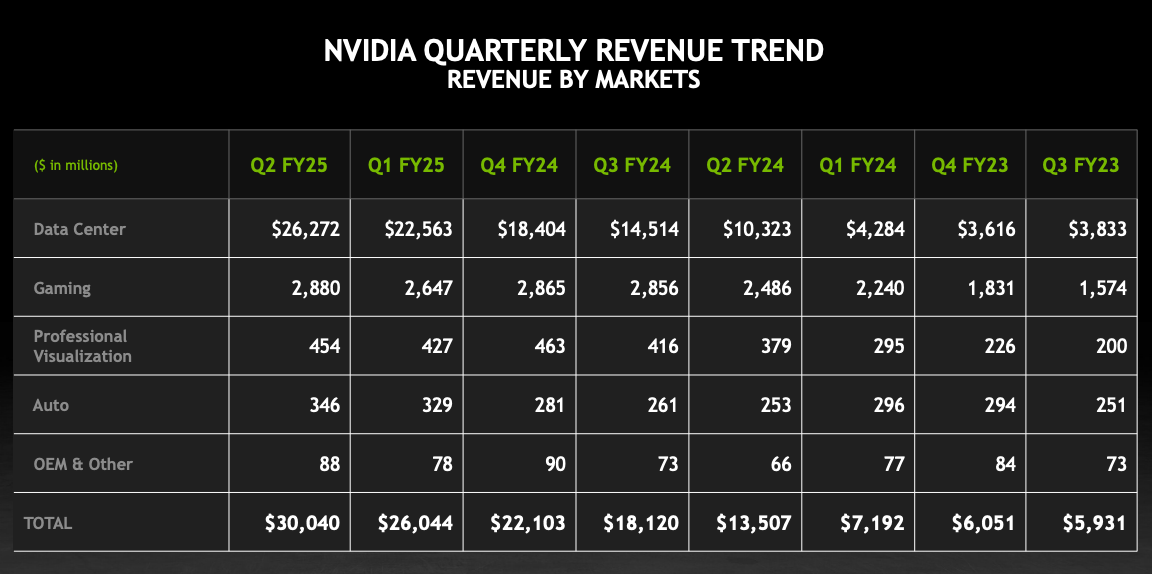

That, despite $30.04 billion worth of revenue (+122%), gross margins of 75.7% (+5%), and $16.6 billion worth of net income (+168%). Even more, Nvidia beat street expectations, grew sequentially from the preceding quarter, and projected that its current quarter would once again set a record for the company.

So why the sigh from the markets? No, the AI wave is not dying out. Nvidia is set to keep growing as hyperscalers, other compute builders, and AI modelers continue to snap up the company’s chips as they strive to win a chunk of the future in today’s scramble to bring artificial intelligence to every digital surface.

There seem to be two things afoot:

Gross margins: While Nvidia’s 75.7% gross margins in its most recent quarter were up from 71.2% in the year-ago period, they were down from 78.9% in the sequentially preceding quarter. That sort of gross margin erosion from a prior high is never something investors will appreciate.

What drove the decline? Per a Fool transcript of the Nvidia earnings call:

“GAAP gross margins were 75.1% and non-GAAP gross margins were 75.7%, down sequentially due to a higher mix of new products within Data Center and inventory provisions for low-yielding Blackwell material.”

Blackwell, keep in mind, is the line of chips that Nvidia is working on that will surpass its existing Hopper set. If you think that H100s are cool, the thinking goes, wait until you get your hands on the new stuff.

But making new, cutting-edge chips is super hard. Nvidia said during its earnings call that it had to make a change to Blackwell’s GPU mask:

We executed a change to the Blackwell GPU mask to improve production yields. Blackwell production ramp is scheduled to begin in the fourth quarter and continue into fiscal year '26. In Q4, we expect to get several billion dollars in Blackwell revenue. Hopper shipments are expected to increase in the second half of fiscal 2025.”

Even with the change, Nvidia’s gross margins are probably not going to return to the ~78% level that investors saw earlier in the company’s fiscal 2025 (emphasis added):

“We expect Blackwell production ramp in Q4. GAAP and non-GAAP gross margins are expected to be 74.4% and 75%, respectively, plus or minus 50 basis points. As our Data Center mix continues to shift to new products, we expect this trend to continue into the fourth quarter of fiscal 2025. For the full year, we expect gross margins to be in the mid-70% range.”

Investors that had modeled a greater gross margin result for Nvidia’s current business year may have had to reduce their expectations for future cash flows.

Vibes: Nvidia beat average street expectations. Analyst forecasts are aggregated, averaged, and then used to benchmark corporate results. Every data provider has their own way of doing this, leading to slightly varied EPS and revenue expectations. But mostly, the numbers are close, so what counts as a “beat” is not too hard to grok.

In the case of Nvidia, however, some analysts really did expect a revenue result that was pretty far above the averaged figure; there was greater spread in street forecasts, in other words. That means that some folks really were hoping for a much larger beat. That didn’t come.

Bloomberg nailed the vibe here: “The company’s quarterly report — the most anticipated part of the tech industry’s earnings season — met or beat analysts’ estimates on nearly every measure. But Nvidia investors have grown accustomed to blowout quarters, and the latest numbers didn’t qualify.”

Nvidia’s recent growth remains one of the most impressive business results in the history of capitalism. Apart from striking oil or gold, I suppose. Feast your eyes on the below and ask yourself if Nvidia is having issues, or the market simply wound up high on its own hope for even more: