Why stablecoins are having a moment, and the State of the Blog

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Written just for you!

📈 Trending Up: Insight Partner’s AUM … Riling up political violence … political violence … flooding in Central, Eastern Europe … the People’s Republic of Kursk … non-profit OpenAI? … fusion power startups … datacenters as national projects?

📉 Trending Down: Cybersecurity … maturity … Axel Springer as a conglomerate (FT) … TikTok’s domestic timeline …

🤔 What Else?

European Commissioner for Internal Market Thierry Breton resigned after President of the European Commission Ursula von der Leyen axed his chances at another term through political wrangling. He then quit, posting his resignation letter on X, ironically.

So what? Thierry is about as popular with American tech execs as FTC chief Lina Khan. It’s not hard to understand why that is the case.

Mix in the recent Draghi report on how to make the EU more competitive and it almost feels like the business-regulatory balance is shifting in Europe?

Is Apple cooked? The company is too wealthy and has too much inertia to be in any real trouble, but the following headlines I think underscore the state of Cupertino:

50 Bips or Bust: The Fed will cut this week. The only question is whether the cut will be 0.25% of 0.50%. I am team 50, but can see an argument for both sides of the coin. From my end of the table, weakness in the labor market is worthy of a full-fat reduction in interest rates.

Circle With Me

No, we’re not talking about the Spiritbox song, we’re talking about Circle, the company behind the USDC stablecoin. A company that I’ve written about for ages and, will, eventually, go public. (More here.)

Circle is back in the news this morning after its CEO, Jeremy Allaire, told the market that his company is moving to 1 World Trade Center in New York City. As a statement of Circle’s goals in the financial realm, it’s a big one. And one that I think is pretty neat.

My biases here are simple:

Blockchains are neat tech that are mostly used for silly thing.

Stablecoins have emerged as a critical blockchain usecase, and one that seems to have real legs

The stablecoin model is also a pretty killer business model in a higher interest-rate environment

I am pretty stoked to see Circle’s numbers when they do come out. I also spoke with Allaire for TWiST, and want to share two quick sections that underscore why I think that stablecoins are worth your attention.

First, why are stablecoins doing well at the moment? Allaire highlighted improving infra (“ [My] mental model for these blockchain networks is these are internet operating systems […] we need higher performance, higher throughput internet operating systems,” adding that current-gen chains “can do higher throughput and the transaction costs for per transaction are” less than a penny), positive networks effects, and usability improvements.

All those are good answers, but I that they are more second-order to the real underlying mechanic that is helping stablecoins rise: People want dollars. Better infra (better bones), network effects (positive market reinforcement), and usability (less friction) are all things that help people access dollars via stables, but are not the real driving force of their rise.

Even better, global demand for dollars means that Circle is building a mechanic that consumes global demand for the American currency, and converts it into stable — sorry — and regular demand for U.S. government debt. Which is inherently stabilizing.

Even more, Circle et al are helping turn the greenback digital, helping it retain a critical market posture even in a less atoms, and more bits-focused future. Here’s your humble servant and Allaire:

AW: The question that keeps coming up in my mind as I listen to you is who are you making mad, because you're disrupting something. You're not disrupting the dollar. You're actually, I think, strengthening the dollar by helping it become digital.

JA: Absolutely

It’s going to be one hell of an IPO when we get the damn paperwork. Hurry up, Circle.

State of the Blog

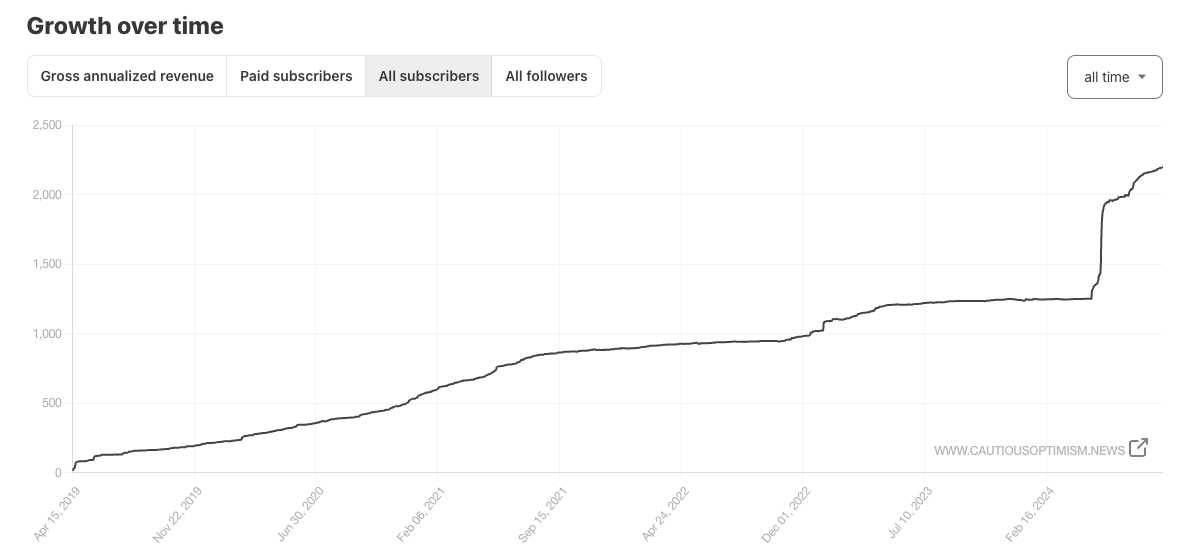

Since leaving TechCrunch — which will always be, in my heart, my home publication — several folks have reached out asking how Cautious Optimism is doing. More or less other journalists are curious if it’s working. I’ve shared lots of data and screenshots of graphs in iMessage threads and Twitter DMs, which doesn’t seem fair. You, my fine friend, should have access to the same information. That in mind, I’ll share updates here and there about how CO is performing.

To wit: CO is growing, albeit modestly, and has reached an early monetization plateau.

CO was originally my personal blog, which I rebranded. So, it had a years of very slow growth as people would occasionally sign up to read my infrequent personal updates. You can spy in the below chart of total free subscribers when I left TC, and began to ask people to give me their email addresses in earnest:

That’s the free subscriber count. On the paid front, CO has scaled to a little bit over $6,000 in gross ARR. To that end, it’s become whatever the sober person equivalent of beer money is. Sadly, after a quick early ascent in people opting to sign up for full access to the blog and newsletter, it’s reached a flattening. Some churn, some new paid subs, mostly netting out to about even for the last month or so.

What’s nice is that I have a day job — tune in! — that means that while CO doesn’t really have to make a lot of money. Put more simply:

CO is damned fun to write for you. I really love it.

And, it already makes enough money that I am probably going to do it forever. Why not, since it pays for its own expenses.

So, no massive call here from me, to you, asking that you sign up to pay for CO. I try to keep the paywalls low when they show up so that everyone can read it if they want. If you did forward the odd email to a friend when you found something useful or funny, that would be lovely.

Now, back to work! — Alex