Will the tech-right survive Trump 2.0 as a political unit?

And: Why does everyone want synthetic bitcoin?

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Monday! Ready to rock? It’s going to be a busy week for earnings, which means we’ll learn loads. In early morning trading the stock market is placid. Just as things are at major West Coast American ports, like Seattle, LA, and Oakland, where it appears that the impact of sharp tariffs with a critical trading partner is starting to show up in trade volume. Shockingly. Here’s hoping for some detente before we’re all forced to learn how to subsist off the land.

Before we get into the thick of it, over on TWiST I interviewed Avery Pennarun, the CEO of Tailscale, which sells enterprise VPNs which are pertinent in the current AI context. You can watch that here, if such things are your jam! — Alex

📈 Trending Up: The price of parenting … European stocks? … making no progress … podcasting? … the ‘womanosphere’? … chances of a hot war between India and Pakistan … which would be bad … nearly getting it … Russian demands …

📉 Trending Down: The IPO calendar … shipping volumes … the agricultural sector … press freedom … UK GDP growth … German GDP growth … median cloud multiples … local gov debt in China …

📖 Quote of the Day: “The bots demonstrated awareness that the behavior was both morally wrong and illegal.”

Kidding, it’s this one: “Russians are not our enemy. We shouldn’t be helping to kill them.” To quote Future, Mask Off.

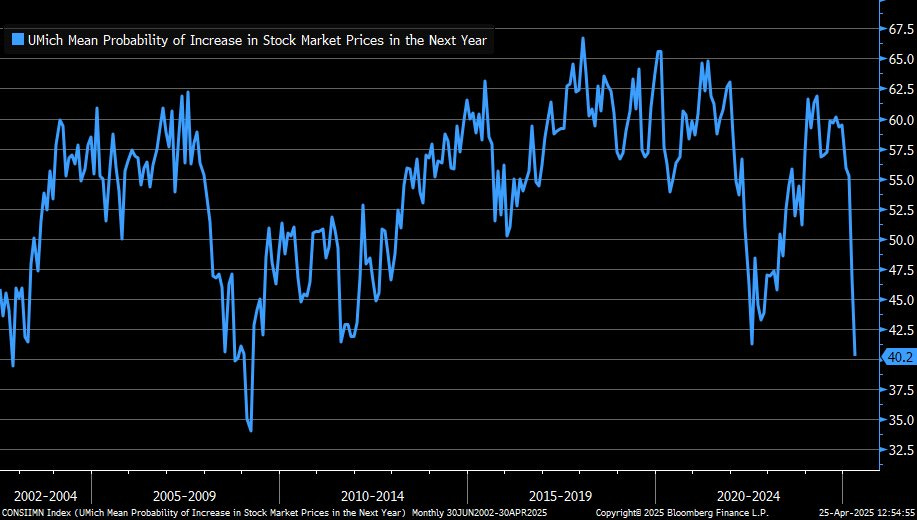

Chart of the Day:

Via Schwab’s Chief Investment Officer Liz Ann Sonders, only “40% of consumers (on average) in April expected stock prices to rise in next year per @UMich:”

Scale-ing up

The indefatigable reporting crew over at The Information dropped some fascinating details on the growth of Scale AI, the well-known data-labeling startup:

Scale AI told prospective investors early last year that it expected to cross $1 billion in revenue in 2024 as the contract workers it managed became more essential to the artificial intelligence boom. It ended the year at about $870 million, about 15% short of the goal, documents shown to investors show.

The same piece goes on to note that despite expectations of breaking even, Scale turned in EBITDA worth -$150 million last year. Bloomberg reporting confirms what TI put out, adding that Scale had an “annualized run rate reaching $1.5 billion by the end of the year” and expects to reach revenues of around $2 billion this year.

To generate $2 billion in total top line this year, Scale will have to close 2025 at a far greater run rate pace than the headline figure. So, Scale expects a lot of growth this year. Not a shock.

What is interesting is just how high Scale’s sights were last year. The company provided TI with a prickly comment that fits neatly into the current Trump-era response of many folks to the media: “We saw 160% revenue growth in 2024 from the previous year, and we secured more than $1.5 billion in new business. Describing Scale’s trajectory over the past few years as anything less than extraordinary is absurd.”

Sure, Jan. You could have just said “We grew a lot last year, and had even higher goals. We’re always reaching for the stars,” and left it at that. But, go off.

The reason we care about Scale’s growth is that the company is working on a share sale at around the $25 billion mark. Against its EoY 2024 run rate, the deal values Scale at just 17x ARR. That feels very inexpensive given what we know about its growth expectations for 2025. I want to know why the figure is not higher. Surely growth of 160% against a nine-figure starting revenue base is worth more than a spiritless 17x ARR ratio — and that figure is dated, as Scale will have continued to grow since the end of 2024.

What gives? Hit reply if you have a guess.

Will the tech-right survive Trump 2.0 as a political unit?

There’s a fascinating look at group-chat culture amongst influential technology figures during the last five years up over on Semafor. The piece echoes the old Carlin line: “It's a big club and you ain't in it!”

Semafor’s Ben Smith writes about how the group chats featuring well-known venture capitalists like Marc Andreessen, folks who joined the Trump administration, and prominent writers, hashed out the public shift to the political right in private. It’s worth reading in its entirety.

A key player in the chats? Erik Torenberg, founder of Turpentine, a media group that publishes technology friendly podcasts. Marc Andreessen recently bought Turpentine for his venture capital firm and added Torenberg as a GP. Big club. You ain’t in it.

But apart from an interesting look into the shifting political winds of our economic betters, there’s an interesting nugget about how even amongst the Trump-favoring, the current moment is divisive. I present to you an incredible series of sentences: