Why the IPO I'm most excited about isn't Databricks or Stripe

Welcome back to Cautious Optimism! It’s Tuesday, June 26th, 2024. Today, we’re talking IPOs and fintech. Tomorrow we’re digging into the debate regarding how big a company must be to go public. And why that number has seemingly changed. For the worse. Let’s go! — Alex

The 2024 IPO I’m Most Excited About

Circle, the company behind the USDC stablecoin, filed privately to go public earlier this year. More recently, it began working to shift its corporate home to the United States.

Circle’s upcoming debut is the IPO I am most excited about this year, thanks to the clarity it will bring to a massive, growing industry (stablecoins), the questions it will answer when it prices (what are its comps?), and what it will teach us about contra-inflation industries more generally.

Backing up, Circle nearly went public via a SPAC back in 2021. I wrote in favor of the transaction at the time, noting that if rates went up, Circle’s business could prosper:

[R]ecall that stablecoins are pegged to an external currency and are backed by the same. So, if lots of folks buy USDC from Circle, it will sit on a mountain of reserved cash. It can generate interest on those sums. Those revenues would likely expand as interest rates [rise]. So, if you are bullish on central-bank tightening in the United States, you may be bullish on Circle’s USDC reserve-related incomes.

I am hardly an oracle, but the point has been born out. Rates have risen, boosting the value of held cash and equivalents greatly. So, since Circle first considered a SPAC — after it repriced that deal to raise its valuation, and in the wake of its eventually scuppered SPAC — we’re on the cusp of getting our hands deep into not only Circle’s own business, operations, risks, and results, but also data concerning how quickly changing central economic policy can lift a company’s financial performance.

On the comps question, I wonder. Every company wants its public-market comps to be richly valued—or at least as richly valued as possible in today’s conservative public market for software companies. What would you comp Circle against? The company will likely covet a software-styled revenue multiple, and it has some claim to such. It is, after all, a technology company that works at the intersection of traditional and distributed finance.

It’s also a massive pile of cash that generates yield, I suspect. I don't think anyone knows how much of Circle’s business will not come from interest-related incomes, but I wouldn’t wager that it’s much in percentage terms. So Circle is a bank of sorts, which means it could be staring down the barrel of a 2-3x revenue multiple. Unless it can prove that it has oodles of growth ahead of it.

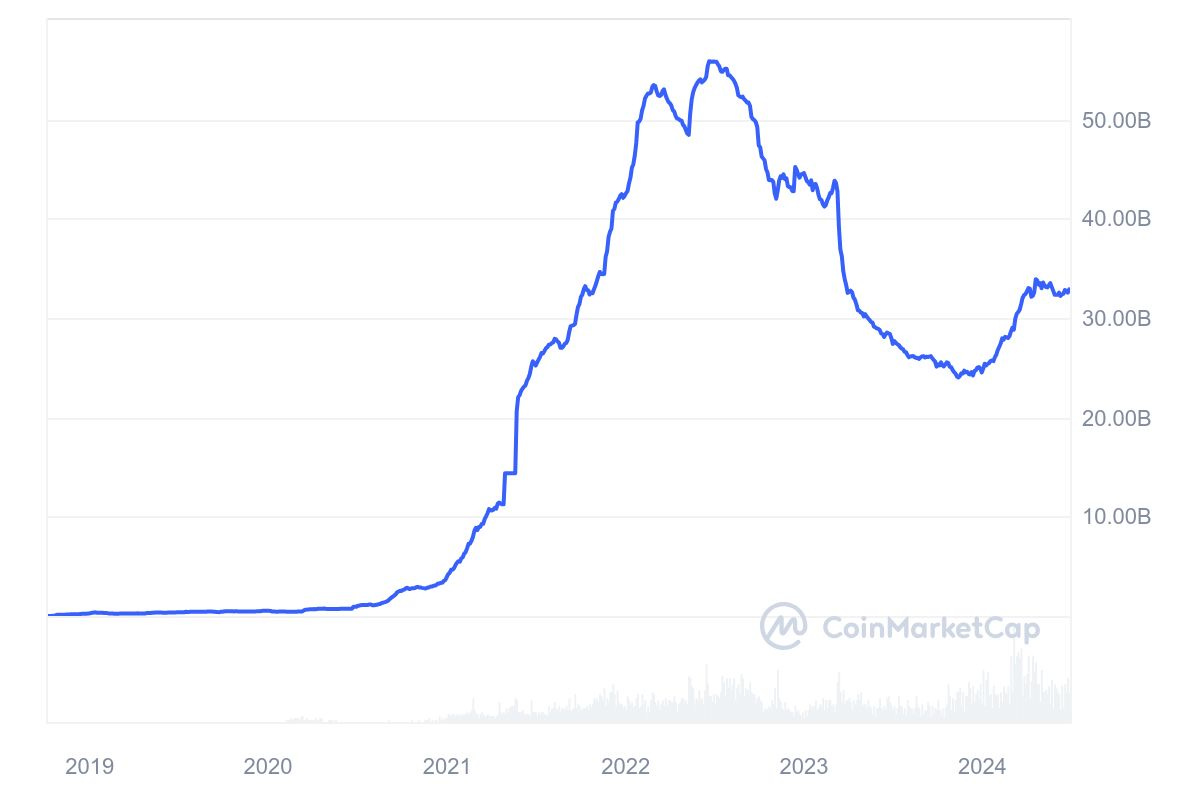

Let’s go to the tape, starting with the total number of USDC stablecoins in the market:

As each USDC token is pegged to the dollar, the above chart tells us the number of stablecoins Circle has in the market. It’s gone up lately, from around $24 billion at the nadir of its recent trough to around $32 billion more recently. More tokens, more reserves, more income.

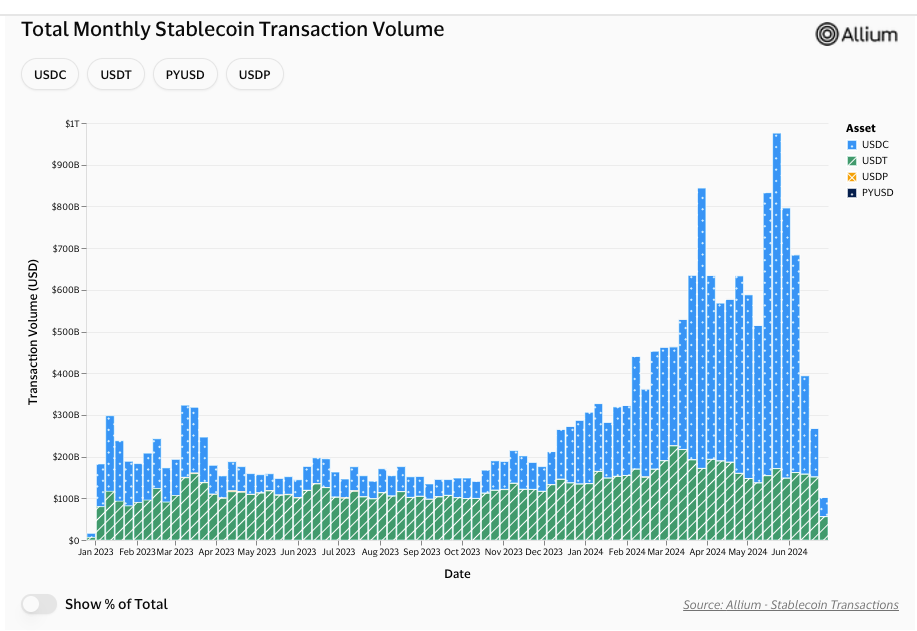

Even more, use of USDC has shot higher in recent months. Via Visa’s crypto dashboard which leans on Allium data:

That’s impressive. If Circle can convince public market investors that its stablecoin is super regulation-friendly, consumer-beloved, and adding new reservers at the same time, it has a growth story to tell, which could help its eventual listing valuation

The last reason I am so curious and excited about Circle’s IPO is that what goes up tends to go down. Like many fintech companies that hold cash, Circle has gotten a massive boost from the Fed, which raised rates in recent quarters faster than we’ve seen in generations. But the Fed giveth, and eventually the Fed taketh away. Rates are going to come down.

What does Circle have planned for that future? If it is a revenue bucket that fills when rates are high and drains when they are low, Circle could look more like a video game company — famous for having episodic revenues — than a SaaS concern. That would limit its eventual listing valuation. But if it can tell investors that it has contra-rates plans to ensure revenue stability, well, that would be different.

All told Circle should get off the sidelines and get its S-1 into the market while rates are painfully high and its revenue growth impressive. Eventually, some of its underlying tailwinds will slow, meaning that its personal IPO window won’t last forever.

Quick Hits:

Trending Up: The pace at which SpaceX launches … Cruise, thanks to a new CEO … Waymo, now without a waitlist in SF … Google, up 33% this year … FedEx, after earnings … Rivian, after partnering with Volkswagen (NYT) … Andruil, set to raise $1.5B at a $12.5B post-money valuation (TI) …

Trending Down: AI best friends … the NFT market … app marketplace fees in China (BG) … AI data ‘borrowing’ … airline volume … logistics demand in China (BG) … Politico …

The mess at Synapse

Banking-as-a-Service is a good idea. Banks are good at banking, software companies are good at software, so why not have a startup build a software layer that sits on top of a bank — or banks — and allows other software companies to interact with the financial institutions as if through an API? I’m simplifying too much, but the model really is cool.

Unless things go to hell, and chaos reigns in fintech-land.