Welcome to Cautious Optimism, a newsletter on tech, business, and power.

📈 Trending Up: Betting on yourself … American metal … dodging Apple’s cut … revenue at PayTm … U.S. data security … Horizon Robotics …

Building something new: A recent Accel-Dealroom report indicates that 15 different European fintech unicorns have generated 12 or more second-generation startups. Klarna leads with 62, closely followed by Revolut at 48. Notably, neither Klarna nor Revolut have yet found an exit.

📉 Trending Down: Epic’s near-term fortunes … Hyundai Motor India … Italy’s birth rate (still) …

Towards a stablecoin-pilled future

Stripe, the private-market payments giant, is putting its money where its mouth is.

Back in April, Stripe co-founder John Collison said that his company would “start supporting global stablecoin payments this summer.” It’s made good on that promise by buying Bridge, a well-funded startup building stablecoin technology. The deal is reported at the $1 billion to $1.1 billion mark, making it worth around 1.4% of its new parent company’s total worth today.

Stripe is not the first non-blockchain company to get in on the stablecoin game. Stables, digital tokens pegged to a particular fiat currency, have attracted names as far afield from crypto as PayPal. Inside the crypto world, Circle’s USDC, Tether’s USDT, and smaller stablecoin projects from Aave and Curve are all competing for market share.

If you’ve watched the crypto market for a few cycles, I don’t blame you if you doubt the utility and potential impact of stablecoins. I was there for the Mt. Gox mess. I covered the ICO boom. I recall the NFT craze. I’ve had the pleasure — really — of covering blockchain tech and its constituent gambling for more than a decade now.

And I am here to tell you that stablecoins are goddamn awesome.

My perspective is grounded in a belief that access to fiat currencies should be unrestricted, that everyone in the world should have access to the same quality financial asset and that liberal democracy is an intrinsic good. That last bit is not idle; we’ll get to it in a second. Let’s start with access.

Accessing the present

Early blockchain use cases included holding bitcoin as a hedge against inflation. Bitcoin’s value measured in dollars appreciated rapidly in value during its early years, making it a popular trade. More recently, countries that have seen painful levels of inflation have seen rising consumer interest in bitcoin as both an inflation dodge and a shot at material gains.

Stablecoins fit only half that brief. But if you put your family’s local currency into bitcoin to protect yourself against inflation, and bitcoin turns around and dumps in the manner that all cryptocurrencies do from time to time, you could wind up in a worse position than you would have been doing nothing at all.

In contrast: if you were an Argentine looking to protect yourself against your domestic currency losing more and more of its worth, you could buy a bunch of stablecoins and, at least compared to your chosen fiat peg, not lose any ground whatsoever — and compared to folks holding the local paper, you would make out like a bandit.

This is why I love stablecoins for emerging markets: They offer a safe way to access highly liquid currencies that are in-demand, hold a known value (portable), and, often, are far less volatile.

Take the crypto out of it: What if I told you that I had a way to provide access to digital dollars around the world, and that the system was protected from local meddling. Populations in countries with poor governance and tricky local economics would have a way to get out of their local situation and tap into the real global market. All while buying into, say, the United States economy and its current inflation rate.?

You’d be in favor of it. Now, underpin it with blockchain and all that entails, and ask yourself if it is still a net-good. It is.

One reason I am a long-term technology bull is that tech has the ability to greatly improve lives, quickly. Offering digital dollars in markets where their physical peers are scarce, illegal, or simply expensive, is a huge shift. And a positive one for the folks who can now protect their families assets and access a greater financial world.

After all, if Stripe is going to accept stablecoins, and Stripe powers and ever-greater chunk of the online economy, folks with access to stablecoins will have more and easier access to global goods and services. Hell yeah.

What about national security?

I admit to being an American maximalist: Liberal democracy and capitalism with some anti-trust and pro-consumer meddling make for a potent blend. They helped the United States become a historical power, and today’s only superpower.

I am such an Americanmaxxi that, frankly, I would admit all of Canada as new states, grant statehood to all U.S. territories, and offer Taiwan and the U.K. admission to the States. Whatever you think of Yglesias, I say yes to one billion Americans.

The stronger the United States is, the stronger liberal democracy and capitalism are. So, I want a beefy ‘Murica.

Stablecoins help. By offering access to dollars, they encourage the dollar’s usage. That is a good by itself; there’s always rumblings that the U.S. dollar is losing its prime reserve currency status. The more the world transacts in dollars — digital or otherwise — the less I worry about RMB pipping dollars for top billing in the global currency olympics.

But that’s just a start. Stablecoins also buy oodles of U.S. government debt, providing a useful underpinning for our currently unsustainable fiscal path. The sums aren’t world-bending. Yet, at least.

But if we observe USDC backer Circle’s holdings that gird its stablecoin, what do we find?

That’s the first 10 of 28 holdings entries, but you will note that it’s all government debt. Indeed, the makeup of the Circle reserve is just over 30% U.S. government notes, and just under 70% of what Blackrock describes as “U.S. Treasury Repurchase Agreement.” (If you want to learn more about tri-party repo, here you go!)

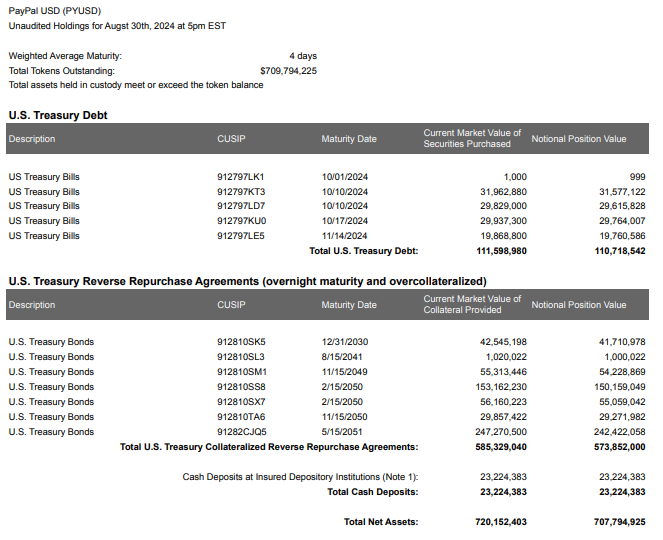

Every single USDC token created yields $1 in backing holdings, which is funneled into domestic debt purchases. Circle is not alone. Here’s the backing sheet for PayPal’s own USD stable:

Look familiar?

If you think that stablecoins have real use — they do — and rising digital penetration of emerging markets will foster greater access to stablecoins — it will — then we’re looking at a market in which private companies are creating synthetic dollar-equivalents that help support the currency they ape, while also ensuring future dollar dominance. Nice.

But what about growth?

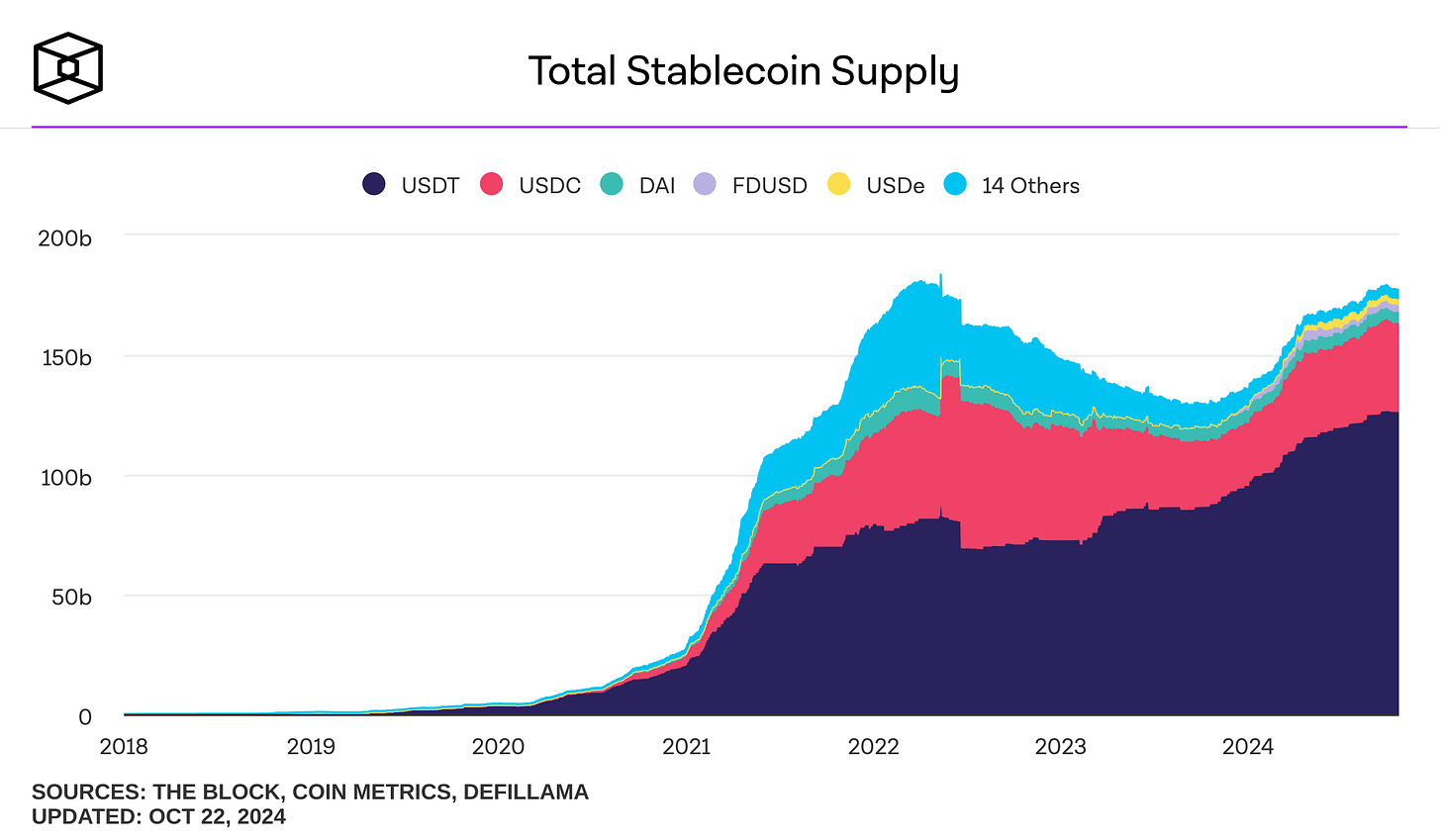

Our above arguments are predicated on the view that stablecoins are useful, and people want them. The data bears that out. Here’s a chart via The Block of total stablecoin supply. Note that we’re just about back to the peak of the market seen back in 2021:

I am not much of a prop-bet guy, but I wouldn’t be shocked if the total stablecoin supply cracked the $250 billion mark next year. Which, given the relatively slow start for non-USD stablecoins, means that another huge chunk of foreign demand for the domestic dollar will get converted into stable holdings of U.S. government debt.

As I argued here, stablecoins are also creating interesting companies. But I am just stoked that more folks will get better, easier, and cheaper access to the best currency in the world thanks to technology—even if it is crypto, which has one of the most annoying fanbases in the world.

Regarding “frankly, I would admit all of Canada as new states, grant statehood to all U.S. territories, and offer Taiwan and the U.K. admission to the States…” those are BIG ideas!!

Hadn't thought about the value of stable coins from the perspective of an emerging economy and how they can help provide greater access to the USD (not everyone can access the FX market).

That said, the Stripe/Bridge deal smells a bit like a bailout.